Root Causes of Continuous Price Decline And Policy Suggestions

2002-12-13

Zhang Junkuo, Liao Yingmin and Deng Yusong Research Report No 099, 2002

China’s price level has been declining since 1998. Despite a slight pick up in 2001, a negative growth reappeared in January-May 2002. In view of the factors causing the current price declines and the trend of their changes, the price level throughout 2002 will be lower than that of 2001. And a possible negative growth cannot be ruled out for the entire year. Price is a composite reflection of the performance of the national economy. Therefore, continuous price declines deserve careful study.

I. An Analysis of Price Decline in January-May and the Trend for the Whole Year

(1) The basic state of prices in January-May

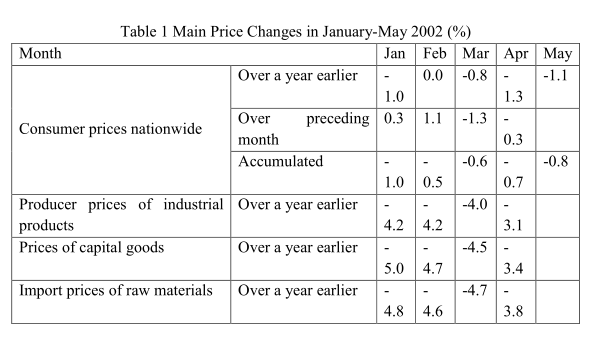

During the January-May period, the general level of nationwide consumer prices continued the declining momentum of the final quarter of last year, and the range of decline was larger. The price level was 0.8 percent lower than that in the same period of last year. The range of decline was 0.7 percentage points larger than that in the final quarter of last year. From January to April, of the eight classified indexes, only three categories -- tobacco, liquor and related products; entertainment, stationery and services; and housing – saw their prices rising slightly, respectively by 0.2 percent, 0.6 percent and 0.2 percent. All the remaining categories saw price decline. In particular, household appliance and services saw their prices decline by 2.4 percent, clothing saw its prices fall by 2.1 percent, medical care and personal articles saw their prices drop by 1.0 percent, transportation and communications saw their prices dip by 1.5 percent, and food items saw the prices 1.0 percent lower. The ranges of these declines were all larger than those in the fourth quarter of last year. Also from January to April, the producer price of industrial products were 3.8 percent lower than that of the corresponding period of last year. Although the ranges of monthly declines were smaller, the accumulated average decline range was still 0.2 percentage points higher than that in the fourth quarter of last year. Specifically, while the price decline range for capital goods shrank only slightly, the import prices for raw materials dropped by 4.8 percent, 4.6 percent, 4.7 percent and 3.8 percent in the four months. The ranges of these declines were larger than that in the fourth quarter of last year. In contrast with the above price trend, however, housing price rose by 5.7 percent in the first quarter over the same period of last year, and the range of price rise was 3.8 percentage points higher than that in the last fourth quarter.

1. The price-pulling factors have weakened. In recent years, the government adjustment of the prices for some commodities and services has been the main force pulling up the prices. In 2001, for example, some regions raised the tuition fees, housing rent, the price of water for civilian use and other charges, thus forced the price indexes for the category of education, culture and entertainment and for the category of housing to rise by 6.6 percent and 1.2 percent respectively over the same period of the year before. In 2002, the central and local governments at various levels strengthened the regulation and control over the prices of the monopoly commodities and services, and improved the government pricing mechanism. As a result, policy-oriented price adjustments covered less items and the government ability to raise prices was weakened. At the same time, personal housing rents reduced after the housing reform, and the interest rate of housing loans was lower. From January to April, the prices of the above two items rose by 0.6 percent and 0.2 percent over the same period of last year, with their range of price rise being respectively 6.0 and 1.0 percentage points lower. Obviously, their ability to pull prices up has weakened.

2. The price-stabilizing factors have undergone changes. In 2001, grain prices began a recovery rise of 1.5 percent (national retail price index), thus bringing an end to the continuous decline of food prices in the preceding four years. Food prices in 2001 were at the same level of the previous year. That was the main factor for stabilizing the price level. In 2002, however, grain export in the first two months dropped by 10.7 percent while grain import increased by 79.1 percent due to the impact of China’s accession into the WTO. Because of the impact by imported low-priced grains and the improvement in grain production, grain prices began declining. The decline during the January-April period was 1.5 percent (consumer prices in 36 large cities). As a result, food prices dropped by 1.0 percent. This was due to the changes in the price-stabilizing factors.

3. The price-declining factors increased and all consumer prices declined. Technological advance has lowered the costs of cultural, educational and communication products and forced down their prices. Sustained market oversupply deepened the declining range of the prices of industrial and consumer products. After the WTO accession, the impact of imported products on the domestic market also restrained the prices.

4. The rapid growth of supply restrained a rebound in the prices of capital goods. Thanks to the rapid increase in fixed asset investment and industrial production, the rising demand for capital goods brought the prices of capital goods slightly up. As a result, the price declining range is small. Beginning from February, the monthly price comparison became positive. The rising market demand has not only led to a rapid growth of the supply of domestic capital goods but also the entry of the imported low-priced products into the domestic market.

(3) Prices for the whole year will remain at low levels.

The above analysis indicates that from January to May, the price-declining pressure surpassed the price-pulling force. The result was that the prices posted a negative growth. As to the price prospect for the whole year, the price-pulling factors include the central government policy to continue expanding government direct investment through the issuing of treasury bonds, the picking up of the world economy and the stabilization of the prices of the basic and raw materials on the international market. At present, the prices of copper, aluminum and steel are slightly higher, while the prices of petroleum and finished products are stable. The rebound of the prices of capital goods is stronger than the general price level and will play a positive role in pulling up the prices. The basic situation of structural overcapacity and the imbalance between domestic demand and supply will not change fundamentally. As there are lots of factors at both the demand and supply ends that are unfavorable for price stability, the pressure for price declines is still great. In addition, China has begun fulfilling its WTO commitments as from 2002. With lower import duties and increased tariff quotas, the prices of imported products on domestic market are bound to fall. This will intensify the competition between imported products and domestically produced products, and force down the prices of domestic products. We expect that throughout the first half of the year, the level of prices will continue the sliding trend at the end of last year. In the second half of the year, the level of prices is likely to pick up somewhat as a result of the gradual implementation of the macro regulatory policies and the gradual improvement of the world economic situation. For the whole year, the price trend of the first half will be declining while that of the second half will be rising. The general level of prices for the whole year will be lower than that of last year. Of course, a possible negative growth cannot be ruled out.

...

If you need the full context, please leave a message on the website.