Draft to bring private fundraising under supervision

|

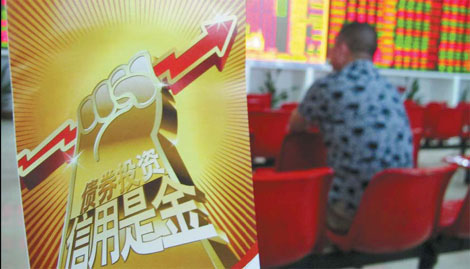

A bond-type securities fund being promoted at a securities office in Haikou, Hainan province. Top lawmakers have begun to deliberate amendments to the Securities Investment Fund Law in order to curb illegal fundraising. Shi Yan / For China Daily |

To curb illegal fundraising, top lawmakers are proposing to place both privately raised money and the companies that manage such money under legal supervision.

In a three-day meeting that started in Beijing on Tuesday, the National People's Congress, the top legislature, is discussing a proposal to modify the Securities Investment Fund Law.

The talks mark the first time that top policymakers are officially considering adopting legal regulations to govern the practice of raising money privately. Analysts said they think the proposed regulation, if adopted, will help reduce both financial and social risks.

A draft from the NPC Financial and Economic Affairs Committee said managers of private funds should register themselves with the supervision and administration institutions of the State Council or with industry associations.

Private money can only be raised from "qualified investors" that have relatively high incomes and risk tolerances, according to the draft.

"The number of qualified investors in a fund should be no more than 200," the draft said.

The fund industry has developed quickly in the past decade. By the end of last year, 69 fund management companies had a total net asset value of 2.2 trillion yuan ($345.7 billion), which was 8.5 times their value in 2003, according to the China Securities Regulatory Commission.

Also in 2011, the market value of the shares held by the funds was equal to 7.8 percent of all shares listed on the Shanghai and Shenzhen stock exchanges, the commission said.

Wu Xiaoling, vice-chairwoman of the NPC Financial and Economic Affairs Committee and a former deputy central bank governor, said at the meeting on Tuesday that the current securities investment law lacks regulations to govern shareholders and managers of fund companies, opening opportunities for insider trading.

One side effect of modifying the fund law could be that it would provide more avenues for investing privately raised money.

"It can be invested into public companies' shares as well as into other equities that are issued by unlisted limited-liability companies," the draft said.

"Fund purchasers are always worried about investing in unlisted companies' securities, which have relatively higher risks because they tend to have poor liquidity," said Hu Lifeng, general manager with the Fund Research Center of China Galaxy Securities Co Ltd.

He said the additional part of the proposed law could help further clarify managers of private funds' responsibilities.

The modified legal regulations are expected to explicitly state what institutions will be in charge of supervising managers of privately raised money, Hu said.

Wu Yuejun, vice-president of Beijing Gold Buffalo Consulting Co Ltd, a private equity fund investment company, said the draft will not only furnish supervision standards for managers of private equity funds in the secondary share market but also regulate other corporate and limited-partner companies that have used privately raised money to make equity investments.

"It can help crack down on illegal fundraising and ensure the sound development of the capital market," Wu said.

Earlier this month, Guo Shuqing, chairman of the securities regulatory commission, vowed to accelerate steps now being taken to make the fund management industry into a comprehensive wealth management industry.

He said the economic growth and industrial restructuring call for the rapid expansion of professional wealth management services to pool private money and channel it into the "real economy", a term referring to the production of goods and services and related activities.

Last year, commercial banks made 60 percent of their gains from managing investment funds, a report from the securities regulatory commission showed.

chenjia1@chinadaily.com.cn

(China Daily 06/27/2012 page13)