Demand for gold rises as central banks diversify reserve holdings

|

Gold bars on display at Beijing International Finance Expo held in the capital city on Nov 30. China is expected to increase the percentage of gold holdings in its monetary reserves in the next few years, according to the Official Monetary and Financial Institutions Forum report. |

Demand for gold may rise as central banks and sovereign funds are likely to replace US dollar and euro holdings with the precious metal amid the uncertainty caused by the global financial crisis, a report issued by the Official Monetary and Financial Institutions Forum said on Friday.

China may decide to increase the percentage of gold holdings in its monetary reserves in the next few years, said the report, an analysis of the world monetary system commissioned by the World Gold Council.

Demand for gold is likely to rise amid the uncertainty about the stability of the US dollar and the euro, the main assets held by central banks and sovereign funds, it added.

China almost doubled its gold reserves in the last five years. The country had holdings of 1,054 metric tons in July 2012 and is now the sixth-largest holder of monetary gold.

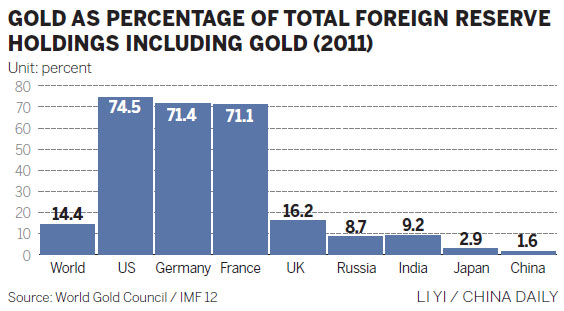

In 2011, gold accounted for 14.4 percent of the world's total monetary reserves.

In a country-by-country comparison, the figure was 1.6 percent in China, while it was 74.5 percent in the United States, 71.4 percent in Germany and 71.1 percent in France, according to data from the World Gold Council and the International Monetary Fund.

China holds the world's largest foreign exchange reserves, which were worth more than $3.31 trillion by the end of 2012, according to figures from the People's Bank of China, the country's central bank.

The amount is so large that China has no other currency options than holding US dollars and euros, the report said.

Driven by China's desire to increase its financial clout, the Chinese renminbi is likely to emerge gradually as a genuine international currency as the country has been easing restrictions on its use in transactions and investments abroad.

During the coming period of uncertainty and transition, asset managers at central banks around the world are likely to be more interested in gold as a result of doubts about the overall strength of global monetary arrangements, the report said.

"China has no wish to be unduly dependent on either the dollar or the euro. This is likely to have been an important reason why the Chinese authorities have decided in recent years to boost the share of gold in reserves," the report said.

The re-balancing process of the global economy through China's economic rise will occur gradually rather than abruptly and will not be straightforward. In particular, the move toward full renminbi convertibility is likely to be only gradual, the report added.

Although the renminbi's rise as a reserve currency is unlikely to pose any immediate threat to the US dollar, "during this period of change and transition reserve holders will spread their investments into a relatively wide range of assets and sectors," the report said.

While the Official Monetary and Financial Institutions Forum does not envisage a return to a gold standard, gold will increasingly have a renewed role in the global monetary system, attracting a higher level of attention from policymakers and financial market practitioners, the report added.

wuyiyao@chinadaily.com.cn

(China Daily 01/12/2013 page9)