On or off, retailers still fight it out

( HK Edition )

Online and offline retailers on the mainland have hit a rough patch amid signs of the e-commerce boom losing steam. As Chai Hua reports, the key to their survival is transformation.

Has China's e-commerce spurt - once seen as a watershed in the country's retail evolution - reached saturation point, run out of steam or, to put it in poorer light, hit the buffers?

If the latest pointers from the China Internet Network Information Center (CNNIC) - the 2-decades-old administration agency responsible for monitoring internet affairs under the Ministry of Information Industry - are anything to go by, there's hardly any room for comfort for the industry.

Online companies, which have seen exponential growth in the past few years as the mobile shopping craze made its mark on the country's massive tech-savvy crowd, and which have been largely blamed for the ill fortunes of their traditional brick-and-mortar peers, have now found themselves in the same boat.

Both sides are reeling from shrinking sales, ostensibly the backlash from an overwhelmed market with intense cut-throat competition and ever changing consumption habits.

Some traditional retailers, which joined in the scramble to open up internet channels at the onset of the e-commerce boom, have now gone back to their roots, realizing that the offline market still has huge potential to dig into, and the key to winning the retail revolution is transformation.

While many offline retailers explore new horizons on the internet, their e-commerce counterparts are doing just the opposite as they found themselves "cornered" with the development pace of e-commerce slowing down.

According to CNNIC's latest report, while the number of online shoppers had hit 514 million by June this year - up 10.2 percent compared with late last year - the growth rate for the last half-year report stood at just 12.9 percent.

The report also shows that the half-year growth rate of the mobile shopping population recorded a historical low level of 9 percent.

The analysis is that it's becoming increasingly difficult and expensive to lure new customers to online shops, forcing many e-retailers to revert to the offline format.

The about-turn has taken on extra significance with tech powerhouse Alibaba Group Holding Ltd opening its first brick-and-mortar store Tao Caf in Hangzhou, Zhejiang province in August and JD.com - the mainland's second-biggest e-commerce player - planning to have 300 physical stores up and running by the end of the year.

If e-commerce is not the way out, what's the best weapon for winning the revolution?

CNNIC analyst Chen Jing's answer is a new retail mode featuring a blurred boundary between online and offline marketing, fragmented consumption, plus intelligent purchasing facilities.

She believes convenience stores could fill the slot, having already drawn huge investments from both offline and online players. Shanghai and Shenzhen have taken the lead with the country's first unmanned convenience stores in action, and the initial public response is said to have been one of cautious optimism.

Convenient answer

A report jointly published by the China Chain Store and Franchise Association and global management consultancy Boston Consulting Group noted that the sales volume of convenience stores on the Chinese mainland grew by 13 percent to more than 133 billion yuan ($20.16 billion) in 2016, compared with the previous year, while the number of stores rose 9 percent to about 98,000.

At the same time, the statistics showed that the sales volume of the country's leading supermarkets went up slightly by 1.5 percent, while that of department stores fell 2.5 percent in 2016.

In Shenzhen, local traditional operator of department stores and supermarkets Rainbow Department Store Co has launched some 200 convenience stores so far, and aims to open another 600 by 2020.

Xie Zhiqiang, deputy director of Rainbow's IT department, said their convenience stores do stand out from the traditional ones. "We utilize big data analysis to make procurement decisions and adjust production supply accordingly. We also have cashier-less payment facilities to increase efficiency and they're connected to our online shopping platform," he quipped. Besides selling daily necessities, these stores also offer daily life services to link up with targeted customers, such as dining, printing, electricity bill payment, booking flowers, laundry and making home cleaning appointments.

Yonghui Supermarket and Rt-Mart - another two of the mainland's major traditional supermarket operators - have also thrown their hats in the ring, launching their own convenience stores in June and August respectively.

Competition is thus getting fiercer as more players enter the fray and eyeing a bigger slice of the cake, including Alibaba and JD, group-buying site and consumer review service provider Meituan-Dianping and even logistics company YTO Express.

Children's facilities

Besides convenience stores, industry insiders note that another opportunity for traditional retailers is experiential consumption, such as children's entertainment facilities.

Joey Yuan, deputy managing director of Colliers International Shenzhen, told China Daily the revenues of department stores and supermarkets hinge on rent, and the rental levels of retail properties have been stable in the past five years.

He said many of them are exploring models to take full use of space, and experiential services are their solution. One typical example during this summer vacation in Shenzhen is the introduction of climbing and other amusement facilities for children. Such facilities can draw greater customer traffic, compared with sellers of physical products, and it's important for owners of shopping centers to take the initiative in negotiating rentals with tenants.

An operations manager, surnamed Xu, at local shopping center Injoy-Mall told China Daily they've rented out a 300-square-meter enclosure to a company to run a children's ocean ball pool for three months this summer at a daily rental of 10,000 yuan.

She said the entertainment facility could attract 200 to 300 clients each weekday and double the number on weekends.

The company charges 65 yuan for 45 minutes per person - either a child or a parent - raking in up to 27,000 yuan daily.

It has been proved that customers are still willing to spend in physical stores - and even more than before - and their consumption habits are changing. The retail revolution may be also seen as a self-challenge rather than a tug-of-war between offline and online retailers.

Contact the writer at

grace@chinadailyhk.com

(HK Edition 09/01/2017 page8)

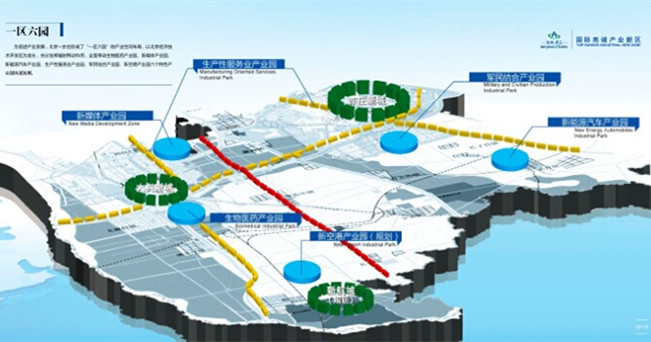

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500