The making of China's consumer society

( China Daily )

China's transformation from a manufacturing-driven and export-led economy to one underpinned by services and domestic consumption is firmly underway. And that's good news not just for China, but also for the future of the global economy.

The 2016-17 edition of the Blue Book of China's Commercial Sector by Fung Business Intelligence and the Chinese Academy of Social Sciences maps the change. China's retail markets reached 30 trillion yuan ($4.6 trillion) in 2015, after more than a decade of double-digit growth. Household consumption has begun to climb, even as the pace of investment has fallen, and now exceeds 6 percent of GDP. Though the consumption growth rate has slowed to 10.7 percent, the Blue Book projects that China's domestic market may reach 50 trillion yuan by 2020.

A key driver of this transformation has been internet technology. Building on heavy investments in public infrastructure, such as ports, airports, roads, railways, and telecommunications, the internet is now expanding rapidly the range of choices available to Chinese consumers, while lowering costs and accelerating delivery.

As a result, China's online retail sales have surged in recent years, from 6.3 percent of total retail sales in 2012 to 12.9 percent by 2015. By 2020, 40 percent of all retail transactions in China may be conducted online. Online sales via mobile phones have jumped from only 1.5 percent in 2011 to 55.5 percent in 2015, and may reach 73.8 percent by 2018.

China has now overtaken the United States to build the world's largest online retail market. With a growth rate of some 33 percent, it is also the fastest-growing such market. And despite growth in internet use - the number of connected Chinese has risen from 253 million in 2008 to 688 million last year - there is plenty of room for further expansion.

This progress reflects innovations that enable broad-based consumption without the construction and maintenance of expensive brick-and-mortar outlets. In fact, growth in mobile sales has been driven by lower-income consumers, particularly in rural areas, where more than 81 percent of internet use occurs via mobile devices.

One key innovation has been multi-sided platforms like Alibaba, which, by providing access to production, logistics, distribution, and payments, challenge traditional business models - with considerable success. In the second quarter of 2016, Alibaba announced that its revenue from China's retail market had increased by 49 percent year-on-year; another online platform, Tencent, reported a 52 percent increase.

By connecting small and medium-sized enterprises (which account for 80 percent of employment in China) with the consumer base, such platforms erode some of the competitive advantage of large State-owned enterprises. Indeed, while the returns from China's internet retailing revolution have been highly concentrated, for once this concentration has not been in the State sector.

In online retailing via mobile devices, Alibaba held an 84.2 percent share of the market last year, with the next largest online retailer, JD.com, capturing just 5.7 percent. In the business-to-consumer market, Alibaba's Tmall claimed a 58 percent market share in the third quarter of 2015, with JD.com taking just 22.9 percent. In third-party online payment services, Alipay held 47.5 percent of the market, while Tenpay captured 20 percent, and UnionPay, the only service developed by the banking community, had 10.9 percent.

As a result, SOEs, which have long specialized in single markets or products, have now begun to recognize that they need to retool to compete both in China and in global markets. Given that SOE reform has long been on China's agenda, this extra impetus may prove beneficial. But the challenge of determining how to create a level playing field for healthy competition and improve capital allocation in the Internet Era remains.

It is not just China's large companies that need to rethink their business models. As China's e-commerce platforms become increasingly global, they may erode the dominance of giant multinationals in international trade. Already in 2015, China's cross-border e-commerce amounted to an estimated 5.2 trillion yuan, or 17.6 percent of the country's total trade; it may reach 8 trillion yuan, or 23 percent of total trade, by next year.

All of this growth is great news for China; indeed, at a time of slowing performance in many traditional sectors, online retailing could be an economic lifesaver. But it also represents a major challenge for a government that has long relied on top-down decision-making.

China's e-commerce revolution enables the country's consumers to decide where to put their money. They can choose not only what kinds of goods and services they deem worthwhile, but also where to live and receive an education. As a result, they have become a key driver behind the transformation of the housing market, supply chains, finance, and even monetary policy.

The task for China's leaders is to respond more effectively to their citizens' needs and desires, including by accelerating progress on economic reform. Specifically, they must phase out obsolete supply chains saddled with overcapacity, bad debts, and falling employment, while taxing the winners in the e-commerce game. These imperatives are challenging traditional approaches to monetary, fiscal, industrial, environmental, and social policies, while testing the capacity of the bureaucracy and political system.

China's transformation into a consumer society will have profound implications for domestic and global suppliers and distributors of goods and services.

At first, it might hurt some of China's trading partners, particularly the emerging economies that have long depended on Chinese demand for their commodity exports. The decline in Chinese imports has already contributed to a decline in commodity prices. Moreover, foreign importers may find that Chinese-manufactured consumer goods now cater more to local tastes and preferences.

Whatever challenges emerge, the fact is that a prosperous China, underpinned by local consumers, will contribute to - and shape - a prosperous global economy. We can thank e-commerce for that.

Andrew Sheng is a distinguished fellow of the Asia Global Institute at the University of Hong Kong and a member of the UNEP Advisory Council on Sustainable Finance. Xiao Geng, director of the IFF Institute, is a professor at the University of Hong Kong and a fellow at its Asia Global Institute. Project Syndicate

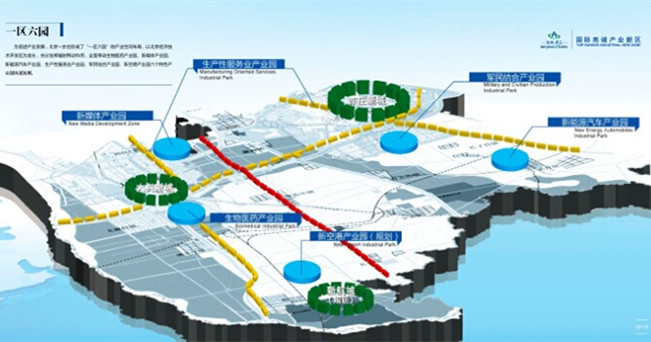

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500