Addressing realty price rises

Further reforms should be introduced to meet social demand for housing and burst the growing bubbles

China's housing market is once again on an irrational upward trajectory because of high demand and speculative profiteering.

According to the China Index Academy, the average price of a new home in China's 100 major cities rose to 9,812 yuan ($1,577) per square meter in January, an increase of 1 percent from December, and the eighth consecutive price rise month-on-month. It was also 1.2 percent higher than a year earlier. With expectations for further price rises dominating the market, the risk of prices spiraling out of control is increasing due to the failure of both the market and government regulations.

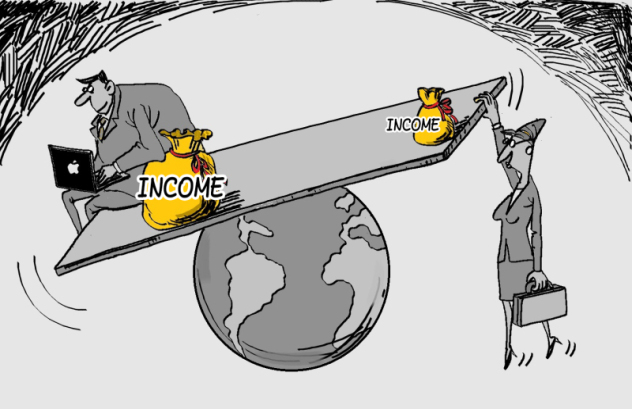

According to the internationally recognized measurements, China's housing bubbles have reached a dangerous level. Compared with reasonable housing prices, which are widely believed to be three to six times median household incomes, home prices in most of China's cities, especially first-tier cities such as Beijing, Shanghai and Shenzhen, are as much as 30 times average yearly incomes. Such a high housing price to income ratio has not only placed a heavy burden on ordinary homebuyers, it has also seriously limited China's economic growth potential. While accelerating the country's urbanization and industrialization and bolstering its fast-growing economy, such a real estate investment-driven economic growth model has brought a wide range of problems to the Chinese economy.

Aside from being driven by excessive dependence on land revenues, accelerated urbanization, supply-demand imbalances and overflowing liquidity, China's skyrocketing housing prices are also the result of a wrong real estate policy orientation, insufficient government efforts to set up a housing guarantee system, as well as the imbalanced distribution of public housing resources.

The demarcation line between investment and the demand for accommodation has become increasingly blurred. The housing market, once dominated by investment demand, has become particularly sensitive to currency supply, capital flows and trends in the land market and house prices will no long obey the basic law of supply and demand, which has led to the disappearance of the so-called balancing point and equilibrium price. As a result, the existence of currency flows and expectations for potential returns result in increased investment and this then causes further price rises.

As China has long viewed real estate as not being part of social policy, its contribution to gross domestic product and national economic growth has been overemphasized, while its function as accommodation has been ignored. The moment when the sector was taken as a pillar industry of the national economy and speculation became the market's main driver, the country's housing policy was taken off the normal track.

Another deep-rooted cause of China's housing bubbles is the establishment of a unitary housing supply model and imbalanced distribution of public housing resources. China should have established a multi-layer supply system to accommodate the different housing demand among high-income, middle-income and low-income groups. For example, a diversified and multi-layer housing supply system, composed of luxury, common and government-subsidized affordable housing units, should be set up.

The experiences of other countries show that real estate should not be fully at the disposal of the market, and well-tailored government interventions are needed to optimize the distribution of resources. In Western nations like the United Kingdom, ordinary residents enjoy real estate welfare offered by the government.

Such experiences indicate that China should launch sweeping and thorough reforms of its current real estate system. It should leave investment and luxury housing demands to the market while leaving consumption demand to the government. At the same time, different land supply and financial policies should be adopted to meet multi-layer housing demand.

The government should include in the public housing guarantee system middle- and low-income groups and even the wealthier middle class whose incomes also exclude them from commercial housing. At the same time, a sound government-sponsored public housing sales and rental system should be set up. China can learn from Germany's experience by adopting a housing subsidy policy, providing different subsidies to conditional residents for their housing purchases and renting.

The high housing prices are like a Sword of Damocles hanging over China's economy. Without fundamental changes to its approach to the housing sector and its current supply model, there is little possibility of the country's inflated housing bubbles being effectively addressed.

The author is an economics researcher with the State Information Center.

(China Daily 02/21/2013 page8)