Financial safety top concern for Qianhai zone investors

Updated: 2014-10-16 08:04

By Zhou Mo and Chai Hua in Shenzhen(HK Edition)

|

|||||||

With the number of companies registered in Shenzhen's Qianhai special economic zone climbing above the 14,000 mark, the issue of financial safety has emerged as a top concern for investors.

Experts say financial safety, rather than financial policies, should get higher priority in the zone's development.

"If Qianhai wants to become a successful channel for cross-border capital flow, the foremost thing to consider is to set up a firewall - to open it freely outside and manage it well inside. To do so, it has established an onshore and cross-border accounts mechanism, which requires more integrated management. London, in this aspect, has rich experience," Xie Yonghai, chairman of BOCI-Prudential Asset Management, told the Qianhai-London RMB Internationalization Seminar in Shenzhen on Wednesday.

"Financial safety is a key issue for Qianhai to explore and also provides it with huge development opportunities, such as reinsurance," Xie said.

He suggested that Qianhai and London jointly hold a forum on international financial safety to take a leaf from the UK capital's 300 years of experience in finance management and study the unsafe factors when investing in the economic zone.

Zhang Bei, director-general of authority of the Qianhai economic zone, said at the seminar he was deeply impressed by the Square Mile during his trip to London. He invited London's investment institutions to set up equity investment funds in Qianhai so that the two sides "could enjoy the benefits of the mainland capital market's opening up together".

Lord Mayor of London Fiona Woolf called the yuan's internationalization a great success that offers huge potential. "We're very ready to support the further development of yuan internationalization, given the immense economic benefits (it could bring) to both our economies and our people," she said in a keynote speech at the event.

London accounts for two-thirds of the global offshore yuan trading outside China, making it the leading Western partner for yuan business, she added.

And, the process of yuan internationalization is accelerating, with the number of companies engaging in yuan transactions and settlements on the rise worldwide.

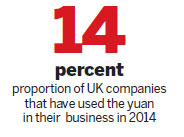

So far this year, 14 percent of UK companies have used the yuan in their businesses, compared with 11 percent last year. Meanwhile, the proportion in Hong Kong rose from 50 percent last year to 58 percent.

The next step of yuan internationalization is to make it a reserve currency, said Joseph Ma, HSBC's Shenzhen branch manager. "HSBC estimates that the yuan will become a genuine reserve currency within two to three years and achieve free convertibility before 2020."

According to statistics from ICAP, a leading markets operator and provider of post trade risk mitigation and information services, the total amount of foreign exchange transactions made in London rose from $200 million to $4 billion last year. Of the daily foreign exchange transactions around the world, 40 percent of them were conducted in London.

The UK government successfully issued a yuan-denominated sovereign bond worth of 3 billion yuan on Oct 14 - the world's first non-Chinese issuance of sovereign renminbi debt and will be used to finance the UK's reserves.

"Currently, the UK only holds reserves in US dollars, euros, yen and Canadian dollars, so the issuance signals the yuan's potential as a future reserve currency," the UK government's finance department, HM Treasury, said on its official website.

The issuing of yuan-denominated sovereign bonds by the UK government signals that the country supports yuan internationalization and shows its firm determination to develop yuan-denominated businesses, chief economic adviser at HM Treasury Dave Ramsden said.

The successful issue of yuan bonds indicates a big step forward in the process of the currency's internationalization, said He Jun, senior researcher at Anbound Consulting.

As a major international financial center, London occupies an important position in the global financial market. It's likely that the European Central Bank will follow the UK's move and incorporate the yuan into its foreign exchange reserves, he said.

Contact the writers at sally@chinadailyhk.com and grace@chinadailyhk.com

(HK Edition 10/16/2014 page8)