The Chinese central bank said Wednesday that new yuan loans grew more than expected in November, as its leaders met in Beijing to discuss policies, including growth targets, for next year.

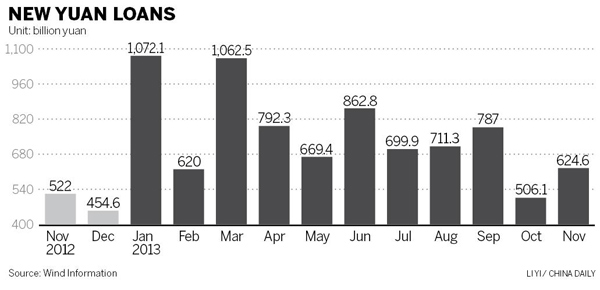

Chinese banks extended 624.6 billion yuan ($103 billion) of new yuan loans in November, almost 24 percent higher than the 506.1 billion lent in October.

The figure topped both the 550 billion yuan median forecast in a poll of 11 economists by The Wall Street Journal and the 580 billion yuan median estimate of 41 analysts surveyed by Bloomberg.

Aggregate financing came to 1.23 trillion yuan, up from 856.4 billion yuan in October.

M2, a broad measure of money supply, grew 14.2 percent year-on-year, 0.1 percentage points higher than the market consensus.

The benchmark Shanghai Composite Index lost 1.5 percent on Wednesday. The central bank released the data after markets closed.

Zhou Hao, a China economist with Australia and New Zealand Banking Group Ltd, believes a revival in shadow banking shored up social financing.

He pointed to a rise in entrusted loans — a type of off-balance-sheet lending in which lenders act as intermediaries — as proof of an increase in shadow banking.

New entrusted loans totaled 270.4 billion yuan in November, an increase of 148.6 billion yuan over the same period last year and the highest monthly figure since August.

Unclaimed bankers' acceptances, another channel for off-balance-sheet lending, grew by 5.7 billion yuan in November, 54.6 billion more than the same period last year.

"Increases in the two areas show that lenders are finding ways to lend more against the central bank's will to control loan growth," said Zhou.

Beijing has been trying to deleverage a Chinese economy that has become increasingly insensitive to investments on the back of decades of rapid growth.

The stock of debt surged to 200 percent of GDP at the end of 2012, up from 129 percent in 2008, when authorities stimulated the economy with a 4 trillion yuan investment package to fight the global financial crisis.

The faster-than-expected loan growth might trigger central bank officials to get tougher on restraining debt as they meet in Beijing this week to map out policies for 2014, analysts said.

"The 'prudent' monetary policy stance will likely be kept, but tightening has already started," wrote British bank Barclays Plc in a research note on Wednesday, commenting on the meeting.

Barclay expects the M2 growth target to be kept at 13 percent in 2014, compared with the actual growth of more than 14 percent year-to-date. And that may translate to tighter liquidity.

Growth targets likely will be maintained at 7.5 percent in 2014, as maintaining rather than changing those targets should help stabilize market sentiment as the government shifts its focus from creating growth to promoting reforms, the bank added.

Also on Wednesday, the Ministry of Finance said the government's fiscal income grew 15.9 percent in the first 11 months of the year, to 912.5 billion yuan.

A front-page commentary by China Securities Journal, owned by Xinhua News Agency, said that China should phase out its "proactive" fiscal policy, as it causes large deficits and jeopardizes local government debt.

Fiscal revenue growth has slowed from 32 percent in 2007 to 13 percent in 2012, while analysts believe outstanding local government debt has risen to 15 to 20 trillion yuan.

Barclay expects a "proactive" fiscal policy stance also is likely to be retained.

"In our view, the fiscal policy stance of the past two years can be described as being prudent, as the government stepped up efforts to support the economy only when growth slowed to approach the 7 percent bottom line," the bank wrote.

|

|

|

|

|

|

|

|