Real estate down under proving to be very attractive

Updated: 2012-01-30 09:47

By Tania Lee (China Daily)

|

|||||||||

BEIJING - Chinese investors are showing an increasingly high level of interest in the Australian property market. Chinese developers were responsible for 9 percent of the 30 percent share foreign developers took in the Australia apartment market last year.

In a review by real estate company CBRE for the fourth quarter, more than 1,200 apartments were either planned, being marketed or were under construction by Chinese companies in Australia. The Chinese mainland was only led by Singapore (37 percent), Hong Kong (20 percent) and Malaysia (12 percent).

|

|

|

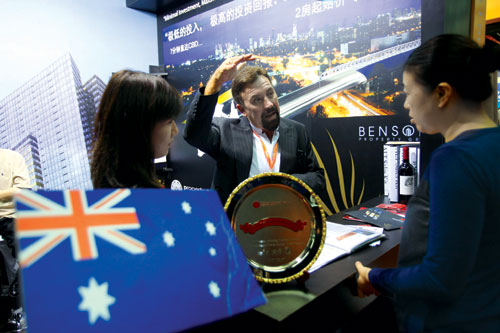

An Australian businessman showing property details to a Chinese visitor at a real estate fair in Beijing last autumn. The number of Chinese consumers buying property overseas has steadily risen alongside an improvement in their incomes.[Photo/China Daily] |

The biggest markets sit along the east coast in Australia's two largest cities: Melbourne and Sydney. About 80 percent of the total number of apartments proposed or under construction by foreign developers were located in these two cities.

According to Kevin Stanley, CBRE executive director of global research and consulting, very strong interest has come from Chinese individuals to buy apartments, predominantly for family use and particularly in connection with children studying in Australia. Australia is seen as a safe investment destination.

Freehold title provides security of tenure. "Unlike in China, once a buyer purchases property in Australia, it's theirs forever and can be passed down from one generation to another," said Melbourne real estate agent Chris Bevan. The Australian government is only able to buy back property under the Lands Acquisition Act 1989, that allows them to acquire land or an interest in land anywhere in Australia for public purposes. Property ownership in China lasts for just 70 years before reverting to the government.

Bevan said his recent sales to buyers from Shanghai ranged from two bedroom apartments priced at $300,000 to a luxury beach-front home for $18 million around Melbourne. He said JP Dixon, the company he represents, has attended property shows in Shanghai for the last three years because they are keen to pitch more Australian properties to the Chinese market. "(This) helps keep our real estate and economy growing," said Bevan.

Stanley said a lot of Chinese buyers liked to invest in mainly residential properties in bigger cities, particularly central Sydney and Melbourne. There is also some investment in the Gold Coast and Brisbane markets, on the northeastern coast.

Chinese buyers also prefer to buy property in areas close to or with good access to university campuses. Currently there are approximately 160,000 Chinese students studying across Australia.

Local developers have been bound by restrictive bank lending requirements that have slowed the overall development of real estate, whereas ample capital, most of which is equity, in China is driving the Chinese to move this offshore. "It's highly likely Chinese investment into Australia real estate will continue in 2012," said Stanley.

In November, the Hurun Report which stated that about 60 percent of rich Chinese people, each of whom has a net asset of at least 60 million yuan ($9.44 million), said they intended to emigrate from China. Among the 980 people interviewed, 51 percent said they had plans to invest in real estate.

Related Stories

Property market cooling 2011-09-19 09:34

Property market has 'risks' 2011-08-13 06:48

Property market is strong: Portman 2011-07-04 10:16

Measures to tame property market 2011-01-27 09:23

China's property market cooling 2011-09-19 08:54

- Real estate down under proving to be very attractive

- Sino-US trade tensions may increase

- Surging new loans calls for another RRR cut

- Top auditor warns of fiscal, financial risks

- Call to adjust interest rates

- Real estate funds expected to rise

- Cadmium pollution contained in river

- Festival holiday boosts retail sales