Investors still have confidence in economy

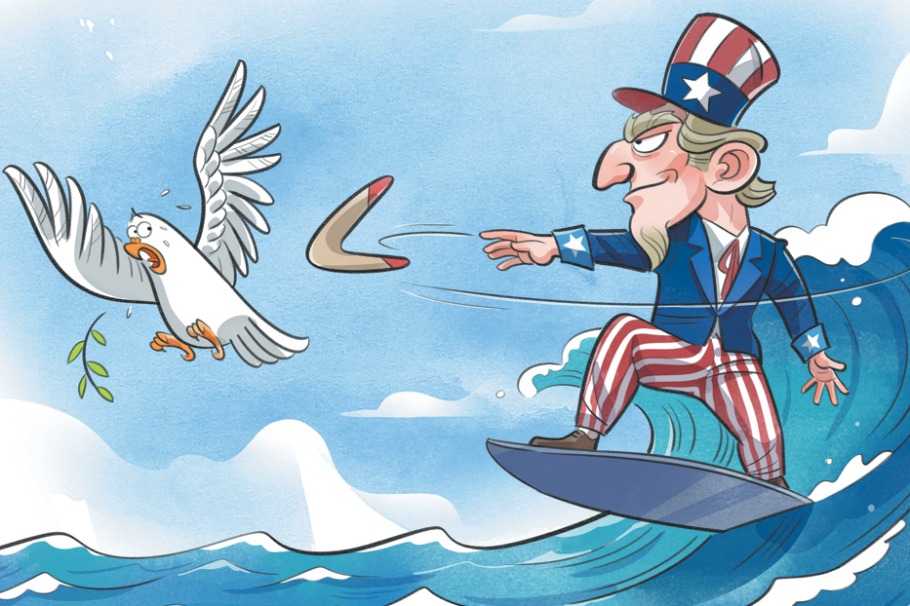

Wealthy Chinese and other Asian investors are near the top of the league tables for economic optimism worldwide. That makes sense because growth in Asia has outpaced that in the rest of the world for the past 20 years. But it does seem to overlook the intensifying US-China trade dispute, which has weighed on markets and economic activity and which ranks as the top worry for the same wealthy Asian investors who participated in a new UBS study.

At first glance, it also flies in the face of the fact that wealthy Asian investors are holding large sums of their portfolios in cash, a clear sign they'd keep what they've got rather than put it to work-and at risk.

What explains this possible contradiction?

On second glance, the investors surveyed in the UBS Investor Sentiment report display a great degree of sophistication. They know both sides involved in the trade dispute have little interest in long-term damage and they trust the authorities to bargain hard but succeed in the end. Free and fair trade is, after all, good for all participants.

They are, in other words, bullish but cautious-just like our chief investment office, which has advised investors to take some risk off the table but remains fundamentally optimistic.

According to UBS's new global survey, 66 percent of Asian investors and 77 percent of Chinese investors are optimistic about economic prospects, significantly above the average and second only to Latin American investors.

Asian investors hold more than one-third of their portfolios in cash-the highest of the regions surveyed-which will likely drag on returns over time. And even though 42 percent of them plan to invest more, they must look to diversify their portfolios to include all worthwhile opportunities across asset classes, many of which may not be in Asia. But, based on conversations with clients, many are hesitant to do this despite the fact that diversification by geography and asset class can improve returns and also provide better downside protection.

Nevertheless, we believe that a diversified multi-asset portfolio that is tailored to investors' needs will help them stay the course amid volatile markets. It will also help them meet their needs when it comes to their day-to-day liquidity, their growing longevity, and their longer-term legacy.

In particular, sustainable investments offer enough room for growth while supporting investors' social or environmental preferences. For instance, green bonds are a sound and sustainable alternative to global investment grade bonds. While an individual green bond usually performs similarly to an otherwise identical non-green bond, the green bond market has a more conservative sector and risk profile and benefits from demand for sustainable investments outgrowing supply. This should result in out-performance at times when credit risk premiums rise, making green bonds an appealing investment at our current late stage of the business cycle.

Green bonds are also a helpful allocation when building a broader and more fully sustainable portfolio diversified globally across equity and fixed income instruments. Wealthy investors in Asia and elsewhere are demonstrating significant demand for this type of portfolio.

So, despite the ongoing slowdown in the country, we still believe investors should cautiously look at China for investment opportunities. And despite the US-China trade dispute, we stand by our latest analyses which indicate there will be an economic re-acceleration here in the second half of the year. Of course, that may be contingent on a constructive and prompt resolution to the Sino-US trade dispute. If tensions persist, we can expect Asian supply chains to readjust, with Vietnam, Thailand and Malaysia benefiting from increased foreign direct investment and Chinese mergers and acquisitions.

We also see other long-term trends emerging in the form of smart cities. Asia is already home to 16 of the world's 28 megacities (those with populations of more than 10 million), with the number forecast to double by 2030. With this we expect Asia's smart cities to generate trillions of dollars in economic value over the coming years which will present significant investment opportunity to investors in areas such as smart mobility, information technology security and health technology.

Lastly, the sustained low interest rate environment has tempted some investors to shop around for better yield. While less traditional investments can certainly boost overall portfolio returns, high quality bonds are still key to protect portfolios against excessive losses.

Not keeping all your eggs in one basket-diversifying your portfolio-may be an old adage in investing. But that's because it's true, even if it means different things at different times. Therefore, investors in China, Asia and around the world would be wise to look further afield.

The author is co-president of global wealth management, UBS. The views don't necessarily represent those of China Daily.