Singapore's flexible policies on taxes, tailor-made incentives attract MNCs

Hong Kong is losing its competitive edge against Singapore as a regional headquarter hub in Asia, accounting body CPA Australia cautioned, citing the Singapore government's taxation policy flexibility as a facilitating factor for attracting overseas investment to the city-state.

According to the Hong Kong Tax Survey conducted by CPA Australia, 59 percent of the respondents said that they preferred to choose Singapore as their corporate regional headquarters. Their Singapore choice was 37 percentage points higher over Hong Kong as their corporate regional headquarters.

|

|

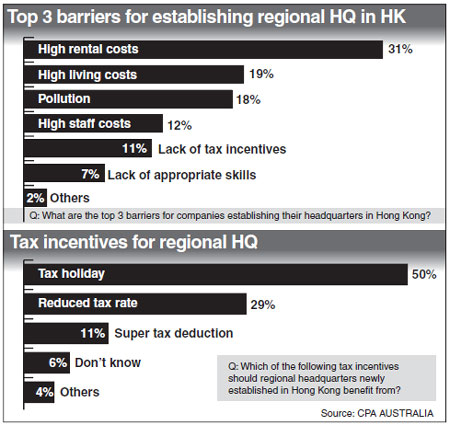

The survey further cited high rental costs (31 percent), high living costs (19 percent) and pollution (18 percent) as the top three barriers for companies establishing their headquarters in Hong Kong.

The survey, which was conducted from Oct 6 to Oct 30, involved interviews with 254 senior accountants and financial professionals based in Hong Kong.

"The Singaporean government is more flexible in attracting multinational investment. It tailor-makes different tax incentive policies to attract different multinationals to establish their headquarters in the city-state, providing these multinationals can promise to hire a certain number of people or fulfill other business criteria determined by the Singaporean government," CPA Australia Taxation Committee Member Anthony Lau said on Tuesday at a news conference.

"Hong Kong government lacks this taxation policy flexibility compared to Singapore," Lau added. "Singapore has already slashed its corporate tax rate drastically so that Hong Kong can no longer leverage on its low tax rates to attract overseas investment. Therefore this kind of taxation policy flexibility will be more important in the future."

Loretta Shuen, CPA Australia Taxation Committee Chairperson, recommended that the Hong Kong government should make two initiatives in the taxation system to attract multinational investment to Hong Kong.

The accounting body said that Hong Kong government should grant a 10-year tax holiday to companies establishing regional headquarters in Hong Kong. With the first three years after the introduction of the exemption, there should be 100 percent tax exemption. This should be followed by a reduced profits tax rate of 10 percent for the remaining seven years. After the 10-year tax holiday, multinationals should pay the standard corporate tax rate of 16.5 percent.

Regarding multinationals which had currently established their headquarters in Hong Kong, CPA Australia suggested that these companies should receive the benefit of a 10 percent concessionary tax rate for seven years.

The accounting body also urged the Hong Kong government to launch its first comprehensive tax review since 1976 to identify sustainable revenue sources to combat the narrow tax base against the aging population and rising costs of social welfare needs; as well as to improve the city's competitiveness in Asia.

CPA Australia recommended the launch of a luxury goods tax of 3 percent on luxurious items such as boats and yachts, watches and jewellery. The tax should be made non-refundable to tourists. CPA Australia estimated that the tax levy can bring HK$3 billion ($387.07 million) tax receipts to the government's coffer and the new tax should not have a detrimental impact on the local economy.

oswald@chinadailyhk.com