Rating bias and spillover impact

Rating bias causes spillover effects. Since the financial crisis, China has become the anchor of the global economy and has provided the public goods for countercyclical global governance. International rating agencies' rating bias has a limited impact on China's fundamentally robust economy, but is likely to cause spillover effects on various levels, increase procyclical global economic volatility and weigh on the global economic recovery.

1) China's economy contributes countercyclical factors to the global economy. Amid the global macroeconomic chaotic era, the global economic recovery has long been weak. Economic globalization is rolling back with the interplay of economic and political risks. China has proactively taken on the responsibility as a great power and provided the public goods for global governance.

This has reduced the procyclical volatility of the global economy in three ways: I) China has been pushing forward the transformation of global governance and the stabilization of the global economy with the US. China has been exporting its economic stability to the world through the global value chain, hence facilitating the recovery of global trade and investment; II) overcoming the global governance predicament through the Belt and Road Initiative. Through "interconnection and intercommunication" and international cooperation on production capacity, the Belt and Road Initiative is speeding up factor flow and regional integration is resolving the structural conflict between the economies involved, starting the new wave of global diversification to achieve economic rebalancing; and III) China is proposing and implementing "building together through consultation to share benefits" in managing global order. The beggar-thy-neighbor style zero-sum game is being gradually replaced with this new concept to strengthen policy coordination between countries, thereby resisting the effects of populism, protectionism and isolationism.

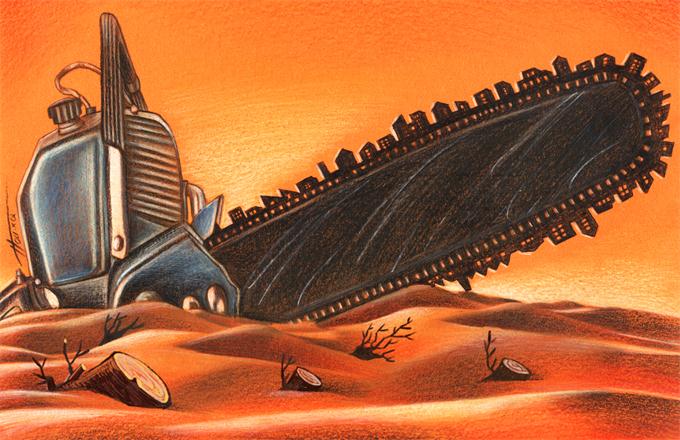

2) Rating bias escalates global procyclical risk. History tells us international rating agencies tend to be procyclical in their rating revisions. This not only fails to forewarn of risk but will also stir up market fear and amplify cyclical volatility. The big three international rating agencies have already been criticized for this during the euro debt crisis. The latest cut of China's credit rating is also very procyclical and damages the countercyclical efforts of China and other countries. This further increases the uncertainty of the global economic recovery.

Firstly, given the systemic importance of China's economy, smearing it will seriously impact the growth expectations of many countries and dampen the global economic recovery. According to the IMF's research[1], for every 1 percentage point drop in China's GDP growth, global growth will lose 0.23 percentage points in the near term and the Asia Pacific region (excluding India) will lose 0.06-017 percentage points in growth.

Secondly, the downgrade of China's sovereign credit rating will increase overseas financing costs for Chinese companies. This somewhat obstructs Chinese companies' going abroad plans and limits their ability to help invigorate and stabilize the economies along the Belt and Road.

Lastly, international rating agencies put aside the greater good for their own interest, ignoring the real economic circumstances of China and other emerging markets, and artificially disrupting the natural capital flow with rating difference. This will shake countries' cooperation incentive during a crisis era and resume the old beggar-thy-neighbor style international exploitation, thereby escalating global political and economic conflict and turmoil.

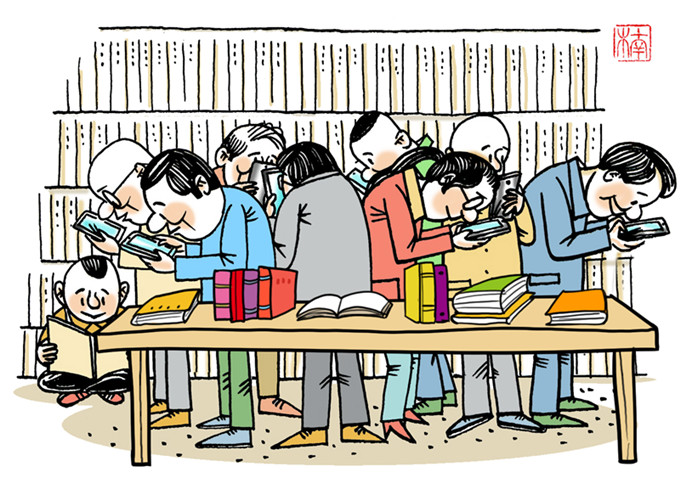

Expectation management eases negative impact. For China's economy, the negative effects of rating bias are mainly caused by expectation manipulation: increasing efforts to cast doubt on China's economy so as to influence domestic and foreign capital flow and to weaken capital support for China's economic restructuring and upgrading. Since crushing the RMB depreciation fear in the beginning of this year, the Chinese government has found a way to effectively manage expectations. After the latest rating downgrade, the relevant authorities swiftly carried out thorough communication with the market. Since then, there has been no unusual volatility of government bond yields and the RMB exchange rate, which correlate to China's domestic and foreign debt servicing capacity. Market expectations have been correctly guided.

It is worth noting that amid the global tug-of-war chaos, international rating agencies' rating bias and the spillover effects will become commonplace. To support the stable recovery of the domestic and global economy, China has to take on its responsibility as a great international power and to ease the continuous negative impact with a long-standing effective expectation management mechanism. Firstly, it is about strengthening its leadership in global governance.

Facing external challenges, China has to participate more deeply in international financial governance and use its economic power to influence the international community to set rules and order, while strengthening the business power and international status of Chinese rating agencies, thereby reducing the over-reliance on international rating agencies. Secondly, China has to optimize the government-market information exchange mechanism, helping the market to get across China's policy arrangement and supply-side reform progress, and pushing for more transparent communication to rectify information asymmetry, hence easing external selling pressure and strengthening positive market expectations for China's economy.

The author is head of research at ICBC International Research Limited in Hong Kong.

- Moody's downgrade not to constitute major impact on China: China, US experts

- Moody's subjective analysis goes awry

- Hard to know Moody's mood

- Experts say Moody's downgrading of China's credit rating shows miscalculations

- Moody's remains confident in outlook

- Moody's sees stable property market, but challenges ahead

- Chinese banks face profitability pressure: Moody's