Tencent shares seen hitting new highs on record profit from entertainment

Updated: 2016-08-30 09:18

By Duan Ting in Hong Kong(HK Edition)

|

|||||||

|

A spokesman for Tencent introduces TencentOS - an operating system developed by the company that can be installed on a slew of smart devices. After the internet giant posted whopping increases of 48 percent and 41 percent in total revenue and net profit for the first half of the year, experts believe that the prospects of Tencent's share price continuing its ascent are still huge, as the company is still experiencing rapid growth on the strength of two key engines - games and mobile advertising. Asia News Photo |

While a good number of the Chinese mainland's top 500 enterprises had reported battered profits or revenues in 2015 for the first time in 15 years, tech titan Tencent Holdings has found itself riding high on the other side of the fence.

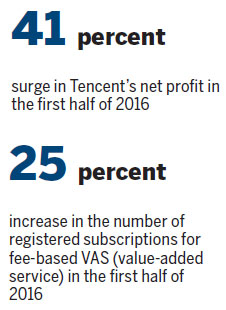

The Shenzhen-based, Hong Kong-listed internet and media giant - one of the world's biggest tech conglomerates - posted whopping increases of 48 percent and 41 percent in total revenue and net profit to 67.7 billion yuan ($10.1 billion) and 20.1 billion yuan, respectively, for the first half of this year, compared with a year ago, according to its financial report released on Aug 17. Tencent's share price rocketed to a record HK$205 apiece at one stage in Hong Kong trading on Aug 17 after having opened with an upside gap of more than 6 percent.

Market experts are going with the tune that Tencent can expect continuous upside potential in its share price, propelled by better-than-expected earnings growth and the projected kickoff of the Shenzhen-Hong Kong Stock Connect before the end of the year.

As the best performer in Hong Kong's benchmark index since its 2004 listing, Tencent - founded by tycoon Pony Ma Huateng in 1998 and with an estimated market value of $200 billion last year - had split the share two years ago from one to five to lower the entry barrier for investors. At the time, its share price had hit more than HK$500, which was considered too expensive for individual investors. Since the share split, the share price has doubled within two years.

Kenny Wen Kit, a wealth management strategist at Sun Hung Kai Financial, pointed out that Tencent's share price has yet to hit its peak as the company is still experiencing rapid growth on the strength of two key engines - games and mobile advertising. Over the next three years, he said, Tencent could see continued upward momentum.

In the second quarter of 2016, the company's online media platform and advertising revenue saw the heaviest traffic, with its mobile platform advertising recording 32.2 billion yuan, compared with total revenue of 35.7 billion yuan during the period.

Li Yujie, an analyst at RHB Research Institute Sdn in Hong Kong, said Tencent was able to grab market share from existing players as a result of the huge traffic volume its mobile apps had generated. "But, the main drivers for cost, like content acquisition and bank handling fees, won't go away any time soon," he said.

John Wong Jun-yu, vice-president at Quam Securities Asset Management and president of Algo Association, shared similar views, saying that the prospects of Tencent's share price continuing its ascent are still huge.

He believes that the large pool of active users supports Tencent's business, and the expected launch of the second stocks trading link between Hong Kong and the mainland would lead to more funds being channeled into the city's stock market, benefitting large-cap blue chips in the process.

Wong explained that Tencent's growth drivers are mainly the increase in the number of users, and improvement in the development of mobile games, social media, payment services and advertisement.

According to Tencent's financial report, the number of monthly active user accounts (MAU) of the company's social media flagship QQ reached 899 million in the first half of this year, representing a year-on-year hike of 7 percent. The combined MAU of Weixin and WeChat soared 34 percent year-on-year to 806 million, while the number of registered subscriptions for fee-based VAS (value-added service) rose 25 percent to 105 million.

For smartphone games, Tencent achieved about 9.6 billion yuan in revenue in the second quarter of this year - up 114 percent from a year ago. Revenue from social networks surged 57 percent to 8.6 billion yuan, driven by virtual item sales and revenue growth from subscription services, especially those for digital content services, such as video, music, and literature.

The company's Tencent Video goes toe-to-toe with Alibaba's Youku Tudou and Baidu's IQiyi. Its online advertising business raked in 6.5 billion yuan ($980 million), fueled by a video streaming service whose NBA games attracted twice as many unique viewers during the latest season.

While being a force in social networking, Tencent is still a relative newcomer to online advertising, with ad revenue that Credit Suisse Group estimates runs at about a sixth of Facebook's. However, investors are keeping a close eye, especially, on self-service ads on WeChat's Moments feature, which executives identified as their single biggest growth opportunity when it comes to advertising.

"It has resulted in Weixin Moments becoming our largest ad-revenue generating inventory," Tencent Chief Strategy Officer James Mitchell said.

Wong added that, in recent years, Tencent has been acquiring assets overseas and effectively promoting its business worldwide, as well as bringing in advanced technology from foreign countries. These strategies also support the company's stable revenue growth.

Global banking firm UBS reinstated its optimism on Tencent's growth outlook recently and lifted the target price to HK$230 with a rating of "buy". Bank of America Merrill Lynch also revised its target price upwards to HK$238 with a "buy" rating.

Despite Tencent's positive business outlook, Wen warned that investors should watch out for its share price adjustment in the short term and avoid placing too much hope on it.

Tencent's share price picked up 0.5 percent in Hong Kong on Monday to close at HK$201.4, while the benchmark Heng Seng Index dropped 0.38 percent to 22,821.34.

Bloomberg contributed to the story.

tingduan@chinadailyhk.com

(HK Edition 08/30/2016 page9)