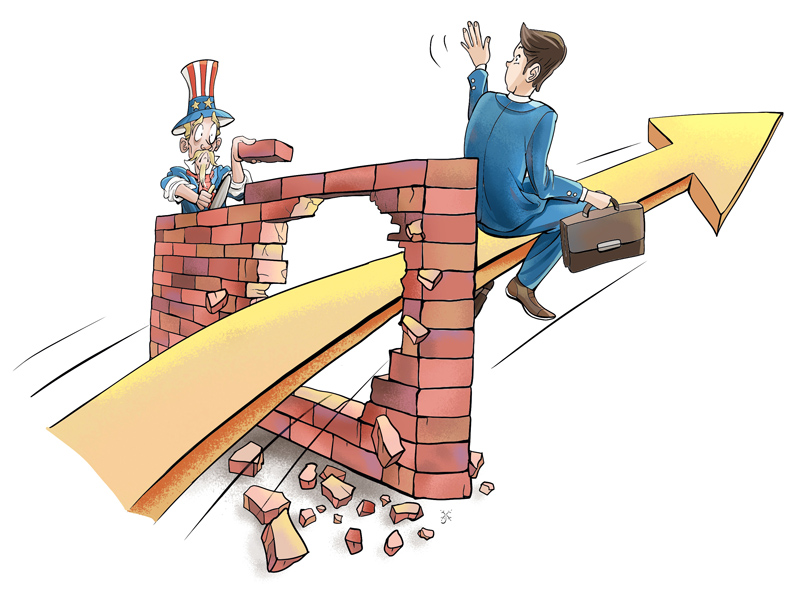

Hiked tariffs won't hamper China's growth

After the 11th round of Sino-US trade talks, the representatives of the two sides said they were willing to continue consultations. But now that the United States administration has raised the tariffs on $200 billion of Chinese goods from 10 percent to 25 percent, the question to ask is: What impact could Washington's move have on the US and Chinese economies?

It is widely believed that additional tariffs imposed by the US on Chinese goods have so far added up to $2 billion to the US coffers. But the 10 percent tariff increase from the previous round seems to have been paid by US companies and consumers. Besides, US importers' profits will shrink if they do not pass the costs of higher tariffs on to US companies downstream and consecutively to the US consumers. So the ultimate burden of the tariffs will be borne by US consumers.

US consumers bear burden of higher tariffs

A study by a group of economists from Princeton University, Columbia University and the Federal Reserve Bank of New York estimates that US companies have suffered a loss of $1.4 billion due to the higher tariffs on Chinese goods, and American consumers have paid more than $3 billion for the increased tariffs.

According to another study by a group of economists from the World Bank and International Finance Corporation, the US-China trade dispute has cost the US economy $6.4 billion, equivalent to 0.03 percent of its GDP. And it seems unwise to force US companies and consumers to suffer such a huge loss for a small increase in fiscal revenue.

Some US strategists believe the US administration's efforts to intensify the trade dispute is aimed at forcing foreign companies to leave China, and thus "decouple" the US and other economies from the Chinese economy. They believe China became the "world's factory" and developed at an unprecedented pace thanks to the massive investments made by foreign companies.

An apt example of negative thinking

If the chain of foreign companies producing goods in China for US and European markets is broken, many of these companies will have no choice but to move out of China. And if China loses its position in the global value chain, it won't be able to maintain a healthy economic growth rate. To minimize China's capacity for development, the US strategists argue, the US and its companies should be prepared to swallow some bitter pills. And to achieve their long-term goals, the US companies should not hesitate to lose a little profit in the short term.

Although there is certain logic to such ideas, they lack precision and nuance. For example, the US strategists' argument does not take into account the fact that Sino-US trade, to a large extent, is composed of semi-finished products. For instance, Chinese companies import semiconductor components such as chips from the US, use them to make mobile phones, computers, and even large-scale mechanical equipment and then sell them in the domestic market or export them to other countries.

The reverse is also true. Some US companies import components from China and assemble them into industrial products. So if the US raises tariffs on Chinese products, China is bound to take retaliatory measures. Also, Chinese companies are likely to reduce the import of commonly used semiconductor components from the US, while US companies could reduce imports of parts from China. This trend will force Chinese companies to allocate more funds for research and development, and increase production to replace US imports. And given that China's industrial production consists of a complete supply chain, increasing investment would be beneficial to the Chinese economy.

This is not good news for US companies, especially because the US' industrial chain is "incomplete", meaning American companies have to import semi-finished products from other countries in order to produce finished goods. Since few countries can replace China as an exporter of inexpensive yet quality products to the US and the fact that their products will invariably cost more, US companies' overall costs will rise rapidly.

The US administration has directed American companies to not supply semiconductor components to Chinese enterprises. But since China is the largest semiconductor market, the news led to a sharp drop in share prices of US semiconductor companies. If US technology companies cannot export to China, they will soon yield place to competitors and lose access to a huge market.

US exports to China have been falling since last year, while Chinese exports to the US have reached historical levels. This shows US companies cannot easily find replacements for Chinese products. On the other hand, China can easily find substitutes for natural gas, oil and soybeans that it imports from the US. Which means the US' efforts to intensify the trade dispute with China would be counterproductive.

US can't stop Chinese economy from growing

If US companies' exports fall, they will be forced to lower their production levels, which could affect the US' economic growth. Conversely, if Chinese companies do not have access to advanced technologies, they will increase their R&D investment and expand their production capacities to make up for the lack of US imports. Which means the Chinese economy will continue to grow.

According to the international trade theory, importing countries are the biggest beneficiaries of international trade. But the US administration does not believe in that theory. Instead, it thinks China has been taking advantage of bilateral trade, and that's why it has a trade surplus with the US. The US believes its notions about trade are more reliable than the long-established laws of economics.

In fact, the US economy has maintained low inflation and stable economic growth rates by importing cheap goods from China. If the trade war interrupts this balance, and the US economy is really "decoupled" from the Chinese economy, it will no longer enjoy low inflation and high growth.

Higher tariffs shows US policies misplaced

China's exports to the US account for only 18 percent of its total exports. In 2018, China's total exports added up to $2.48 trillion. So by imposing a 25 percent tariff on $200 billion of Chinese products, the US will excessively tax less than 10 percent of China's exports. Besides, the proportion of exports in China's total economic output is only 20 percent. So a reduction in Chinese exports will not have any serious impact on the Chinese economy.

US Trade Representative Robert Lighthizer was a key player in the US-Japan trade war in the 1980s. As such, he may use the same techniques to deal with China that he once employed to browbeat Japan.

But China today is different from what Japan was in the 1980s. The structure of China's exports to the US is completely different from that of Japan's, and the reasons for the respective trade surpluses are different as well. If the US applies the same logic that it used to settle the US-Japan trade conflict to address the Sino-US trade dispute, it will only end up hurting its own economy, as most of China's exports to the US are intermediate products, which are different from the finished products that Japan exported to the US.

Besides, the US should know that without the cheap goods imported from China, downstream US companies will suffer enormously, which incidentally will hurt the US economy.

The author is deputy director of China Development Research Center.

Source: chinausfocus.com

The views don't necessarily represent those of China Daily.