HSBC net profit more than doubles

Updated: 2011-03-01 06:33

By Oswald Chen(HK Edition)

|

|||||||

|

A tram passes the HSBC headquarters in Hong Kong. The company's full-year net profit rose 1.27 times to $13.2 billion. Jerome Favre / Bloomberg |

Bank records $13.2b in earnings, misses median estimate of $13.7b

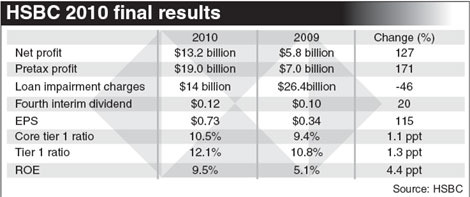

Global banking conglomerate HSBC Holdings PLC reported via a conference call in London on Monday that its full-year net profit for the year ended Dec 31 rose 1.27 times to $13.2 billion from $5.83 billion in 2009.

However, it missed the $13.7 billion median estimate of 15 analysts surveyed by Bloomberg.

The London-based bank said its cost-income ratio rose to 55.2 percent from 52 percent as rising staff costs outpaced revenue growth. The bank said costs were at an "unacceptable level".

HSBC also announced it was raising its fourth-quarter dividend payment to $0.12 per share, up $0.10 in the corresponding period in 2009. The full-year dividend will be $0.36 per share. HSBC will also pay quarterly dividends of $0.09 per share for the first three quarters of 2011 compared with $0.08 per share during the equivalent period in 2010.

HSBC Chairman Douglas Flint attributed the dividend payment increase to strong capital generation, greater clarity on the direction of regulatory reform of capital requirements and an improving economic backdrop in the developed world.

The surge in HSBC's net profit was mainly due to a 46 percent decline in the bank's loan impairment charges and other credit risk provisions to $14 billion in 2010 from $26.4 billion in 2009. Provisions were at their lowest level since 2006.

Strong asset growth in commercial banking and expansion of wealth management businesses in Asia also offset interest income pressure exerted by the sustained low interest rate environment, it said.

Meanwhile, HSBC's personal financial services segment and the North America region have returned to profitability from a year ago. In addition, the group's pretax earnings of the Asia Pacific region (excluding Hong Kong) at $5.9 billion overtook the city as the most profitable region for the first time.

Looking ahead, HSBC Group Chief Executive Stuart Gulliver said that the evolving regulatory environment will continue to exert an impact on the bank's business operations.

"The capital requirement of the new Basel III will make our core tier 1 ratio lower than the Basel II core tier 1 ratio by 250 to 300 basis points," Gulliver said. "However, as the new Basel III requirement will progressively take effect over six years leading up to 2019, we are confident that we can mitigate the new effect."

Because of the higher costs associated with these standards, the bank has targeted the return on shareholders' equity (ROE) be in a range of 12 to 15 percent in the future, said Gulliver. This is down from a previous target of 15 to 19 percent, he added. He also pointed out that the future benchmark for the dividend payout ratio will be around 40 to 60 percent.

Financial analysts cautioned that HSBC's long-term profit growth prospect may be constrained due to the low interest rate environment and the lack of further merger and acquisition opportunities.

"With the current low interest rate environment, interest income will remain compressed and will hinder further profit growth," said Louie Shum, chief executive officer at Sincere Securities. "This was already evident in its Hong Kong operation. In addition, HSBC can no longer rely on mergers and acquisitions to propel future earnings growth." Shum added that investors still need to pay attention to events unfolding in Europe to determine whether the debt crisis there will take a toll on HSBC.

"The recent rally of the HSBC's share price means that the market has already priced-in the earning improvement news. The current stock valuation is reasonable and attractive, so I predict the HSBC share price will hover around the HK$85 to HK$88 level," said Michael Wong, a director at Convey Asset Management. HSBC's share price on the local bourse Monday edged up 1.52 percent to HK$90.4 per share ahead of the results. However, the stock dropped 4.8 percent to close at 677 pence in London trading after the results were announced.

HSBC's local banking arm, the Hongkong and Shanghai banking Corporation, meanwhile said that its net profit was up 27 percent on a year-on-year basis to HK$57.5 billion due to a surge in fee income and decline in impairment charges and other credit provisions.

Meanwhile, HSBC's subsidiary company, Hang Seng Bank, also reported its net profit for the year ended Dec 31 on Monday. Its net profit rose 14 percent to HK$14.92 billion compared with 2009. The bank also announced a fourth quarter interim dividend of HK$1.90 per share, making a total dividend of HK$5.20 per share for full-year 2010.

Bloomberg contributed to this story.

China Daily

(HK Edition 03/01/2011 page2)