Vanke's 45 billion yuan metro offer in limbo

Updated: 2016-06-21 08:07

By Chai Hua in Shenzhen and Duan Ting in Hong Kong(HK Edition)

|

|||||||

|

A promotion booth of China Vanke Co in a Shenzhen shopping mall. Although China Resources - Vanke's second-largest shareholder - is opposed to Vanke's proposal to invite Shenzhen Metro to its board, analysts believe that Vanke's deal with Shenzhen Metro would be beneficial to its long-term development and expansion. Edmond Tang / China Daily |

Mainland builder's plan to acquire Shenzhen Metro assets hits snags as China Resources vetoes the deal

A 45.6 billion yuan ($6.9 billion) plan by mainland property giant Vanke to acquire assets of Shenzhen Metro - the city's subway system - risks being thrown out amid stiff opposition from Vanke's second-largest shareholder China Resources.

China Resources has stuck to its guns, warning that it will ultimately veto the plan if it's financed by a proposed share placement rather than cash.

But, analysts believe that Vanke's move would be beneficial to its long-term development and expansion.

Vanke - one of the mainland's largest real estate developers, with a recorded sales volume of 260 billion yuan last year - said last week it plans to acquire a 100-percent equity interest in Qianhai International held by Shenzhen Metro Group (SZMC) by issuance of new shares, with the consideration preliminarily estimated at 45.61 billion yuan.

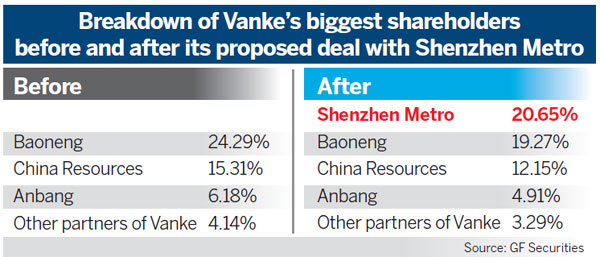

The offer, if materialized, would make the subway builder Vanke's largest shareholder with 20.65 percent of the enlarged issued share capital upon completion of the deal, surpassing Baoneng Group's 19.27 percent after dilution.

However, China Resources has questioned the legality of the Vanke board's resolution, saying at the weekend that the plan would need the approval of two-thirds, or eight, of the board's 11 members.

Shenzhen-based Vanke said on Friday its board had voted with seven-to-three in favor of the plan after one director chose to abstain, citing a conflict of interest.

The three negative votes came from China Resources, which said Vanke has a low debt burden and can use either cash or debt to finance the deal, and doesn't need to sell new shares.

It argued that the proposed deal, which focuses on two pieces of land in Shenzhen that form the major assets of Qianhai International and estimated to be worth of 45.5 billion yuan, would not contribute to the company's profits for the next two to three years, but would only dilute earnings.

Nevertheless, China Resources agreed that acquiring the properties can contribute to Vanke's development; but it disapproves issuing additional stock.

Sam Chi-yung, senior strategist at South China Financial Holdings, believes that the proposed acquisition is positive to Vanke's business in future as SZMC, which operates the city's subway system, is a good asset.

He expects Vanke to develop the "MTR plus property" strategic business approach in partnership with SZMC - a strategy that has been successfully applied in Hong Kong.

Benson Xiao, a partner of Dacheng Law Offices, told China Daily that a share placement is the most direct and convenient method to raise funds to secure the land resource.

"Land means money," said Xiao, adding he's optimistic about Vanke's business in the long term if the deal gets the green light.

Ouyang Liangyi, associate professor at Peking University's HSBC Business School in Shenzhen, also backed the plan, saying it's more to the benefit of small and medium shareholders in the long run.

He said China Resources would like to see Vanke complete the transaction with cash, while the former would buy more Vanke shares to meet capital demand.

For small and medium shareholders, he stressed, their concern is China Resources may need more time to make up its mind.

Vanke is expected to hold a general meeting of stockholders in September to discuss the deal, and predicts that it would be rejected as China Resources has said it will continue to oppose it.

He suggested that both sides should make some compromise and find a way out of the impasse from the perspective of shareholders' interests.

Vanke's mainland-listed shares have been suspended from trading since Dec 18 last year after the stock's price had cumulatively soared 68.6 percent over 20 trading sessions. However, the price of its H shares has slipped almost 30 percent since the suspension.

Sam explained that the drop in Vanke's share price may be related to the higher premium of the company's H shares compared with those of other mainland real estate firms listed in the SAR.

Vanke's H shares opened at HK$17.48 in Hong Kong on Monday, before closing down nearly 3 percent at HK$17.

Contact the writers at grace@chinadailyhk.com

(HK Edition 06/21/2016 page9)