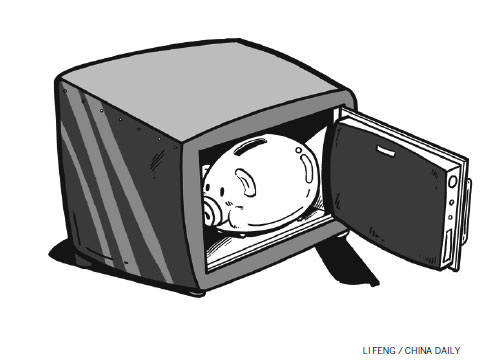

The introduction of the bank deposit insurance system in China will cause significant changes in the banking sector, increasing big banks' savings and putting small banks at a disadvantage. The move also signifies a fundamental change in the regulatory mentality.

Earlier, the government was obliged to keep all banks safe and solvent, but the new deposit insurance system will allow the market to have a bigger say in deciding the future of the banks.

On Sunday, the government issued draft rules on the crucial bank deposit insurance system, which will directly cover deposits of up to 500,000 yuan ($81,433) if banks go bankrupt. Such a scheme will protect 99.63 percent of Chinese depositors, the central bank said.

Primarily, the new arrangement is aimed at protecting the interests of the public as China's economic reforms, including those in the banking sector, deepen.

The expansion of the Chinese economy has given rise to some new risks, especially those brought about by exposure to the ballooning real estate sector and the pile-up of local government debts, both of which are related to the banking sector. If the risks become real, they will deal a heavy blow to the banks, leading to possible bankruptcy of some small lenders, which the insurance regime is intended to minimize.

This is not an unfounded alarm. From 1998 to 2003, more than 300 financial institutions and companies became insolvent and collapsed, producing large amounts of debts that were largely covered by the monetary authorities through issuing credits.

Although the bad loan ratio of China's banking sector remains low at about 1.1 percent, the central bank warned in April that the non-performing loan ratio of the 17 major banks could quadruple in the worst scenario of stress tests.