Budget handouts will only fuel inflation in the city

Updated: 2011-03-09 07:03

(HK Edition)

|

|||||||

The sudden turnabout by Financial Secretary John Tsang in deciding to give out cash is disappointing. When the financial secretary proposed the original budget, he was correct in pointing out that giving a cash refund would overly stimulate the economy, causing overheating.

The budget has broad effects, directly affecting the macro economy of Hong Kong. Given this importance, we would have believed that the government, with prominent economists such as the Secretary for Financial Services and the Treasury K.C. Chan, would have undertaken serious research before making any major decisions. This includes the effects on major economic indicators such as inflation.

A well thought-out policy proposed by professional decision makers running an international financial center shouldn't have been overturned in a matter of days just because the government wants to console those protestors wanting a free lunch. Catering to populist demand could undermine the credibility of government policy.

Take, for instance, the example of central banks. If a central bank lowers the interest rate whenever there is a protest in the media, how can there be prudent monetary policies?

Given the new policy, the government is forecast to run a deficit of about HK$10 billion when the economy is growing above 6 percent. When there was a financial crisis, it was correct that the government gave a tax refund to stimulate the economy. However, if there is tax refund whenever there are protests, Hong Kong will develop a structural deficit, which is hardly desirable for the long term stability of the economy.

A crucial point of the debate is whether government stimulus causes inflation. Many people claim that as Hong Kong's consumer goods are mostly imported, inflation is mainly triggered by higher import prices while government policies do not play an important role. This is simply a misunderstanding of the CPI.

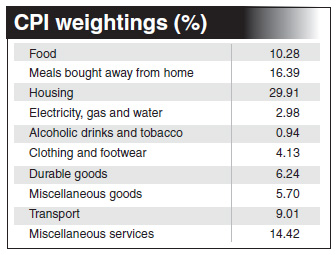

As we can see from the table, the major item that is imported is food, which accounts for 10.28 percent of CPI. For meals bought away from home, rent increases are a more important factor in the rise. This can be seen from the detailed breakdown of the CPI for January 2011, which rose 3.6 percent year-on-year. Though food prices jumped by 8.2 percent, the price of meals bought away from home rose by 3.3 percent only, while that for housing went up by 3 percent. Prices for other imported goods such as durable goods declined 2.8 percent, with that of clothing and footwear up 5 percent. Despite the upsurge in energy prices, section indices for transport only went up by 3.2 percent, but 7 percent for electricity, gas and water. All the other categories recorded growth very similar to the overall CPI.

The categories that are strongly affected by import prices, e.g. food, durable goods, clothing, footwear, electricity, gas and water, accounted for only a 1.1 percent rise in the CPI last year, less than one-third of the overall increase. Therefore, domestic demand was the main reason for inflation in 2010. Further driving up demand in an overheating economy is simply irresponsible.

Housing is the single largest item of the CPI. Even with a weighting of 30 percent, this still understates the effect of rental growth on inflation. For most of the retail and restaurant industries, rental costs account for a significant proportion of business operating costs. Therefore, to combat inflation, the top priority is to lower rents, instead of adopting counter-productive measures such as giving out tax refunds in cash.

Those supporting the tax refund may also argue the HK$36 billion that will be needed is not such a large amount. They further argue that since some of the refunds will be saved, the overall effect will be small.

However, this forgets to factor in the Keynesian multiplier. The money one person spends is the income some other person earns, who in turn will spend it, creating income for another person, and so on. The total effect will be much bigger than the initial stimulus.

Macroeconomic policies should be counter cyclical. In other words, apply the brake if the economy is growing too fast, but accelerate if it is too slow. There are only two types of policies: fiscal and monetary. With a zero interest rate and quantitative easing, it is hard to imagine a more stimulating monetary policy.

It is strange enough that such a policy is being adopted by an economy which is growing at a break neck pace of more than 6 percent but with an unemployment rate less than half that of US. It is simply suicidal to further stimulate the economy with fiscal spending.

As Hong Kong citizens anticipate more refunds and cash transfers from the government in the future, given that it costs almost nothing to protest, the economy may stagnate with dwindling willingness to work. Furthermore, the loss of credibility will make it difficult for the government to push for long-term reform that may involve short-term adjustment issues.This decline in government efficiency and lack of long-term planning will hurt the competitiveness of Hong Kong as an international city. This new policy is frequently compared to the popular policy of Macao. However, Macao is not a competitor of Hong Kong. But Singapore is. This sharp turn of policy may win temporary applause for the government, but it may also sow the seeds of ruin. Long Singapore, short Hong Kong - that sounds like the right trade.

The author, a former investment banker, is currently the associate director of MBA programs at the Chinese University of Hong Kong. The opinions expressed here are entirely his own.

(HK Edition 03/09/2011 page2)