No dammed lake of money

Supply rate of 13 percent necessary if China is to avoid an economic downturn and increased unemployment

China's money supply has generated enormous publicity recently. The amount of broad money, or M2, is one of the important indicators of money supply, and the ratio of M2 to gross domestic product is typically used as the measure of a country's money supply. In general, the larger the ratio, the more excessive the money supply.

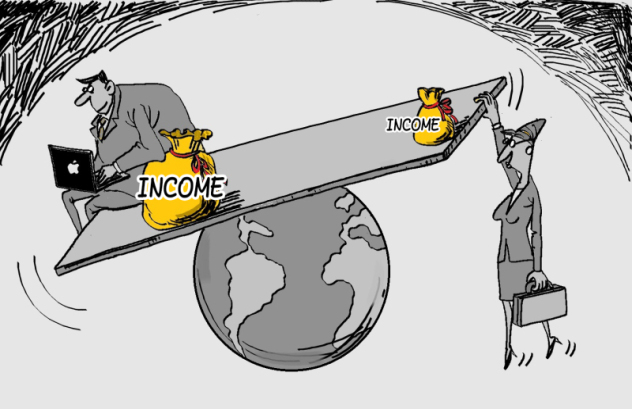

China's marginal money supply accounted for nearly half of the total money supply growth in the world and its M2 reached 97.41 trillion yuan ($15.5 trillion) in December 2012. Its GDP reached 51.93 trillion yuan and the M2 to GDP ratio hit a record high of 1.88. In contrast, the M2 of the United States was $10.5 trillion at the end of last year, while its GDP was $15.7 trillion, a ratio of just 0.67.

Some have claimed that China's money has become a dammed lake. But in my view, this judgment is inaccurate.

First of all, the composition of M2 in China and the US is not the same. The economic development stage of the two countries is different, as China is a developing country, and the US a developed one. The US has a sophisticated financial market with well-diversified financial products, and thus, investors have a variety of choices. In China, although there has been some development in the capital market, bank deposits remain dominant, therefore residents, to a certain extent, have to choose bank savings for investment. Generally speaking, money is used to pay debt to meet the demand of business transactions, speculation and prudence. However, money or deposits in the banking system are also kinds of financial assets, being similar to other financial assets such as stocks and bonds. Like investors, the creditors of bank certainly pursue returns on investment.

In a modern market economy, the boundary between financial assets and money has become fuzzy due to increasing financial innovation. Thus, taking into account the $65 trillion of underlying financial assets including bank deposits, bonds and stocks (mutual funds and financial derivatives are excluded) in the US today, which is about four times its GDP, a $4 investment only earns a return of $1. China has 160 trillion yuan of underlying financial assets, which is about 3 times its GDP, implying that there is a return of 1 yuan on an investment of 3 yuan. This demonstrates that investment return in China is higher than in the US, as determined by their different economic development stages. China is still in the process of urbanization, industrialization and information development, as well as agricultural modernization, while the US is the most developed country in the world. With the expansion of capital, marginal revenue will decline. From the perspective of relations between capital stock and output, China's M2 growth is reasonable. Comparing the M2 growth between the two countries in a one-sided manner is misleading and unscientific.

In the course of maintaining stable economic growth last year, the Chinese government stressed maintaining the M2 growth at 13 percent while its GDP growth was 8 percent. Some assume that the difference between its M2 growth and GDP growth will cause inflation, and thus the central bank should reduce money supply. But I don't agree.

First, the growth rate of the money supply in any country should not be lower than its GDP growth rate. In other words, the growth rates should keep pace with each other. This implies China's money growth rate will reach 8 percent at least. If not, there will be deflation, due to the fact that the money supply is insufficient to meet the demand of economic activities.

Second, as a developing country, China's inflation should not be zero. At the present economic development stage, an inflation rate of 3 percent is reasonable. With zero inflation, some problems would hurt the real economy because of China's inefficient financial market and defective market mechanism. So with GDP growth of 8 percent and 3 percent inflation, China's growth of money supply will reach 11 percent.

However, China is transforming itself toward a modern market economy. Considering the increasing costs of its factors of production, such as land, wages and natural resources, the central bank will need to pour a certain amount of money into real economy. Furthermore, the development of China's financial market has been very fast, as a result it too demands a certain amount of money. Adding them both up, an additional 2 percent of money supply growth is needed. So, China's M2 growth rate should be 13 percent: GDP growth of 8 percent plus CPI growth of 3 percent, plus the transitional demand of 2 percent.

Indeed, if the growth in China's money supply is unable to reach 13 percent, it will lead to deflation, an economic downturn and increased unemployment. Therefore, in line with today's reality, China should maintain M2 growth at 13 percent.

The author is a professor in finance and deputy director of Information Department of China Center for International Economic Exchanges.

(China Daily 02/25/2013 page8)