Why combating tax evasion matters

We live in an era when the rapid integration of the global economy is causing great stress in the lives of many people. Workers in the manufacturing sector, regardless of their location and nationality, can lose their jobs in large numbers if the facility where they are employed is no longer productive enough. And in many a country, social benefits are being trimmed constantly to make the welfare state sustainable during conditions of rapid population aging.

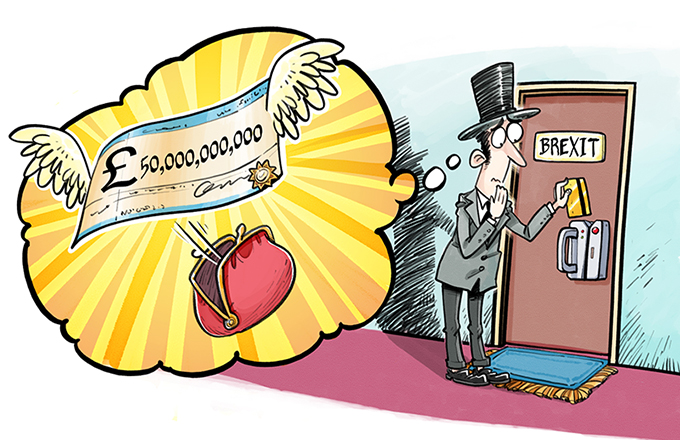

Under such circumstances, it is politically explosive - and in a democracy ultimately self-defeating - to let some individuals go on in their belief that they, unlike most regular tax-paying citizens, do not really have to play by the rules.

In such a world, it is pivotal that people live and operate under the same set of rules. There cannot be one set for all regular wage earners, who have their taxes and other charges automatically deducted from their monthly wages, and another set for people who enjoy great "flexibility".

True enough, there is a whole raft of prominent banking institutions, accounting companies and law firms - never mind the myriads of shady operators in this field with much lesser names and completely dubious reputations - who make a rich living indeed from setting up and operating this netherworld of tax evasion.

But their activities do not happen in a social and political vacuum. Economic globalization has brought about a significant increase in terms of income inequality in most Western societies. That is even true of countries that traditionally put much more emphasis on equality and solidarity, as is the case throughout Scandinavia.

When that happens, public policy must take appropriate measures to ensure a clear sense of tax fairness and equity in domestic society. And if the effort to ensure that requires resorting to extraordinary and, yes, in the minds of some, illegal measures, then that is what is required.

The law is never an absolute category. It is ultimately the codification of a set of moral choices between various layers of conflict situations, as they are either known or anticipated to exist.

When tax authorities can obtain information that penetrates the otherwise impenetrable world of tax evasion, then clearly any government is within its proper rights if it chooses to take action against the truly immoral choice.