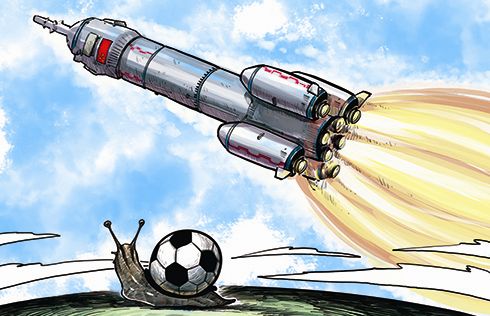

The flood of mortgage loans cannot lift all boats

Data from the People's Bank of China showed that, in the first three quarters, China's new housing loans to individuals raised to 3.63 trillion yuan, or 35.7 percent of new loans.

It is reported that, while housing prices in some larger cities rocketed by as much as 40 percent so far this year, the share of mortgages among new loans surged from 23 percent in the first quarter to 47 percent in the second quarter and 60 percent in the third quarter.

With such unprecedented credit support, it is no wonder that the property sector will more or less make some "obvious contribution" to the country's GDP growth. But is that kind of growth desirable or affordable?

It is estimated that while growth in loans to households rose to 57.3 percent year on year in September 2016 from 17.6 percent in 2015, the country's property investment growth only ticked up to 5.4 percent from 1.0 percent over the same period, still less speedy than the overall economic growth.

Clearly, such strong credit expansion only has a very limited impact on bolstering real GDP growth in the short term.

Even worse, the scenarios of both an unchecked housing bubble that raise costs for all other enterprises and a collapse in housing prices that leave many Chinese families and banks brutally hit would considerably undermine investors' confidence in the country's growth prospects in the mid and long run.

Chinese policymakers have begun to apply the brake on the red-hot property markets across the country since the very end of the third quarter. It is high time to abandon the illusion that the flood of mortgage loans will work magic without big costs.

- China's economy better than expected: Premier Li

- Putting too many eggs in one basket is not good for the economy

- Chinese economy stabilizes but risks still lurk

- Investors better to remain coolheaded about Chinese economy

- Economy tackling challenges, growing within reasonable range: Central bank governor

- Chinese economy is stable: central bank official