Now, startups' valuations begin to melt

( China Daily )

|

|

A Chinese mobile phone user uses the ride-hailing app Didi Chuxing on his smartphone in Jinan, East China's Shandong province, Feb 22, 2015.[Photo/IC] |

In ancient mythology, Chinese unicorns are lucky, rare creatures that appear to mark the arrival or death of a great leader, like Confucius. Today, China's tech unicorns-private companies valued at $1 billion or more-are far more commonplace and look increasingly cursed.

Four of the world's seven most valuable private companies are now Chinese, all founded in the past seven years. Didi Chuxing, the ride-hailing app, and Xiaomi, the smartphone manufacturer, for instance, both have valuations topping Airbnb and Snapchat. Five Chinese companies have valuations of at least $10 billion, and 37 are valued at $1 billion or more, according to research firm CB Insights.

The pace of unicorn births has accelerated dramatically over the past three years. From 2010 to 2013, investors valued no more than one Chinese company each year at $1 billion or more. Then China saw five new companies deemed unicorns in 2014-and an eye-popping 19 foaled in 2015. In the first 10 months of 2016, investors crowned another 10 new unicorns.

Chinese companies are now often viewed as potential global conquerors. But, there's growing skepticism about how valid some of their sky-high valuations are.

Investors and analysts are whispering doubts about startups' ability to maintain such lofty numbers when they try to raise future funding or go public. Some fret the waves of cash pouring into China's technology industry may sometimes swamp innovation, not stir it.

"A paper unicorn is just a paper unicorn," said Jenny Lee, Shanghai-based managing partner at GGV Capital. "It's nothing until you can show the value you're providing to customers, and that consumers are willing to pay for it."

Gary Rieschel, managing partner at Qiming Venture Partners, said startups are quietly beginning to accept lower valuations-and more unpublicized down rounds are on the way. "Gravity will eventually take hold."

After Jack Ma-led Alibaba Group Holding Ltd's blockbuster IPO in the US raised $25 billion in 2014, investors rushed to find the next Ma. Between 2012 and 2015, the amount of venture funding invested in Chinese internet companies quintupled, reaching $20.3 billion last year-eclipsing the $16.3 billion invested in US internet companies in the same period, according to PriceWaterhouseCoopers.

|

|

An employee (left) assists a customer as she looks at a Xiaomi smartphone inside one of the company's stores in Beijing. [Photo/Agencies] |

Xiaomi, the Beijing-based smartphone maker founded in 2010 by serial entrepreneur Lei Jun, was market leader for several months in late 2014 and early 2015. Three months after Alibaba's IPO, Xiaomi raised funding that valued it at $46 billion.

But, its position in China tumbled from first to fourth. Its current value may be $4 billion to $10 billion if it tried to raise more money now, estimated Clay Shirky, an associate professor at NYU Shanghai and author of a book about the company.

China's Lenovo Group Ltd, for example, holds about the same share of the Chinese smartphone market as Xiaomi and is valued at about $7 billion. Lenovo is also the biggest PC maker in the world. "Xiaomi shouldn't be six times Lenovo," Shirky said. Xiaomi declined to comment.

Vancl, an online fashion retailer, became a unicorn in December 2010 and commanded 7.7 percent of China's online apparel and footwear market in 2011, second only to Alibaba, according to the research firm Euromonitor. Its valuation hit $3 billion. But the company stumbled in its expansion and struggled to manage inventory.

By 2015, Vancl's market share had dropped to 2 percent. Its valuation is well below its peak. A recapitalization a couple years ago valued Vancl at about $200 million. Vancl declined to comment on its current valuation.

The Beijing startup Wandoujia hit the magical $1 billion valuation in 2014, amidst the euphoria over China's fast growing smartphone market. The lead investor was Japan's SoftBank Group Corp, the same company that made a fortune from its stake in Alibaba.

But Wandoujia's business of selling Android apps proved vulnerable to competition and the online store struggled to stand out. In July, Alibaba acquired Wandoujia for less than half its peak valuation, according to a person familiar with the deal. SoftBank and Alibaba declined to comment.

Even some of China's most valuable unicorns have seen their plans for world domination interrupted. Lu.com is a peer-to-peer lender valued at $18.5 billion and backed by some of the country's most powerful investors, including the finance giant Ping An Insurance Group.

CEO Gregory Gibb had said in January that he planned to take the company public this year to raise additional capital. But those plans are off the table after months of tumult in the online lending market.

China has no real precedent for dealing with the bust of a high-flying startup, or several at once. Most domestic venture firms were founded after the last major downturn 15 years ago. There's no history of publicly disclosing down rounds, or the decrease in a startup's valuation-although investors may privately write down struggling companies.

Provincial governments have been wary after they had to reluctantly let some failed businesses go under. They may be even more fearful of tech startup failures, which would eliminate jobs and threaten future investments.

China venture capital investments surged from $6.6 billion in 2013 to more than $50 billion in the first nine months of this year, according to researcher Preqin. But in the third quarter, investments fell almost 50 percent from a year earlier. Maybe that's a relief, at least a few investors said.

"Some entrepreneurs say they need all the money," said Anna Fang, Shanghai-based CEO of Zhen Fund. "But some people say, if you have too much money, you make mistakes, or you make mistakes for longer."

Duncan Clark, founder of Beijing-based consultancy BDA China, said: "How many of those 30-some unicorns are really worth a billion? Probably a few. The problem is that when people appear to be successful, everyone comes out of the woodwork to back them. That happens in the US. But it's more extreme in China."

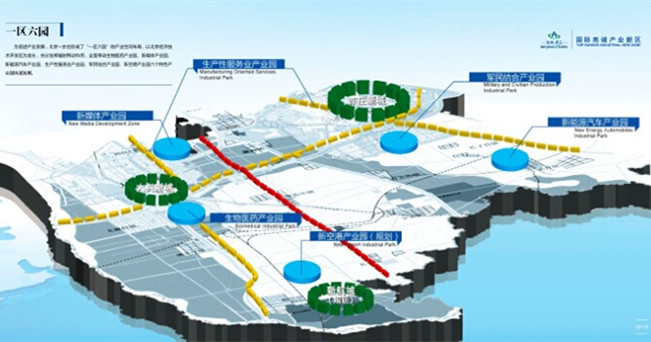

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500