Agriculture a fertile field for investment

BEIJING - Venture capital and private equity companies are showing great interest in investing in China's agricultural industry.

However, analysts said the relatively small profits, inclement weather and other risks could hinder their plans.

"Because of strong support from government policies, different kinds of capital, both at home and abroad, have flowed into the agricultural sector," Zhang Yuxiang, chief economist of the Ministry of Agriculture, said in Chengdu recently.

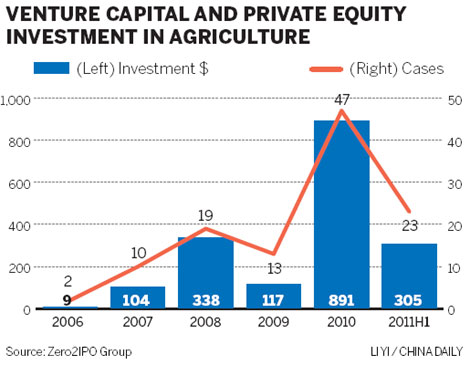

Venture capital and private equity companies invested $305 million in the agricultural industry in the first half of this year. Their total agricultural investments in 2011 are expected to hit a record high, said Gavin Ni, chairman and chief executive officer of the Beijing-based Zero2IPO Group, a leading venture capital and private equity consulting company in China.

Venture capital and private equity companies began pouring into China's agricultural industry about five years ago. Between then and June this year, their accumulated investment in the industry has totaled $1.76 billion, a report from Zero2IPO showed. Crop farming, pesticides, fertilizer and animal husbandry have garnered the most money, the report said.

For example, Beijing Century Chestnut Ecological Agriculture Co Ltd, a company that provides eggs and chickens to large Chinese cities, raised 100 million yuan ($15.8 million) this year from a financial consortium led by the Shanghai-based DT Capital Partners.

Legend Holdings Ltd, parent company of Lenovo Group, the world's second-largest personal computer maker, spent 1.13 billion yuan in acquiring shares and this year became the largest stakeholder in two domestic companies that make baijiu - a Chinese spirit produced from various grains. The company purchased a 39 percent stake in Hunan Wuling Wine Co Ltd and 34 percent stake in Henan Qianlongzui Wine Co Ltd.

Even so, the percentage of all venture capital and private equity companies' investment that has gone into agriculture in China is very small, said Ni at Zero2IPO. "It is about 3 percent, and I believe the figure is not likely to surpass 5 percent in the next three years," Ni said.

Between January and November, venture capital and private equity companies completed 175 mergers and acquisitions deals in China, according to Zero2IPO.

The transaction amounts of 157 of those have been disclosed and totaled $9.9 billion.

Venture capital and private equity companies have invested less in the agricultural industry than other industries, such as the medical and e-commerce industries, said Xiao Jun, an agricultural analyst with Zero2IPO. That, she explained, is likely because the rate of return on agricultural investments is fairly low and because capital usually chases bigger payoffs.

In addition, most agricultural products are susceptible to the weather, land conditions and other environmental influences, Xiao said. She said just because a business model works in a particular place, that does not mean it can be transferred successfully to others.

"Investing in agricultural projects requires more patience and hard work," said Blecho Yan, partner of Fortune Venture Capital Co Ltd, a venture capital company.

Yan said investors should adopt a long-term strategy because most new agricultural companies require time before they can undertake an initial public offering.

"About 20 percent of our portfolio is related to agriculture projects," Yan said. "We will maintain that figure in the future in case of risks."

Infinity Group, a private equity company supported by the Israeli conglomerate IDB Group, said it is cautiously optimistic about investing in China's agricultural sector.

"The uncontrollable factors in the agricultural sector have made us cautious," said Joey Zhu, a spokesman for Infinity Group. "But we are still interested in investing in areas such as biological agriculture, irrigation technology and high-end agricultural machinery."

Infinity Group manages assets worth more than $730 million. It has relationships with more than 2,000 Israeli agricultural companies and has made several agricultural investments in China. The company declined to reveal specific figures about those investments.

China Daily