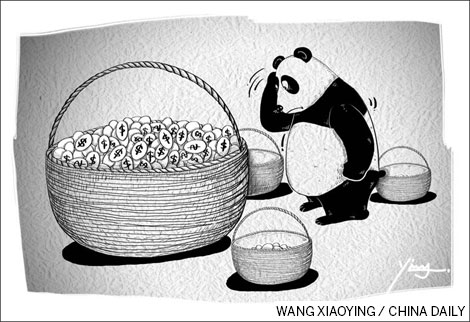

Of the $3.2 trillion in reserves managed by the State Administration of Foreign Exchange, about $1.1 trillion are in US Treasuries, according to US Treasury International Capital System figures. After Standard & Poor's (S&P's) downgraded the US sovereign credit rating, many Chinese commentators, policy advisors and economists have argued more aggressively that China should diversify its massive foreign reserves, a large part of which now is in US dollars.

Such people are either urging China to diversify its foreign reserves away from US dollars to other currencies or suggesting that it move more quickly to asset classes such as commodities. Among the reasons cited for this are "the risk of US government default is rising", "there will be a significant reduction in the purchasing power of Chinese holding of US Treasuries or US dollars", "the forthcoming QE3 (third quantitative easing in the US) will exacerbate US inflation and force a devaluation of the US dollar", and "it is an opportunity for China to speed up its yuan internationalization".

But China's reserve management strategy should not change drastically from its current path of gradual diversification. A sudden acceleration to diversify China's reserves away from the US dollar now is practically difficult, and could well be dangerous for China as well as the global economy and financial markets.

First, any significant selling of dollar assets by China will be immediately noticed by the global markets and could lead to panic selling of dollar reserves on a much larger scale. That could lead to a crash of the dollar, push up US interest rates and dampen the US economy, which in turn would hit the Chinese economy through falling demand from developed countries for Chinese goods. Besides, China will be blamed for exacerbating the global economy's woes at a time when global confidence is already very weak.

Second, if the dollar falls sharply, the yuan will also fall significantly against most other currencies, given that China does not allow major movements of its currency against the greenback. This will result in political pressures from China's other trading partners that would suffer from reduced competitiveness because of the yuan's devaluation against their currencies.

Third, any abrupt effort to diversify away from dollar reserves is likely to lead to an even faster reserve accumulation by the People's Bank of China (PBOC, or China's central bank) via the hot money channel. This is because a rapid decline in the dollar (forced by China's selling of its dollar assets) against other currencies will put China under greater pressure to revaluate its currency against the dollar over the medium term (because a rapid revaluation of the yuan has proven politically impossible). The expectation of faster revaluation of the yuan in the future will trigger stronger hot money inflows via traditional mechanisms (that is, fake overseas direct investment, over-invoicing of exports, black markets and individual conversions to yuan through Hong Kong banks).

Fourth, any abrupt move to diversify away from US dollar reserves could deal a serious blow to the yuan's offshore market in Hong Kong. Speculation over a more rapid revaluation of CNY (the yuan which is traded onshore, that is, on the Chinese mainland) will lead to a wider premium of CNH (the yuan's offshore market in Hong Kong) over CNY. Chinese importers (whether genuine or not) will therefore pay more aggressively in yuan to Hong Kong to enjoy the better CNH rate. This will force a faster accumulation of dollar reserves by the PBOC. As a result, regulators are likely to come under pressure to restrict transactions on the CNH. This will be a serious setback to the mainland's efforts to internationalize the yuan.

Fifth, even if China wants to diversify its foreign reserves rapidly, the lack of depth and liquidity in other currencies' fixed income markets poses a serious constraint because of the size of China's reserve portfolio. For example, the size of the Bund (German federal bonds) market is only 14 percent of the US government's debt market. Given the lack of liquidity in other markets, the impact generated by China's fast diversification on them could be very much self-defeating.

Sixth, the euro's fixed income market is the most liquid after the US market, but many European sovereigns (that is, the Spanish and Italian) are facing significantly higher default risks than US Treasuries. And following S&P's downgrade of US rating, many market participants have begun to worry that France may be the next target. In addition, the worsening of the eurozone sovereign debt crisis could easily lead to a further devaluation of the euro against the US dollar in the next one to two years.

Finally, although shifting foreign reserves toward equities and commodities is a strategy we believe China should adopt on a long-term basis, doing this now could be risky. This is because the growth of the US and the European Union is clearly on another deceleration path and the probability of another global recession has risen substantially over the past weeks.

When the global economy slows and contracts, the most obvious victims are commodities and equities. US Treasuries, on the other hand, could be well supported by the "risk off" global reallocation of assets, despite the downgrading the US' rating.

Therefore, China should not accelerate its reserve diversification now, although gradual diversification should remain a long-term strategy. A more important message that China should and is likely to learn from this historical event - S&P's downgrade of US rating - is that further accumulation of foreign reserves is becoming increasingly risky both financially and politically.

Thus, it is important for China to accelerate its domestic structural reforms (that is, promoting domestic consumption, improving the social safety net and encouraging imports and overseas direct investment) to cut the overall balance of payments surplus and, in the process, reduce the pace of future reserve accumulation. This reform will, on a more fundamental basis, help improve the health of the Chinese and global economies and reduce the risks arising from the global imbalance.

The author is chief economist of Deutsche Bank, Greater China.

(China Daily 08/10/2011 page9)