Policy consistency could stabilize property market

|

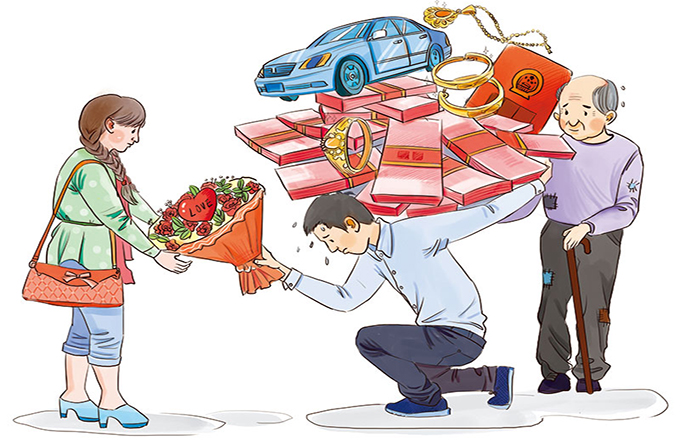

| MA XUEJING/CHINA DAILY |

The authorities in a number of northern and eastern cities, such as Beijing, Hangzhou and Xiamen, have rolled out stricter measures to dampen property purchases and cool the real estate market.

The measures have been introduced against the backdrop of continually rising housing prices since October, even after many cities initiated a spate of demand-dampening policies aimed at preventing real estate prices from rising too fast.

Obviously, the October round of tightening measures failed to thwart China's affluent buyers, forcing policymakers to show more teeth.

The latest round of demand restriction policies have caused a large number of deals to be cancelled due to requirement for higher mortgage down payments and revised eligibility standards for residents to buy an apartment.

But while the new policies have curbed, at least temporarily, some speculative investors, they have also hurt those with real demand, triggering a lot of complaints from young prospective purchasers.

However, the new policies are necessary. In the first two months of 2017, investment in China's real estate market rose 8.9 percent year-on-year to more than 985 billion yuan ($143 billion), and housing sales jumped 26 percent from the same period of 2016 to over 1 trillion yuan.

Although the official statistics did not reveal how fast housing prices have risen in the past months, data by research institutions show real estate prices have surged by more than 30 percent in many cities in the past six months.

If such a trend is not stopped, China will face the challenge of asset bubbles and if not handled properly, the bursting of bubbles will bring financial risks to the country, which has put prevention of financial dangers high on its agenda.

In the past decade, China's real estate prices have seldom stopped rising, and policymakers have adopted several rounds of tightening policies to cool the market. Usually, those policies have worked for awhile, but after they are lifted, prices simply resume their rising momentum-only at a faster pace.

Real demand is the driver behind such rising prices. China's urbanization process has continued steadily in the past decade and it has seen a large number of people moving from the rural to urban areas and from small towns to major cities, creating massive demand for housing.

However, the weakening confidence in the sincerity and willingness of local governments to hold back real estate prices is also an important factor behind the panic buying of properties.

The local governments benefit from more land sale and tax revenues if the real estate boom continues. Moreover, when falling property prices risk leading to or worsening an economic downturn, they are often pressured to ease restrictions and encourage people to buy houses, leading to renewed price rises.

The public, as a result, has doubt in the efficacy of tightening policies by the local governments, which is why prices continued to rise despite the restriction policies introduced in October.

Policymakers, therefore, should improve policy consistency as this would anchor public confidence that the prices will remain reasonably stable.

The author is a senior writer with China Daily

xinzhiming@chinadaily.com.cn