Curing the drug market of its ills

China has ordered investigations into alleged corrupt practices of some multinational pharmaceutical companies following the bribery scandal of British pharmaceutical giant GlaxoSmithKline and detention of four of its senior executives last month. Infant formula makers are also part of the investigations.

Earlier this month, the National Development and Reform Commission, China's top economic planning body, imposed a record fine of 670 million yuan ($110 million) on six infant formula producers, including Mead Johnson and Abbott, for price fixing.

Despite being based on Chinese law, the crackdown on the corrupt practices has invited complaints from some foreign media outlets. A few conspiracy theorists even allege the crackdown, aimed at streamlining the pharmaceutical and infant formula market, is part of China's broader plan to tighten the grip on multinationals to benefit local brands. And some of them blame China's business environment for the medicine and infant formula scandals, claiming that the GSK case highlights the risks multinationals face in the Chinese market, where the "healthcare system is notoriously dogged by graft".

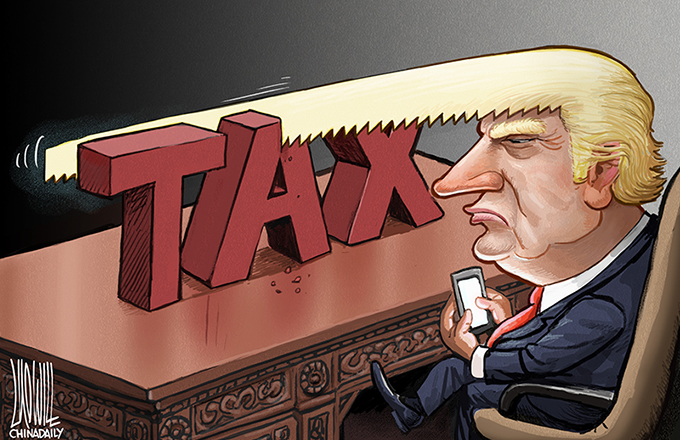

The fact is that it has been proved beyond doubt that some foreign companies were involved in corrupt practices. Chinese authorities have found that some senior GSK executives are guilty of commercial bribery and tax crimes. These executives paid bribes to government officials, medical associations, hospitals and doctors, either directly or through sponsorship, to boost the sales of their products. Also, GSK issued exclusive but false value-added tax invoices to get cash and colluded with travel agencies to issue fake invoices to finance their illegal acts.

Responding to the investigation, GSK issued a statement in mid-July, saying: "Certain senior executives appear to have acted outside of our processes and controls which breaches Chinese law. We have zero tolerance for any behavior of this nature."

Such criminal violation of law will invite penalty in any country. As Ministry of Commerce spokesman Shen Danyang said, the Chinese government is firmly opposed to all types of commercial bribery, and any company, domestic or foreign, violating the country's laws will be penalized.

As far as the business environment is concerned, China like any other developing country has its share of problems. But that does not mean China tolerates business malpractices and will allow reputable multinationals like GSK to violate the country's laws.

For arguments' sake, let us assume that the business environment in China is poor - and it indeed prompted GSK to breach the country's laws. But what about the markets in the United States and New Zealand, where too GSK was found guilty of felony? A New Zealand court imposed a heavy fine on GSK in 2007 for issuing misleading advertisements. And in July 2012, GSK agreed to plead guilty and pay $3 billion to resolve a criminal and civil liability case in the US, which involved the illegal marketing of certain prescription drugs and its failure to publicize safety data.

GSK, however, is not the first (nor will be the last) pharmaceutical company to be fined for corrupt practices in the US. In December 2012, US drugmaker Eli Lilly and Co agreed to pay $29 million to settle civil charges against its subsidiaries, which were charged with bribing foreign government officials or third parties to win business in Russia, Brazil, China and Poland.

Over the past decade, US courts have imposed heavy fine on quite a few pharmaceutical companies. For example, Schering-Plough, Pfizer, and Johnson & Johnson have paid $500 million, $2.3 billion and $1.1 billion as fine for violating American laws - and the amounts speak volumes of the severity of their crimes. So is the business environment in the US fertile ground for corruption?

The allegation by some foreign media outlets that the investment environment in China is "steadily worsening" because foreign companies have become "easy targets" of official crackdowns is baseless. Of course, the authorities have launched an investigation into infant formula makers and imposed record fine on six of them, including Mead Johnson, Abbott and Friesland, for price fixing.

But there is no truth to the allegation that China is cracking down on foreign companies to deflect public anger at the country's own food and drug safety scandals, and to bolster domestic brands. Five years ago, Sanlu Group, then the largest dairy product maker, had to wind up operations after its melamine-contaminated milk powder claimed the lives of six infants and left tens of thousands of others ill.

China's crackdown on malpractices is a warning to both foreign and domestic companies. And instead of deteriorating the investment environment in China, the crackdown is heralding in a fairer market order and an ever-improving investment climate for foreign businesses.

The author is a professor at the School of International Trade and Economics, University of International Business and Economics, Beijing.

(China Daily 08/21/2013 page9)