No let-up seen in HK property rally as tempo stays

Updated: 2017-07-02 14:35

By Lin Wenjie in Hong Kong(HK Edition)

|

|||||||

|

Limited land supply and huge demand have fuelled the rally in Hong Kong's property market. A growing number of mainland property developers have entered the foray to grab a slice of the market in pursuit of higher returns. Anthony Kwan / Bloomberg |

Chinese mainland-based property developers, with a sound capital base, embarked on an unprecedented shopping spree in Hong Kong's land market in the first half of 2017, snapping up all of the residential sites tendered by the government.

The influx of mainland developers is said to have diversified the local residential property market, while providing a greater variety of choices for homes buyers and investors.

Mainland builders had once withdrawn from Hong Kong's residential land sales market following the city's property market bubble burst in late 1997, but have made a gradual comeback after 2011.

According to a report by property consultancy JLL, the proportion of residential sites awarded to mainland developers via government public land sale had soared from 1 percent in 2011 to 100 percent in the first half of this year.

Mainland developers now account for 63.7 percent of the total market capitalization of property developers listed on the Hong Kong Stock Exchange, suggesting there's still huge potential for companies engaged in Hong Kong's property development, the report said.

"Hong Kong's residential market has diversified in recent years due to the big inflow of non-local developers. If the market is dominated by local developers, it wouldn't make any progress," said Vincent Cheung Kiu-cho, Hong Kong-based deputy managing director of Asia valuation and advisory services at Colliers International.

He told China Daily mainland developers have been offering innovative products to local homes buyers. Instead of traditional tower blocks that can accommodate more than six units in one floor, they've introduced slab apartments with a north-south orientation that offer a good amount of sunlight.

Some people are worried that mainland developers will further push up the city's already sky-high property prices with their huge capital base, compared with their local counterparts.

Cheung said property prices are determined mainly by supply and demand instead of land prices. "If a site were to be awarded to a local developer at a lower price, the completed apartments could still be sold at high prices depending on supply and demand."

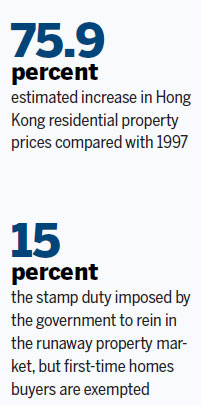

Hong Kong's residential property prices are now 75.9 percent above the peak recorded in 1997, which means that a typical apartment that would cost HK$4 million in 1997 will now sell for about HK$7 million. JLL believes the price rally will continue into the second half of 2017.

"Despite the government's market cooling measures and the impact of anticipated interest-rate increases, we expect homes prices to go up by between 10 and 15 percent this year, supported by strong pent-up demand from first-time buyers, who accounted for about 90 percent of overall transactions recently," said Joseph Tsang, managing director at JLL.

He said the local residential market is much healthier now compared with 1997, as the majority of the apartments bought are for self-use. In 1997, almost all buyers were short-term speculators.

To check skyrocketing property prices, the Hong Kong government has introduced several rounds of cooling measures, such as raising the stamp duty by 15 percent, and lowering borrowers' applicable loan-to-value ratio capitalization by 10 percentage points for property mortgage loans.

"These measures have steered purchasing power to the primary market, with developers offering bigger loans for buyers to get onto the housing ladder, while the second-hand market, where the supply is concentrated, became deadlocked. Thus, homes prices will continue to rise as developers are still eager to provide loans for their new projects," said Tsang.

At the same time, Hong Kong builders, riding on the mainland's rapid economic development, have been heading north to tap the country's red-hot property market.

Joe Zhou, head of research at JLL in Shanghai, said Hong Kong developers had also been aggressive in acquiring residential or commercial sites in first- or second-tier mainland cities in the past 20 years. But, as land prices have soared with mainland developers gaining a bigger market share, they have been holding back in recent years.

"Hong Kong developers had been the leading offshore-capital investors on the mainland from the 1990s and had benefited a lot from rising land prices in the past two decades. Although they're now less aggressive in the mainland market, they're still big players as their land inventory is huge enough for them to develop for years," Zhou said.

Hong Kong developers are also having robust balance sheets. According to JLL's report, Sun Hung Kai Properties, with a market capitalization of HK$334 billion, has a long-term debt-to-equity ratio (DE) of 13.5 percent; Cheung Kong Property Holdings has 24.4 percent DE, and Sino Land has only 0.99 percent D/E ratio, which means they don't need to borrow too much to start a project.

Mainland developers, on the other hand, are more likely to utilize financing early in the development process. They would borrow up to 47 percent of the value of the land, meaning that if they don't have enough capital offshore, it will be difficult for them to bid for a site.

cherrylin@chinadailyhk.com

(HK Edition 07/02/2017 page14)