|

BIZCHINA> Center

|

|

Related

Consumer inflation may continue to fall

By Xin Zhiming (China Daily)

Updated: 2008-08-08 08:57

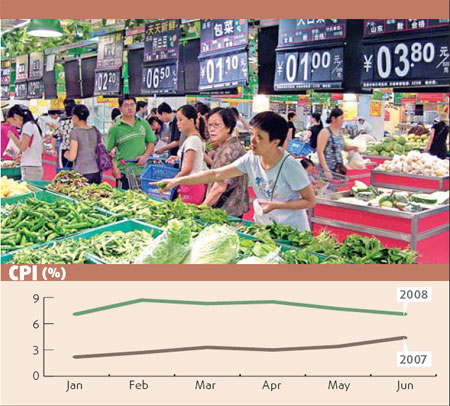

China's consumer inflation may continue to decline in July, marking the second consecutive month this year that it has dropped, according to economists' estimates. That may mean a departure from the rising spiral of inflation after it peaked at an annualized 8.7 percent in February. Lehman Brothers economist Sun Mingchun said his team's research found the July consumer price index (CPI), the main barometer of inflation, may drop to 6.7 percent year-on-year from 7.1 percent in June. The domestic Bank of Communications research arm said the figure could fall at 6.4 percent, which is also the estimate of Southwest Securities. One of the reasons why prices are stable is that there has been no flooding, a regular feature of the rainy seaon, said Sun of Lehman Brothers. Daily price data from the Ministry of Agriculture and the National Development and Reform Commission show that agricultural product prices rose only slightly in July while meat prices fell. Weekly price data released by the Ministry of Commerce also showed a moderate decline in food prices.

The relatively high statistical base of last July also contributed to the drop in inflation this July, said Guo Tianyong, economist with the Central University of Finance and Economics. China's CPI hit 5.6 percent year-on-year last July, the first time it reached the 5-percent level that year. "If no major natural disaster hits China in August, CPI could fall below 6 percent in August, providing more room for the government to remove its price controls," said Sun. Economists said that without many unexpected incidence, it will gradually ease to around 5 percent by the year-end. A possible price liberalization of oil products, however, should not be a one-off adjustment, which will put a huge pressure on the country's battle against inflation, Guo said. China raised the prices of oil products and electricity late June. Analysts said that once the inflation pressure eases, policymakers may start a second round of price liberalization, which may lead to a rebound in CPI. If such liberalization moves are indeed made, they should be done in phases, not in one go, said Guo. Only that will ensure inflation does not peak again, as it did in February. The pressure from the rising producer price index (PPI), which gauges ex-factory prices and influences CPI, may be a concern, but even taking into consideration its impact, consumer inflation may no longer exceed the February peak in the coming months and the first half of next year "The worst times are behind us," said Dong Xianan, macroeconomic analyst with Southwest Securities. "From the second half of last year, the tightenting stance had been obvious, which is a pre-emptive move to ensure the current easing of inflation." Macroeconomic growth The economic growth may gradually slow down in the rest of the year, analysts said, but the fine-tuning of policies would shore it up. Dong from Southwest Securities forecasts that given the current growth momentum, the whole-year figure for GDP growth may be 10.1 percent, well below the 11.9 percent of last year. Other estimates are around the 10 percent mark. The global economic slow-down, which reduces external demand for China's exports, will bring much trouble to China, but its domestic consumption and investment will remain stable, analysts said. More importantly, the central authorities may adjust its tight policies to cater to individual demand of regions and sectors that have found it difficult to survive the tightened policies.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 久久婷婷综合色丁香五月| 精品少妇一区二区三区视频| 久久久亚洲欧洲日产国码是av| 欧美日韩精品免费一区二区三区| 国产福利97精品一区二区| 在线中文字幕日韩| xxxxbbbb欧美残疾人| 高清精品视频一区二区三区| 久久婷婷综合色丁香五月| 一区二区三区日本久久九| 人妻日韩精品中文字幕| 一区二区视频观看在线| 国产精品久久久久久无毒不卡| 久久精品国产亚洲av热九九热| 亚洲情综合五月天婷婷丁香| 国产亚洲女人久久久精品| 亚洲丰满老熟女激情av| 国产精品性色一区二区三区| 精品一区二区三区少妇蜜臀| 国产精品午夜福利91| 亚洲乱码一卡二卡卡3卡4卡| 手机在线看片不卡中文字幕| 亚洲AV成人片在线观看| 老牛精品亚洲成av人片| 思思久久96热在精品不卡| 亚洲欧美日韩人成在线播放| 偷拍精品一区二区三区| 在线播放国产精品亚洲| 欧美精品1卡二卡三卡四卡| 国产精品免费激情视频| 99久久精品久久久久久婷婷| 亚洲综合一区二区三区在线| 丁香五月婷激情综合第九色 | 国产成人久久精品77777综合 | 免费人成在线观看网站| 粉嫩av蜜臀一区二区三区| 樱花草视频www日本韩国| 亚洲欧美中文日韩V日本| 国产无遮挡又黄又爽不要vip软件| 午夜亚洲AV成人无码国产| 亚洲欧美日韩精品久久亚洲区色播|