The year of living dangerously- Global economic prospects at a turning point

The year 2023 represents a turning point. If economic realities guide global prospects, it will be a positive turnaround. If geopolitics will continue to penalize economic prospects, a negative inflection point is more likely.

Recently, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), suggested that the year 2023 could "represent a turning point, with inflation declining and growth bottoming out." She based the prediction on economic assumptions. Unfortunately, we no longer live under an economic status quo.

Since the mid-2010s and the advanced economies' trade protectionism, sanctions and militarization, geopolitics has driven global prospects, as it did in the interwar period. As long as these underlying conditions prevail, so will persistent inflation.

The year 2023 could represent a turning point. Not the kind Georgieva had in mind – but a negative reversal.

Poor economies driving global growth

While the latest IMF projections show global growth slowing to 2.9 percent this year, the IMF anticipates a modest rebound to 3.1 percent in 2024. But it is the emerging and developing economies that are providing the momentum.

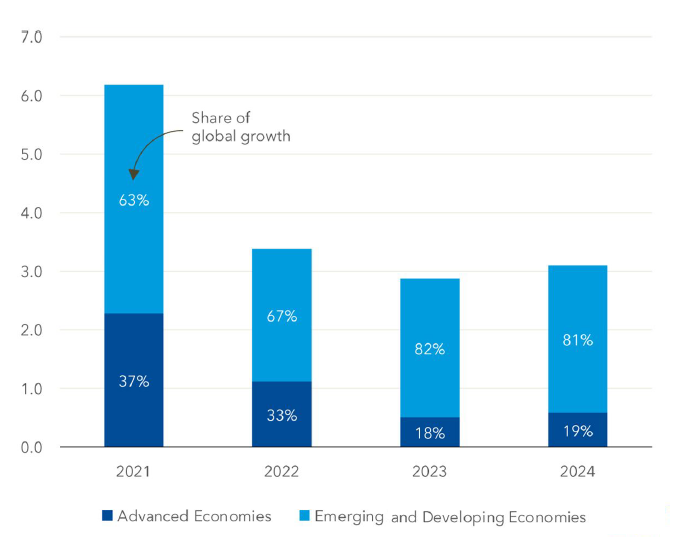

In 2021-24, the share of global growth by the largest emerging and developing economies will climb from 63 to over 80 percent. Accordingly, the share of the advanced economies will almost halve to less than 20 percent (Figure 1).

Figure 1 Global growth, 2021-E2024

Starting from a low base, India's GDP is still barely an eighth relative to the US and its growth is now slowing from the 7% growth projected to 6.8% in the 2023/24 fiscal year, as the global slowdown is likely to hurt exports. However, China's GDP is already three-fourths of that of the US and this year growth in the mainland (5.8-6.5%) could prove almost as fast as that of India (6.0-6.8%).

Together, China and India are likely to account for almost a third of global growth in 2023, as the major advanced economies are coping with recessionary conditions. Furthermore, the share of emerging and developing economies of global growth will progressively increase, whereas that of advanced economies will continue to fall as secular stagnation is spreading among them.

The Fed as a global risk

Global economic prospects have been further penalized by the US Federal Reserve's ill-advised monetary policies, particularly since fall 2021. After years of easy money and rounds of quantitative easing, the Fed misread the market signals after mid-2021, when inflation started to climb rapidly, and Fed chairman Jerome Powell downplayed the threat of soaring prices calling them "transitionary."

It was a fatal policy mistake, which a year ago led to my warning that US inflation was the global risk of 2022. With the onset of the proxy war only a month later, I predicted that the world economy would have to cope with the risk of stagflationary recession, compounded by energy and food inflation. The rest, as they say, is history.

In its February 2023 meeting, the Fed raised the interest rate to 4.5-4.8 percent, pushing borrowing costs to the highest since 2007. Recently, Powell warned of more rate hikes and seems to be aiming at a rate of 5.25 to 5.5 percent, thus flirting with a recession.

Rather than transitionary, inflation has proved sticky and persistent. Thanks to America's central role of the US in the world economy, what happens in America won't stay in America.

