Political adviser: Targeted deductions to ease individual tax burden

|

|

Zhang, partner at Ruihua Certified Public Accountants, member of the Chinese People's Political Consultative Conference (CPPCC) committee, was doing interview with China Daily website.[Photo by Zhang Guangteng/chinadaily.com.cn] |

Individual income tax reform is the priority in an overhaul of the country’s fiscal and tax system, top accountant Zhang Lianqi, who is a member of the 12th CPPCC National Committee says.

"A major breakthrough could be achieved this year," Zhang said in an exclusive interview with China Daily website.

Zhang, who is a partner at Ruihua Certified Public Accountants, suggested that most of his proposals submitted to the committee this year would focus on fiscal and tax reform, covering the budget, individual income tax and tax cuts.

"A principle that I followed through the formulation of all suggestions is hearing the needs of people to improve people’s livelihood," Zhang emphasized.

Since China's value-added tax (VAT) reform was officially launched last year, debate among the public has not stopped with doubts about whether it would really help corporations and individuals achieve the amount of tax savings it claimed.

Zhang was involved in the process of drafting the policy and has observed it in operation in various industries and believes it has brought solid benefits for corporations.

"If a company has business segments both in manufacturing and the service industries, a composite tax rate of 17 percent was applied before, while after the VAT reform, the two sectors are deducted as separate tax rate of 6 percent respectively, which is, in fact, equivalent to offering tax preference for this company."?

"The crucial problem here is there needs to be a process for corporations to get familiar with the reformed tax system so they can make use of it and benefit from it," Zhang concluded.

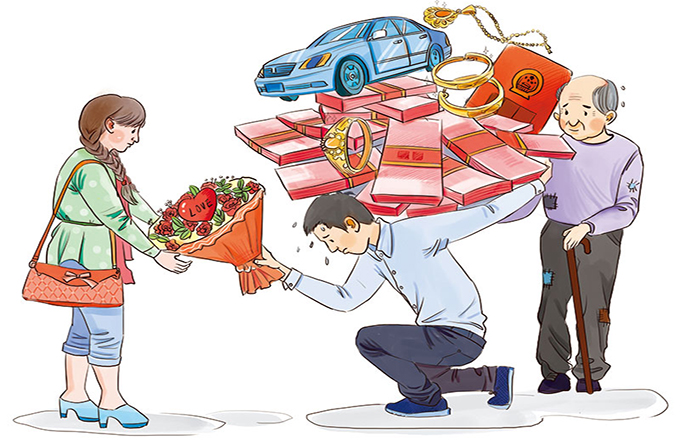

As for individual income tax, the public wants to know whether the monthly income tax exemption threshold - the amount people can earn before paying tax - will be raised.

However, Zhang said they are more likely to adopt various exemption levels depending on individual financial burdens.

"The threshold in essence is a unified deduction. Simply indiscriminately raising the amount deducted is neither fair, nor the direction of our tax reform."

Trial programs allowing more expenses to be deducted, such as commercial health insurance, have been in place since last year. For individuals whose commercial health insurance premiums reached 2,400 yuan, the mean monthly tax exemption threshold would rise from 3,500 to 3700 yuan, under the new policy adopted in 31 pilot cities.

The expenses of raising a second child, supporting the elderly and getting professional training have also been named as possible deductible items from an individual's taxable income.

"Obviously, that's equivalent to offering incentives for people to better perform their responsibilities," Zhang said.

He was keen to point out that, in the long run, this move would not hit the governments’ tax revenue. He said it may in fact benefit both government and individuals.

"For example, if the employees are trained to obtain more professional skills, consequently he would get paid better in the future, the increased part of his salary is actually within our government’s schedule of making the source of taxation more sufficient," Zhang said.

Zhang predicted major breakthroughs in the reform process would be achieved this year,,although he said it would be a gradual implementation due to unbalanced development among the regions and the need for supporting measures that are still being developed.

He said hearing opinions from experts and the public would help develop such comprehensive policy.