Brace for global economy to hit iceberg of US debt

|

|

MA XUEJING / CHINA DAILY |

Although two more interest rate rises this year may eventually bring to an end of the unprecedented era of ultra cheap money, the global recovery from the 2008 financial crisis, the worst in more than seven decades, is far from done.

If the world's largest economy cannot come up with any credible plans or commitments to dig itself out of an ever expanding debt slough, it is simply too early for the international community to breathe a sigh of relief.

In this sense, China's latest decision to set its growth target at about 6.5 percent this year should be more than welcome. It is an ambitious goal because that is what it will take for China's GDP to reach 90 trillion yuan ($13 trillion) by 2020, when the nation is expected to have a middle-class population of about 400 million. It is also much needed for such a growth rate will enable China to continue to serve as the major growth engine for the world economy.

After the flood of cheap money that has significantly inflated inequity and debts around the world for so long, it is high time the international community took some joint and concrete measures to raise productivity and upgrade the real economy.

That is why the high expectations of the Belt and Road Forum for International Cooperation and the BRICS summit, two major international gatherings China will host this year to promote economic cooperation and spur global growth, are justified.

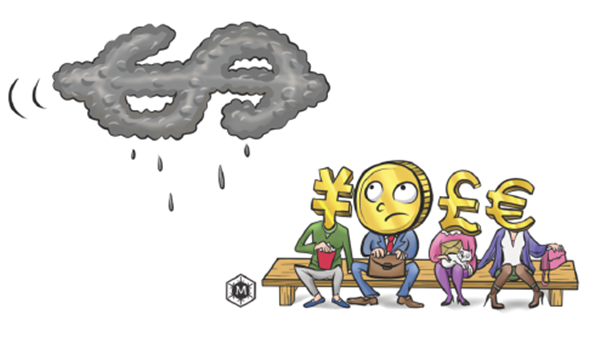

However, given the dominance of the US dollar in the international financial system, policymakers from developing countries should better prepare for the consequences of continuous hikes in US interest rates.

On the one hand, it is predictable that emerging markets and developing countries will see growing turbulence in exchange rates that could make domestic growth more difficult to achieve. Higher interest rates will gradually make the US dollar stronger against other currencies and accelerate capital flows in the short run, and rising protectionism in the US cannot wait to target countries with devaluation as the manipulator of foreign exchange.

On the other hand, it is totally unpredictable when and if the US will deal with its ballooning debts that will determine not only the sustainability of its economic growth but also the legitimacy of the US dollar as the dominant international reserve currency in the long term.

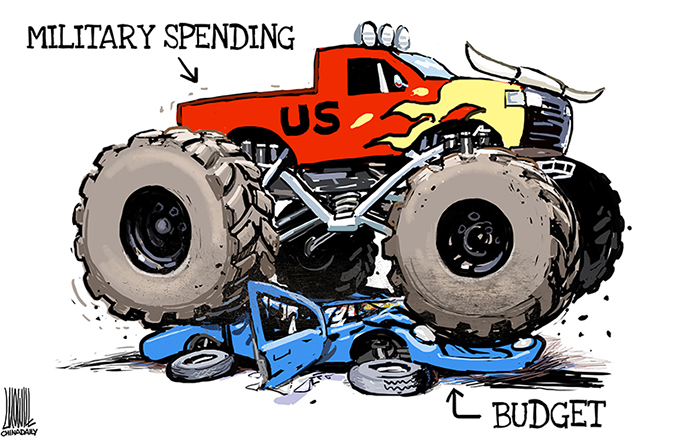

The self-imposed US debt limit was once deemed a symbol of fiscal responsibility. But after being raised more than 20 times since 1993, it seems no longer meaningful. With the US government vowing to cut tax and increase expenditure, more increases in interest rates will only send the total US government debts through the once unthinkable ceiling of $20 trillion.

The apparent reason for the Fed to raise interest rates for the third time since it began to stop the financial alchemy of near zero interest rate two years ago is the robustness of the US economy and low unemployment. But the unanswered questions are how the rise in interest rates will affect the serving of US government debts and how long can the US economic recovery based on ultra low interest rates survive when the tide of cheap money is turning.

Given that higher interest rates will increase the danger that someday the iceberg of $20 trillion debt may collapse under its own weight, it is far too early to claim the Fed's latest move is a convincing step to return monetary policy to a more normal footing.

The author is a senior writer with China Daily. zhuqiwen@chinadaily.com.cn