Targeted deductions crucial to tax reforms

|

| ZHAI HAIJUN/CHINA DAILY |

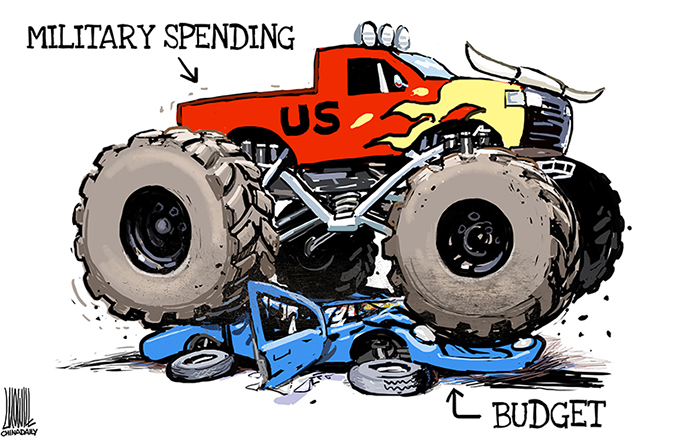

Raising the individual income tax threshold is always in the public's interest. But since an indiscriminate increase in the threshold will neither be fair nor serve the purpose of China's tax reforms, the authorities have decided to adopt various exemption standards to ease different income groups' financial burdens.

The Government Work Report mentions applying different exemption standards for different sectors to charge individual income tax; the application also found mention at the finance minister's news conference during the just-concluded annual sessions of China's top legislature and top political advisory body.

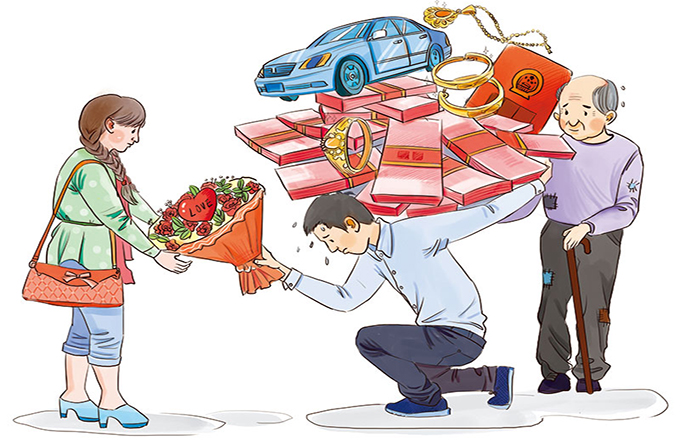

The pace of the tax reforms, however, should be progressive, with the individual income tax reform leading the overall reform process. The reforms will ease the financial burdens of families and individuals if they can help improve people's livelihoods. That's why some have suggested that the expenses for raising a second child, supporting the elderly and acquiring professional training should be deducted from an individual's taxable income, because it will provide incentives for people to better fulfill their responsibilities.

Programs allowing certain types of expenses to be deducted from the taxable income were put on trial in some places last year. For example, the policy to exempt the premium paid for commercial health insurance from the taxable income, which was launched in 31 pilot cities, will raise the individual income tax threshold from 3,500 yuan ($506.4) per month to 3,700 yuan if the premium for commercial health insurance reaches 2,400 yuan a year, according to a document jointly released by the Ministry of Finance, the State Administration of Taxation and China Insurance Regulatory Commission.

However, this doesn't mean the government's tax revenues will reduce in the long run. Since "nothing is certain except death and taxes", the government will talk about tax reduction only if its overall tax revenues remain stable. For example, if employees are trained to acquire more professional skills, they will earn more in the future. And the more they earn, the higher the income tax they will pay.

The method of paying income tax could pose a problem, though. Private companies and government organizations now deduct the individual income tax from employees' salaries and deposit it with the tax authorities. With the deepening of the reform, people might have to report their personal incomes and provide the details of their exemptible or deductible expenses themselves, which will require a more comprehensive and stricter regulatory environment, especially for supervising the certification of taxpayers' deductible expenses.

The need, therefore, is to build a modern information tracking system across China, which will include all the information on personal incomes and property, and the entire process of tax collection, management and validation. Also, some sectors and groups of people require special supervision. For instance, specialized tax records and files should be put in place for professionals who manage cross-border investments and trade.

Another point I tried to make in my proposal to the Chinese People's Political Consultative Conference National Committee this year is to reduce the number of tax rate categories. At present, salaries and wages are classified into 11 types, so there is a different exemption threshold and tax rate for each type of income. Developed economies' experiences show simplified tax rates can be better managed. Besides, the tax rates at the primary stage should be lowered as the lower-income groups are not targeted to pay higher taxes.

The tax reforms can achieve major breakthroughs this year, though they should be initiated gradually across the country owing to the different levels of development and supportive measures in place in different regions. Also, to make the reforms more effective, we need a more comprehensive policy design based on the advice of experts and public opinions.

The author is a member of the 12th Chinese People's Political Consultative Conference National Committee and partner of Ruihua Certified Public Accountants. This article is an excerpt from his interview with China Daily's Wu Zheyu.