|

WORLD> Opinion

|

|

The 1997-98 crisis offers lessons to China

By Wang Dongjing (China Daily)

Updated: 2009-01-12 07:56

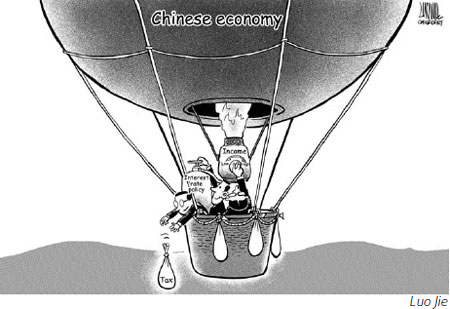

History is repeating itself in many different ways, as the current economic downturn in China parallels the 1997-98 Asian financial crisis in many ways. The plague of the financial crisis spread across Asian countries 10 years ago, while today the US subprime crisis, which erupted in mid-September, 2008, is dragging the world economy into recession. Academics agree the Chinese economy is still in good shape despite ominous signs. Potential pitfalls lie ahead but if proper measures are adopted, China is bound to ride out the global economic woes. Tens of millions of workers were laid off in China's State-owned enterprises in 1998 and some 12 million people lost their jobs in the country's private sector last year. The nation also suffered unprecedented natural disasters, causing huge economic losses in the past two years. Many policies used in 1998 can be borrowed to fight against the current financial turbulence. After the outbreak of the crisis in 1997 the government shifted its macroeconomic policy stance from a tightening to an expanding fiscal policy complemented with a moderately relaxed monetary policy. It floated 100 billion yuan treasury bonds and injected 100 billion yuan into major commercial banks in 1997, all of which was pumped into infrastructure projects. The Ministry of Finance doled out more than 100 billion yuan each year for the following four years to support the nation's western development strategy. The central bank eased monetary policy to help boost investment. It lowered the bank reserve requirement ratio, or the proportion of money banks must set aside as reserve, five times from 13 percent to 8 percent. In the five-year tenure of former premier Zhu Rongji the interest rate was slashed nine times, beginning in 1998. The next year the central bank started allowing consumer credit to encourage people to buy their own houses and cars. These measures vigorously spurred domestic demand and played an important role in curbing economic recession. The country maintained the stable value of renminbi against the currency depreciation in neighboring nations. If it failed to keep a stable exchange rate and let the yuan depreciate 20 percent against the dollar then, the relative hike in the value of the yuan now would have been much higher - maybe even 50 percent instead of the actual 20 percent - since China de-pegged the yuan from the dollar in July, 2005. In that case a much larger amount of hot money may have flocked into the country, making the situation even harder to cope with. However China also failed to do several things it should have in the wake of the Asian financial crisis. One of the important lessons is it did not offer tax cut incentives to lure investment. China sought to increase government procurement to boost domestic demand. But while government procurement could hardly benefit all Chinese enterprises, tax cuts are an effective way to boost investment. Although China raised tax rebates for exports during the Asian financial crisis, the overall corporate tax rate did not drop, which prevented it from recovering faster from the crisis.

It also failed to greatly increase people's income to spur individual consumption. But that was a hard choice for China; since the country failed to cut taxes for enterprises, raising people's income would only increase corporate cost and restrain investment. The Chinese economy is getting hit harder by the ongoing economic woes than it was by the financial turbulence 10 years ago. China's only strategy to counter the downward risk is to boost domestic demand, which can be achieved through tax cuts, easing credit control and pay hikes. Some government officials may not agree to further cut taxes, as they say the tax burden in China is not heavy and takes less than 25 percent of the total GDP. But if that is the case, how could we explain the nation's fiscal revenue rising 30 percent last year, which is more than twice the GDP growth rate of 11.9 percent? It is also important to increase wages to raise people's income. Compared with the roughly 10 percent growth of GDP, inflation of about 5 percent is acceptable, as long as the growth of people's income keeps up with the price hikes. China's new labor law, unveiled earlier last year, stipulates minimum wages, and did not get much positive response from businesses, many of which have tried to circumvent the law. If the government cuts taxes for businesses, the minimum wage policy will be carried out more effectively. The author is an economist with the Party School of the CPC Central Committee; the article is reprinted from People' Daily overseas edition (China Daily 01/12/2009 page2) |