Brighter Asia despite risks

This year should be better for the global economy than what the International Monetary Fund feared six months ago. Owing to action by policymakers in advanced economies, major tail risks have receded. Asia's prospects are also brighter, as discussed in the IMF's Regional Economic Outlook, released on April 29.

After a subdued year, growth is set to pick up gradually to about 5.75 percent, on the back of robust domestic demand and strengthening exports. Economic activity is being held up in part by relatively easy financial conditions - created by accommodative monetary policies, rapid credit growth and a round of capital inflows - as well as intra-regional demand spillovers, notably from growing integration in final consumer goods trade.

Besides, in the absence of shocks to global food and commodity prices, inflation should remain broadly unchanged from last year and generally within the comfort zone of the region's central banks.

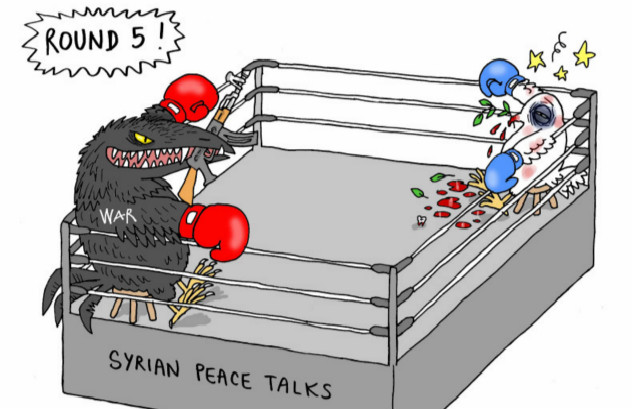

Nevertheless, there are important risks to this baseline outlook for Asia. While some tail risks have decreased, recent good news from the United States has been tempered with renewed worries about the eurozone. As a result, potential negative external shocks still pose a considerable threat to Asia's open economies.

At the same time, risks and challenges from within the region have come into focus. First, financial imbalances and asset prices, fueled by easy financing conditions, are building up in several economies. Second, given Asia's highly integrated supply chains and growing dependence on intra-Asian demand and finance, a number of regional risks could reverberate across its economies. These include trade disruptions from a natural disaster or geopolitical tension, a loss of confidence in Japan's efforts to restore economic health, or a sharp slowdown in China.

So how should Asian policymakers respond this year? They face a delicate balancing act. On one hand, they need to deliver appropriate support for growth. On the other, they must guard against the potential buildup of financial imbalances and rebuild the policy space that they used up in countering the global crisis.

Last year, given uncertain global prospects, Asian central banks maintained their already low policy rates or reduced them further. With inflation remaining low and stable, this accommodative stance was generally welcomed. But financial imbalances have grown, and these are often persistent and hard to unwind.

Moreover, output levels are close to or slightly above trend in several Asian economies. Therefore, central banks should be prepared to respond early and decisively to shifting risks. Macro-prudential measures will also have to play an important role in economies in which rapid credit growth or persistently strong capital inflows could create problems for financial stability. In general, Asia has buffers to cope with such risks, because banking and corporate sectors' balance sheets remain generally sound. These imbalances, however, call for careful monitoring and adequate supervision.

On the fiscal side, specific circumstances including the need for demand rebalancing and available policy space, will determine the appropriate pace of consolidation in a country. In many Asian economies, structural deficits are above pre-crisis levels, so greater efforts are needed to rebuild fiscal space. And with risks more balanced, automatic stabilizers should provide a strong enough first line of defense against moderate downside shocks.

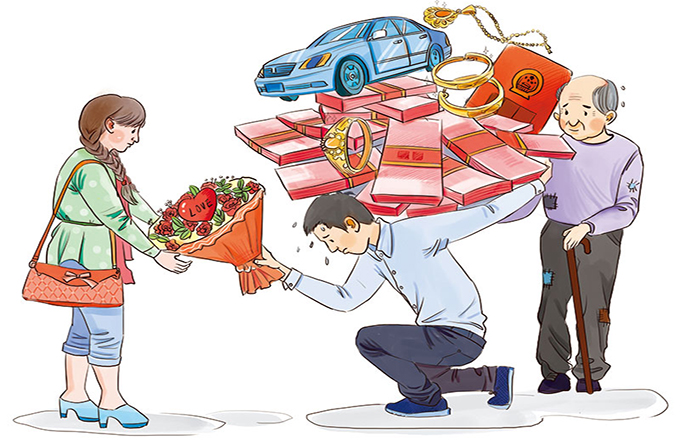

China's economy, for example, is slowing after decades of averaging 10 percent growth. But this is welcome, because China needs to shift to a growth path that is more moderate, inclusive and sustainable - both economically and environmentally. We expect China's growth to be around 8 percent this year, and inflation to remain subdued. This relatively benign outlook provides a good opportunity to focus on advancing the rebalancing of the economy away from investment and toward consumption.

Attention should also be paid to reining in the rapid growth in credit, both bank and non-bank, which was used to support China's recovery from the global crisis but has created stress on the balance sheets of corporates, local governments and financial institutions. Should downside risks materialize, fiscal policy should do the heavy lifting rather than a repeat of the past credit-financed stimulus which would exacerbate risks to the banking sector and local government finances. Instead a stimulus, if needed, should be executed through the budget to promote transparency, accountability and efficiency.

Perhaps the greatest risk to China's outlook is that stimulus props up the economy at an unsustainable pace. This could overshadow the urgency of reform, leading to a buildup of imbalances that would eventually cause a sharp and painful correction. Therefore it is encouraging that the authorities have recognized the importance of moving to a more sustainable growth model centered on improving the living standards of the people.

With investment already high and the labor force set to shrink, economic growth will need to be driven more by gains in total factor productivity and less by increases in capital and labor or excessive credit expansion. A comprehensive package of reforms is needed to generate these productivity gains, including financial reform to allocate capital more efficiently and open up service sectors to greater competition.

More importantly, the policies to transform to a more sustainable growth model go hand-in-hand with those for managing near-term risks associated with high levels of investment and credit, countering income inequality and reducing pollution by lowering the energy intensity of China's growth.

Anoop Singh is director of the IMF's Asia and Pacific Department, and Murtaza Syed is the IMF's deputy resident representative for China.

(China Daily 05/08/2013 page9)