'No panic' appeal as yuan hits 6-year lows

Updated: 2016-10-26 09:22

By lin wenjie in Hong Kong(HK Edition)

|

|||||||

State-owned banks step in to slow Chinese currency's retreat while greenback surges on renewed rate-hike talk

In the face of a grim economic outlook and fresh hawkish remarks by US Federal Reserve officials that the next interest-rate rise is around the corner on a surging greenback, the yuan has continued to lose steam, plumbing record six-year lows against the US dollar on Tuesday.

But, mainland regulators emphasized that there's no basis for a persistent depreciation in the Chinese currency and that it will soon find its footing.

Monetary and financial experts feel that the renminbi could instead make use of the opportunity to let off depreciation pressure fueled by a possible US interest-rate hike by year-end, without creating the sort of panic seen in August 2015 and earlier this year when the yuan was on track for a substantial depreciation.

The offshore yuan slid to 6.7834 per US dollar as at 4:30 pm in Hong Kong on Tuesday after having slipped to its weakest intra-day level of 6.7885 since September 2010. The onshore yuan retreated mildly by 60 basis points to 6.7778 as at 4:30 pm - the lowest level in six years.

Mainland media reports said the yuan had begun stabilizing after large State-owned banks intervened by selling US dollars in a bid to slow the currency's decline against the greenback.

The People's Bank of China (PBOC) set the yuan's fixing rate at 6.7744 against the US dollar on Tuesday - the lowest level since September 2010 - according to the China Foreign Exchange Trade System (CFETS). The onshore exchange rate is allowed to rise or fall by 2 percent from the fixing rate each trading day.

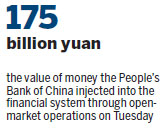

Capital outflows have intensified as a result of the currency's accelerated decline, forcing interbank liquidity to be tightened. After the central bank released the yuan's fixing rate on Tuesday, the interbank overnight money rate jumped by 17 basis points to 2.41 percent - the highest level in 18 months. To ease the liquidity constraints, the PBOC injected 175 billion yuan ($25.8 billion) into the financial system through open-market operations at the same time.

The yuan has lost almost 1.5 percent in value in the past month as the US dollar gained momentum and on the back of continual apprehension over the state of the mainland and global economies.

Two US Federal Reserve officials were quoted as saying on Tuesday that December could be the "best time" to tighten borrowing costs and that interest rates could go up three times before the end of 2017.

Analysts have adopted a positive stance over the future direction of the renminbi.

"The central bank could make use of the depreciation trend at this stage to ease the yuan's exchange risk before the US Federal Reserve ups interest rates by the end of this year," said Guo Lei, chief macro-economy analyst at GF Securities.

She emphasized that the currency's depreciation is not the result of the fundamental factors, pointing out that in the first two week of this month, the yuan had depreciated by just 0.57 percent against the greenback while, at the same time, having appreciated by 0.6 percent against a basket of currencies under the CFETS.

"Any US rate increase at the end of the year will have little impact on the renminbi," Ma Jun, chief economist of the PBOC's research bureau, said on Tuesday.

He again emphasized that China's monetary policy is moderate, and the yuan's depreciation this month has been due to a resurgent US dollar as the currency is not depreciating against a basket of other currencies.

"The US dollar's long-term appreciation, undoubtedly, will pile pressure on other currencies. But, if foreign currencies pour into China's bonds market, the yuan will enjoy strong support," Ma said.

Overseas institutions raised their holdings of China's sovereign debt by 12 percent last month to 385.97 billion yuan, according to the China Central Depository & Clearing Co.

In an article in the People's Daily on Tuesday, PBOC Deputy Governor Yi Gang stressed that there's no basis for the yuan continuing to fall, and the Chinese currency is more stable compared with other exchange rates in emerging markets.

cherrylin@chinadailyhk.com

(HK Edition 10/26/2016 page1)