Rich economies' geopolitics penalizes global growth

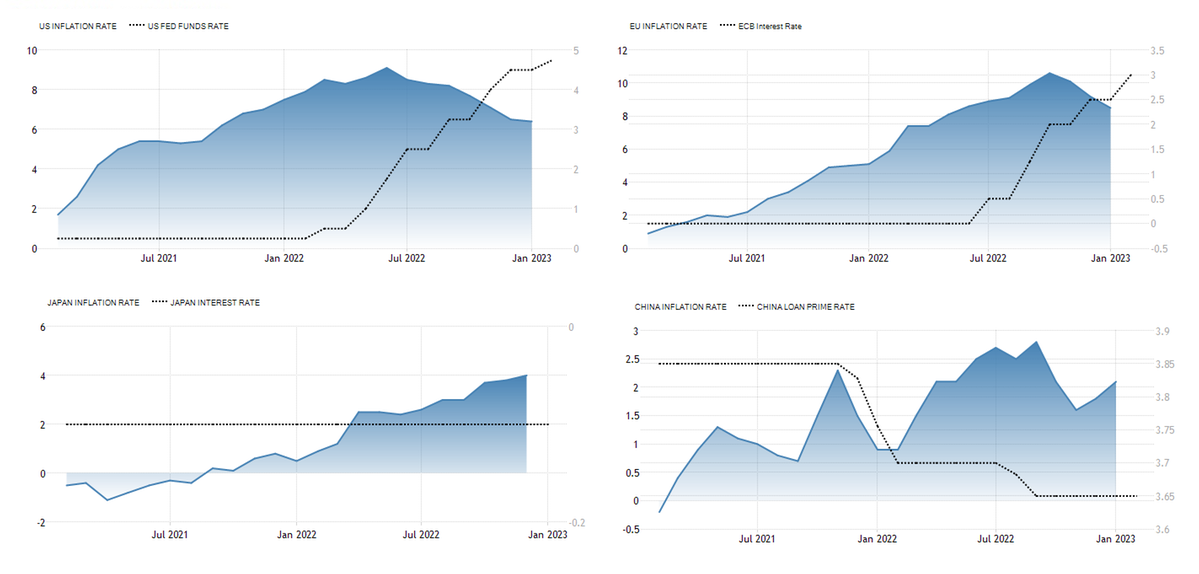

Recently, US stocks sank to their lowest levels in a month, with the S&P 500 Index dropping under 4000. Despite interest rate at almost 5 percent, the inflation rate, which soared close to 10 percent in summer 2022, slowed only to 6.4 percent in January.

After the US hit its $31.4 trillion debt limit set by Congress, Treasury Secretary Janet Yellen warned that a failure to make payments that are due "would undoubtedly cause a recession in the US economy and could cause a global financial crisis." New debt limit can be enacted, but not without unsustainable debt-taking.

In January, euro area bank lending fell again amid downturn, while cash and liquid deposits declined for the first time ever, thanks to rapid rate hikes by the European Central Bank (ECB). The ECB analysts stressed that the euro area has " shown remarkable economic resilience to the effects of the war [in Ukraine]." But that resilience is elusive because it's also based on massive debt-taking.

Consumer price inflation was revised slightly higher to 8.6 percent year-on-year in January. That's significantly below the peak of 11.1 percent in November, yet remains far above the ECB's target of 2.0 percent. It is likely to result in half a percentage hike at the Bank's mid-March meeting.

In Japan, inflation was negative until fall 2021. By January, it soared to 4.2 percent; the biggest increase since September 1981. Core inflation has been well above the Bank of Japan's (BOJ) 2% target for nine months in a row. This is largely attributable to continued increases in the cost of fuel and raw materials. Hence, the market's rising concern about global bond market spillovers if and when the BOJ's new chief Kazuo Ueda will hike interest rates (Figure 2).

Figure 2 Inflation and interest rates: US, euro area, Japan, and China

China's rebound offsets the Fed's risks

When Chinese policymakers began to prepare the reopening of the world's second-largest economy, many international observers warned it would unleash inflationary headwinds. But numbers do not back up the story.

China's annual inflation rate rose to only 2.1 percent in January. Expectedly, prices of food jumped and those of non-food gained further on the back of the Lunar New Year festival and the removal of pandemic measures. Nonetheless, the inflation rate remains only half relative to Japan, a third to the US and a fifth compared to the euro area.

At the eve of the two sessions, Chinese leaders pledged stronger growth. Recovery is taking hold and economic activity picking up pace with the country's reopening. China's GDP growth could soar to 5.5 to 6 percent in 2023, or over 6 percent on a quarter-to-quarter basis.

Internally, China's emphasis on social policies promoting a moderately prosperous society supports rising purchasing power among new middle-income groups. External risks have been in part reduced by the misguided US trade wars and protectionism, which have compelled Chinese policy authorities to stress the importance of self-sufficiency. Spillovers will be significant in those economies that participate in China's huge Belt and Road Initiative (BRI), and the Regional Comprehensive Economic Partnership (RCEP), the vast new trade bloc.

Global growth engines, without voice

The US, the euro area and Japan are struggling with secular stagnation and exporting runaway inflation. By contrast, China's growth is accelerating while inflation remains in check. Its reopening could lift global GDP up to a stunning 1 percent in 2023.

Large emerging and developing economies are today's global growth engines. Currently, their share of global growth exceeds 80 percent. While cyclical recession will end in the major advanced economies, their secular stagnation has barely begun. In the coming decade, the growth gap between the rich and poor economies won't go away. It is positioned to deepen.

With broadening secular stagnation, the long-run economic growth in the major advanced economies will approach zero. Perhaps that's why they are now so eager to use geopolitics and military muscle.

Dr. Dan Steinbock is an internationally recognized strategist of the multipolar world and the founder of Difference Group. He has served at the India, China and America Institute (USA), Shanghai Institutes for International Studies (China) and the EU Center (Singapore).

The original commentary was released by China-US Focus on March 1, 2023.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.