The two engines of sustainable yet booming consumption

|

|

Sales on Alibaba's platforms race above 120.7 billion yuan ($18.2 billion) as of 1:09 pm Saturday.[Photo/IC] |

China's Singles Day shopping bonanza on Nov 11 is now the largest of its kind in the world, and this year's record sales may one day allow historians to find an interesting footnote in the gradual and accelerating shift of global economic gravity toward the East.

As Chinese consumers' propensity to spend more becomes increasingly manifest, one key engine to boost consumption growth already seems to be in place.

But will Chinese consumers be able to sustain their spending spree? Well, that will largely depend on the other engine-steady growth of purchasing power backed by higher salaries and more property income, including capital gains from bank deposits, securities, real estate and other assets.

About four decades of robust economic growth has gradually but significantly lifted the income level of the Chinese people, although not in a totally inclusive manner. As the world's largest developing economy keeps growing at a stable and moderate pace, Chinese policymakers' efforts to pursue sustainable and inclusive growth are likely to help raise the income level further so that more, if not all, families contribute to the rising tide of consumption.

Again, will Chinese consumers make good use of their accumulated wealth to increase their property income and sustain the consumption boom? Perhaps the question is weighing on the mind of the Chinese authorities, too, as they have intensified the crackdown on irregularities in the stocks markets and taken bold steps to further open up the financial market.

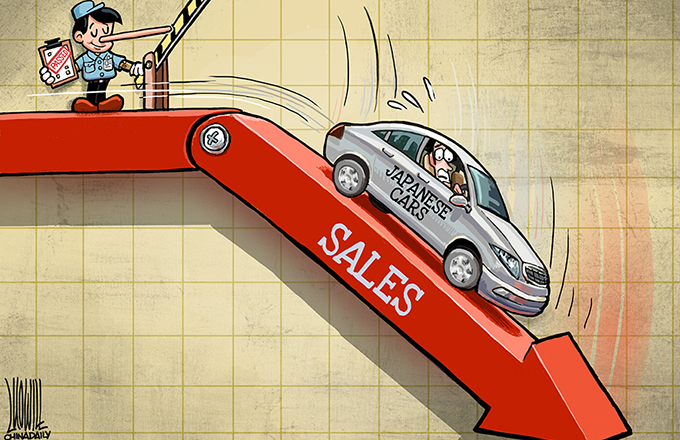

Last week, billionaire actress Zhao Wei and her husband were banned from China's securities markets for five years for market violations, according to a report filed by Zhejiang Sunriver Culture Co, which Zhao's company sought to acquire in February this year but failed. China's securities regulator said that, by making misleading announcements, Zhao's company has dealt a blow to market equality, transparency, and investors' sentiments and confidence in the securities market, and violated market rules.

Separately, in order to further open up China's financial sector, Vice-Minister of Finance Zhu Guangyao recently announced measures such as raising foreign ownership limits in domestic financial companies and granting foreign investors greater access to the country's financial services market. These efforts have long been seen as a fundamental part of China's reform and economic transformation in the coming years.

Given that property income contributes only a small percentage to the country's per capita disposable income, these regulatory and opening-up moves, for the moment, could boost consumption-led growth, something that policymakers are vigorously pursuing.

Yet underestimating the impact of the domestic stock market "crash" in late 2015 and the real estate fever across China last year will be detrimental to long-term consumption growth.

Admittedly, record Singles Day sales in the previous two years indicate consumers' sentiments have not been significantly dampened by those events, even though they could have reduced their property income. And the faster-than-expected growth in online spending on Nov 11 this year demonstrates the continuing enthusiasm of Chinese consumers and the increasing depth of their wallets.

But again that is no guarantee for success in the future. To sustain this consumption boom, we need a better-regulated stock market and a more competitive financial sector that would enable Chinese consumers to ensure continuous growth in property income. And as the Chinese people add to their wealth, property income will play an increasingly bigger role in shaping their consumption behavior.

The author is a senior writer with China Daily.

zhuqiwen@chinadaily.com.cn