Financial regulators vow innovation, coordination to prevent systemic risks

China's top financial regulators vowed on Friday to continue pushing reform and innovation and preventing financial risks amid concerns that rising asset prices and high debt levels could cause troubles.

Top officials from the People's Bank of China, the central bank, and from the banking, securities and insurance regulatory bodies said at a financial forum, organized by the China Society for Finance and Banking in Beijing, that they will improve policy coordination and adopt prudent regulatory methods to ward off systemic risks.

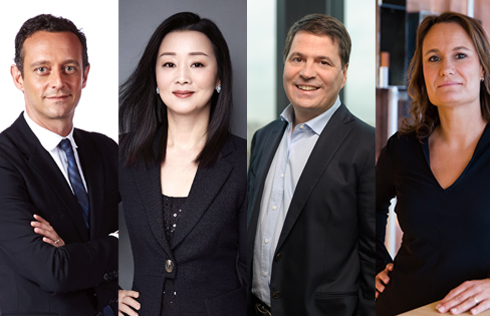

Central banks around the world have realized that stability of individual financial institutions cannot guarantee overall stability of the financial system and that prudent policy tools should be used to prevent systemic financial risks, said Chen Yulu, vice-governor of the central bank.

"China's central bank has actively explored the coordination between monetary policy and prudent macroeconomic policies, and we will make every effort to prevent systemic financial risks," Chen said.

China's economic growth has shown initial signs of stabilization since various economic indicators pointed to brisk economic activity in the first two months.

But the country still faces challenges, such as reducing excessive production capacity, lowering corporate leverage and debt levels and dealing with fast-rising real estate prices in some cities.

At the tone-setting Central Economic Work Conference in December, top policymakers said the country will put preventing financial risks higher on their agenda.

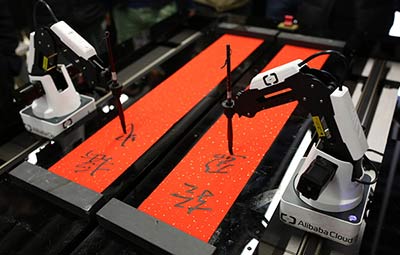

In the banking sector, China has seen a lot of innovative financial activities - such as securitization of assets and internet-based finance - increase in recent years, contributing to the quality of services by financial institutions.

But some financial activities conducted under the guise of financial innovation have brought risks and disorder to the financial and banking systems, said Wang Zhaoxing, deputy head of the China Banking Regulatory Commission.

Wang said, "They have had some effect and even posed a threat to the security and stability of the financial and banking systems."

China should support financial innovation that can help improve services of the banking system while limiting and properly regulating false financial innovation, he said.

The CBRC will work with the central bank and other financial regulatory departments to establish a coordinative mechanism and push information sharing to eliminate a regulatory vacuum, Wang said.

He also said that China faces risks from overseas markets and that regulatory cooperation and information sharing with other countries should be improved.

Liu Shiyu, head of the China Securities Regulatory Commission, said its financial reforms so far cannot effectively resolve the complicated situation and the risks that have accumulated in the economic and financial systems in the past years should be monitored.

For its part, the CSRC will prevent formation of bubbles in the capital market, Liu said.