Older bank clients miss passbooks

Updated: 2012-02-21 07:40

By Xu Wei and Shi Yingying (China Daily)

|

|||||||||

BEIJING / SHANGHAI- For many older people like Lu Meiju, bank passbooks have unparalleled advantages over bank cards in convenience and security.

Lu, a 57-year-old Beijing resident, has found herself struggling at ATMs to get cash.

"I don't know how to use it because I can't see the buttons on the machine clearly," Lu said. She added that her intimidation grew when the machine swallowed her bank card last year.

Lu's concern represents the disappointment many felt when the Industrial and Commercial Bank of China (ICBC) stopped issuing new paper deposit books in Beijing and Shanghai, and encouraged customers with savings account books to trade them in for bank cards.

According to the customer service department of ICBC in Beijing, the passbook deposit service was halted in most branches in November as part of the bank's effort for "paperless office work".

Peng Bo, a public relations officer at ICBC's headquarters in Beijing, said the bank still offers pass books to the disabled and people older than 50, but some clients have complained they couldn't apply for a paper bankbook.

"Passbooks for current accounts have not been available for some time, yet those that have been issued are still in use," said a teller named Wang at ICBC's Yandang Road branch in Shanghai.

The change was a problem for many older clients who were used to keeping a track of each transaction and did not know how to use ATMs or Internet banking.

Shanghai resident Yang Hong, 52, who has bank accounts in China Merchants Bank, Bank of China and ICBC, said the change to the bank card made her feel uneasy.

"I used to know each of my transaction records and all my withdrawals were listed one by one in the passbook," she said.

Lu Meiju also voiced doubts of the banks' intent to enforce such moves. "With a bank card they can charge customers annual fees. You can save the yearly fees with passbooks."

But ICBC's decision to get rid of deposit books is agreed by many banks, even if it was accused of favoring the younger customers. Some banking insiders say all passbooks will inevitably be replaced by the cards.

"It (changing from passbook to bank card) shortens the endless lines of people waiting in the bank and saves on personnel," said Chen Yejiong, director of China Construction Bank's branch in Shanghai.

Chen said he thinks that learning about ATMs and Internet banking is for older peoples' own good.

"Imagine there's an emergency in the hospital in the middle of the night, a bank card could help you with things a deposit book couldn't do," Chen said. "You always need the assistance of a bank employee to use the bankbook, and that isn't the future of banking."

Chen said that the bank also has to take account of other groups who have other needs than older people.

"Older people have plenty of time to wait in the bank, but the younger generation hasn't. They're always in the hurry and can't afford to wait."

Meanwhile, starting on Feb 10, the public has been invited to comment on proposals that would limit how much Chinese commercial banks can charge for their services.

Under the draft regulations, commercial banks should use multiple methods to notify clients in advance of increases in the price of services and the introduction of new fees.

The draft regulations, jointly compiled by the China Banking Regulatory Commission, the People's Bank of China and the National Development and Reform Commission, aim to protect financial consumers' rights and promote transparency in banking.

Xinhua contributed to this story.

Hot Topics

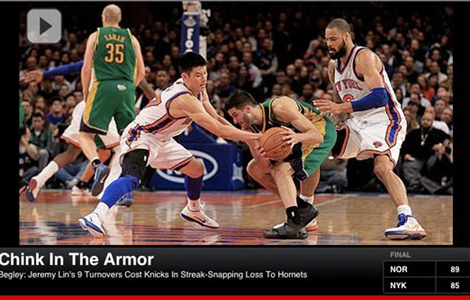

Wu Ying, iPad, Jeremy Lin, Valentine's Day, Real Name, Whitney Houston, Syria,Iranian issue, Sanyan tourism, Giving birth in Hong Kong, Cadmium spill, housing policy

Editor's Picks

|

|

|

|

|

|