Fed's rate cut to have limited impact on China

The US Federal Reserve cut the interest rate by 0.25 percent on July 31 for the first time since the 2008 global financial crisis. The Fed said the rate cut is in light of the implications of the global economic outlook and muted inflation pressure. Fed Chairman Jerome Powell, on his part, said the rate cut is a mid-cycle adjustment to policy rather than the beginning of a series of rate cuts.

Compared with the large-scale interest cuts to cope with the 2008 global financial crisis, the rate cut this time is more like a "preventative" measure.

Many real economy indicators show the US' economic growth has been higher and faster than its potential growth rate. Last year, the United States' GDP grew 2.9 percent, while in the first half of 2019 its estimated growth rate was 2.6 percent, which was higher than the 2.5 percent potential growth rate based on US economic data since 1990.

The labor market and inflation are two major concerns for the Fed's policymakers. At present, the US' non-agricultural employment rate is high while the unemployment rate remains at a historical low. If the US can sustain a 0.2 percent monthly growth rate of core inflation, it would be able to keep the inflation rate at or below the 2 percent target set by the Fed.

But taking economic growth, employment and inflation into consideration, the Fed could have waited for some time before cutting the interest rate. Perhaps the main reason for the Fed to cut the interest rate is to prevent global economic downturn in the backdrop of the US-China trade war.

First, the Fed is more worried about the negative impact of the Sino-US trade war and US-European Union trade frictions on the US economy, because any major disruption in the global trade chain can greatly undermine the US economy.

Second, in July the International Monetary Fund downgraded its forecast for global economic growth for the second time this year because of sluggish global demands, which could weaken the US economy.

And third, the US' economic growth has been propelled largely by tax cuts, which will gradually fade out. As such, it is doubtful whether it could maintain its current economic growth rate.

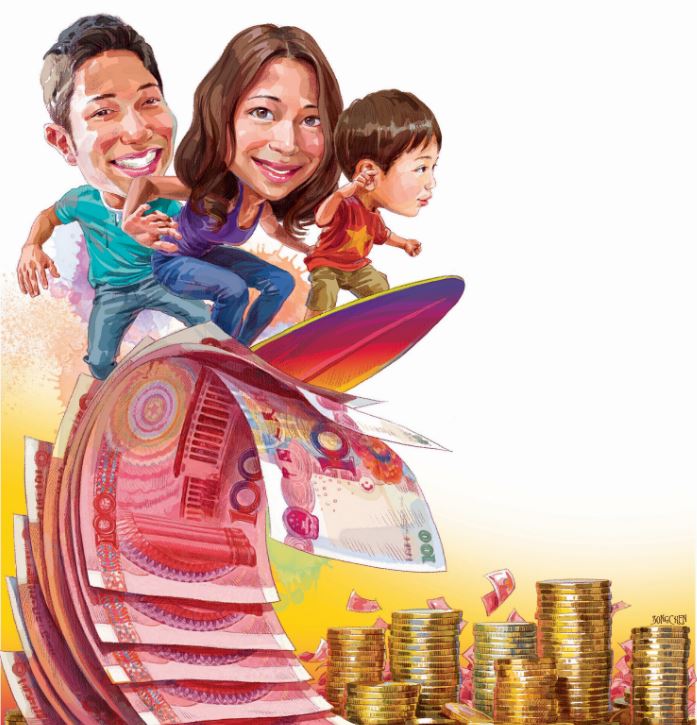

Besides, the Fed's rate cut could consolidate the US' financial condition, which in turn could help the US maintain a relatively healthy economic growth rate. But at the same time, the rate cut could be conducive to promoting global economic growth, which in turn could further promote China's economic growth.

Also, the Fed's previous interest rate hikes increased the real interest differentials between China and the US, putting more pressure on China to depreciate its currency and increasing the risk of foreign exchange outflow. So to keep the interest rate stable and maintain the international balance of payment, China's monetary policy should centered on its economy.

Although the Fed's rate cut doesn't necessarily mean the US has initiated its monetary easing cycle, it does indicate that the US has stopped its interest hike cycle. Which means China should devise a monetary policy that suits its domestic economic conditions.

Judging by the monetary policy signals given by the recent meeting of the Political Bureau of the Communist Party of China Central Committee and China's central bank, the country is not expected to altogether ease its monetary policy.

The Fed's remarks indicate the rate cut this time will not open the gate for continuous interest rate cuts. Moreover, weakening the dollar is not an option for the US economic decision-makers. Also, if the US doesn't opt for competitive devaluation of the dollar, it would be conducive to maintaining stability in the foreign exchange market.

This probably means there will not be any competition for devaluing currencies in the short term, which could be beneficial to Chinese exporters in the backdrop of the trade war.

The author is a senior analyst with the Bank of China, Macao Branch.

The views don't necessarily represent those of China Daily.