New tax law a boost for PE fund houses

Updated: 2015-08-25 07:32

By Celia Chen in Hong Kong(HK Edition)

|

|||||||

Hong Kong's position as Asia's leading private-equity (PE) fundraising hub would be further cemented after profits tax exemption was extended to PE funds from offshore funds, said Peter Lee, managing director at Veco Invest Asia Ltd.

The attractiveness of the profit tax exemption legislation, which was passed last month, will hasten the entry of more Chinese mainland PE firms into the SAR, he said.

Mainland PE fund houses, such as CDH Investments and Lunar Capital Management Ltd, are making good use of Hong Kong as an international platform to draw foreign investment. Most large global PE firms have already set foot in the city and are expected to expand their business.

"In the past, the PE sector has always been operating in a grey area, but the new legislation will make tax rules clearer for businesses," said Lee.

The new legislation could remove uncertainty among investors as it's now simple and feasible for PE fund managers to manage tax-risk exposure.

For PE funds to exist, the stock market is always a priority, and the current depressed state of Hong Kong stocks will dent their performance to a certain extent.

Lee said high volatility in stocks, especially in the short term, is bad. The benchmark Hang Seng Index slumped 5.2 percent, or 1,158.05 points, on Monday to close at 21,251.57, having plunged for six consecutive trading days.

"However, PE funds are always looking for long-term returns covering three to five years," Lee reckoned. "Hong Kong stocks are relatively stable compared with other markets in terms of long-term performance as the majority of the players are mature institutional investors."

Extending profits tax exemption to PE funds will not only lift Hong Kong's competitiveness as a full-service asset management hub, it will boost demand for business consulting, tax, accounting and legal experts, as well as investment bankers in Hong Kong, said Lee. "More money will come into the market, and more opportunities will be on offer for local professionals," he added. The development of PE funds also means that the SAR's economy will no longer have to rely on one single segment. The diversified base of the city's economy is safe for its development, he said.

Hong Kong, backed by the mainland's vast market, enjoys a natural geographical advantage in developing the PE industry.

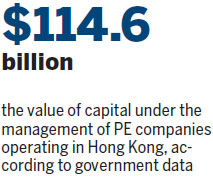

As of late last year, about 390 PE companies were operating in Hong Kong with $114.6 billion of capital under their management, according to Hong Kong government statistics. However, more than 70 percent of the local fund business comes from non-Hong Kong investors and fund managers invest about 80 percent of clients' funds outside Hong Kong.

celia@chinadailyhk.com

(HK Edition 08/25/2015 page8)