As the US Federal Reserve attempts to exit from its unconventional monetary policy, it is grappling with the disparity between the policy's success in preventing economic disaster and its failure to foster a robust recovery. Given the extent to which this disconnect has fomented mounting financial-market excesses, the exit will be all the more problematic for markets - and for the US' market-fixated monetary authority.

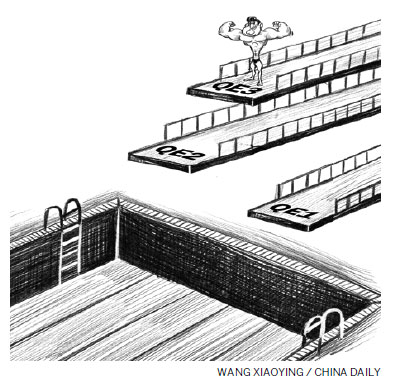

The Fed's current quandary is rooted in a radical change in the art and practice of central banking. Conventional monetary policies, designed to fulfill the Fed's dual mandate of price stability and full employment, are ill-equipped to cope with the systemic risks of asset and credit bubbles, to say nothing of the balance sheet recessions that ensue after such bubbles burst. This became painfully apparent over the past years, as central banks, confronted by the global financial crisis of 2008-09, turned to unconventional policies - in particular, massive liquidity injections through quantitative easing (QE).

The theory behind this move - as espoused by Ben Bernanke, first as an academic, then as a Fed governor and eventually as Fed Chairman - is that operating on the quantity dimension of the credit cycle is the functional equivalent of acting on the price side of the equation. That supposition liberated the Fed from fear of the dreaded "zero bound" that it was approaching in 2003-2004, when, in response to the collapse of the equity bubble, it lowered its benchmark policy rate to 1 percent. If the Fed ran out of basis points, the argument went, it would still have plenty of tools at its disposal for supporting and guiding the real economy.

But this argument's intellectual foundations - first laid out in a 2002 paper by 13 members of the Fed's Washington, DC, research staff - are shaky, at best.

The paper's seemingly innocuous title, Preventing Deflation: Lessons from Japan's Experience in the 1990s, makes the fundamental assertion that Japan's struggles were rooted in a serious policy blunder: the Bank of Japan's failure to recognize soon enough and act strongly enough on the peril of incipient deflation. (Not coincidentally, this view coincided with a similar conclusion by Bernanke in a scathing attack on the Bank of Japan in the late 1990s.) The implication was clear: substantial monetary and fiscal stimulus is critical for economies that risk approaching the "zero bound".

Any doubt as to what form that "substantial stimulus" might take were dispelled a few months later, when Bernanke, then Fed governor, delivered a speech emphasizing the need for a central bank to deploy unconventional measures to mitigate deflationary risks in an economy that was approaching the "zero bound". Such measures could include buying up public debt, providing subsidized credit to banks, targeting longer-term interest rates, or even intervening to reduce the dollar's value in foreign exchange markets.

A few years later, the global financial crisis erupted, and these statements, once idle conjecture, became the basis for an urgent action plan. But one vital caveat was lost in the commotion: What works during a crisis will not necessarily provide sufficient traction for the post-crisis recovery - especially if the crisis has left the real economy mired in a balance sheet recession. Indeed, given that such recessions clog the monetary policy transmission mechanism, neither conventional interest rate adjustments nor unconventional liquidity injections have much impact in the wake of a crisis, when deleveraging and balance sheet repair are urgent.