HKEx unveils new strategies after 2009 net profit drops 8%

Updated: 2010-03-05 07:34

By George Ng(HK Edition)

|

|||||||

|

Hong Kong Exchanges & Clearing Chief Executive Charles Li poses at the Hong Kong Exchange (HKEx) final results of 2009 and strategic plan 2010-12 press conference yesterday. He said HKEx will work to use the citys unique position as a gateway to China and its established position as an international financial centre to encourage the internationalization of the RMB. edmond tang / china daily |

Dip due to lower turnover-related and net investment income, previous year's one-off gain

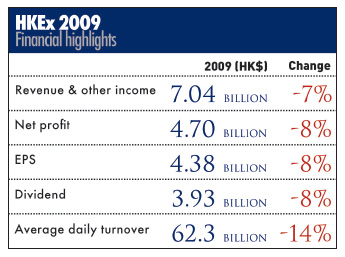

Hong Kong Exchanges and Clearing Ltd (HKEx) unveiled a 3-year strategic plan aimed at tapping growing business opportunities from the mainland as it reported an 8 percent drop in net profit for 2009.

Net profit declined to HK$4.70 billion from HK$5.13 billion in 2008 due to lower turnover-related income, lower net investment income and the absence of a previous one-off gain, said HKEx, the operator of the world's second biggest listed exchange in terms of market capitalization.

The negative market sentiment caused by the financial tsunami that hit the world in September 2008 persisted through the first quarter of 2009, the bourse operator said.

As a result, the average daily turnover on the local bourse for the year dropped 14 percent year-on-year to HK$62.3 billion, despite a recovery in market activity in the last three quarters of the year as ample liquidity boosted investors' confidence.

With weaker daily trading activity, turnover-related income fell 3 percent to HK$4.57 billion from HK$4.70 billion in the previous year.

Meanwhile, net investment income dropped 38 percent to HK$621 million from HK$999 million a year ago, mainly because of a significant decline in net interest income which, in turn, was attributable to lower interest rates and a smaller margin fund, the bourse operator said.

The smaller margin fund was primarily attributable to the decrease in open interest in futures contracts and the lower margin rate applicable per futures contract, it explained.

A HK$69 million one-off gain from the disposal of properties in 2008 that was not repeated in 2009 also depressed last year's results, it said.

However, lower operating expenses helped offset part of the decline in incomes.

Total operating expenses during the year were down 8 percent to HK$1.49 billion, mainly due to lower provisions for impairment losses of trade receivables from defaulting participants.

Accompanying the results announcement, HKEx unveiled a new strategic plan for 2010 to 2012 aimed at fending off competition from rivals and tapping ever-growing business opportunities from the mainland.

"Going forward, we see two major forces of opportunity and competition at play - opportunities resulting from the further opening of the mainland market and more intense competition from exchanges and trading platforms around the world and in the region," Chairman Ronald Arculli said in a statement.

"The opening of China is our blessing," Chief Executive Officer Charles Li declared at the press briefing for the results and strategic plan announcement.

A factor that distinguishes this strategic plan from prior ones is the recognition that the opportunities available to HKEx within its core market of Greater China are global, not just regional, in scale and scope, the bourse operator said.

The increasing internationalization of the Renminbi (RMB) will further advance these two forces. It will significantly expand the mainland opportunities for HKEx as well as intensify the competitive pressures facing HKEx, as these mainland opportunities are also attractive to rivals as well, it noted.

The new strategic plan is precisely aimed at helping HKEx capture the new mainland opportunities and position the local bourse competitively against emerging international competition, Li explained.

The new plan comprises three strategies, namely the Core Strategy, which aims at generating organic growth in current businesses; the Extension Strategy, which means to preserve current position and prepare for future opportunities; and the Expansion Strategy, which aims at expanding product platforms, investor base and geographic coverage over time.

The new strategic plan will be implemented through 19 initiatives including development of RMB products, facilitation of access to Hong Kong market data by mainland investors and improvements in execution efficiency.

For alighment with its new strategic direction under the new strategic plan, HKEx has also undertaken a revision of its organization structure, which includes the establishment of a new market development group.

(HK Edition 03/05/2010 page2)