VC plants seeds in agriculture industry

|

Workers pick organic vegetables, which will eventually be packaged and sold as gifts in the Xingyun Modern Agricultural High-tech Park in Lianyungang, a city in Jiangsu province. Geng Yuhe / For China Daily |

|

Workers package citrus fruits on a photoelectric wax production line in the Wuling district of Yichang, a city in Hubei province, in November. Zhang Guorong / For China Daily |

Knowledge about value chain vital for successful investment in sector

Transforming an old business can be much harder than building a new one, especially in agriculture, a business that has been around for thousands of years.

So Wang Cen, a partner at Beijing Tiantu Capital Ltd, has every reason to be proud of his achievements so far, investment of more than 100 million yuan ($15.9 million) in two fast-growing companies, after six years of close study of the broader farm business. Tiantu was one of the earliest venture capital funds in China's agricultural sector.

More investment will be made in agriculture, Wang said, citing a research paper by Southwest Securities Ltd that showed annual per capita pork consumption in China had reached 33.1 kilogram by the end of 2010, a rise of 85 percent over the past two decades.

In the meantime, annual per capita consumption of dairy products was 11.27 kg, a seven-fold rise from just 10 years earlier.

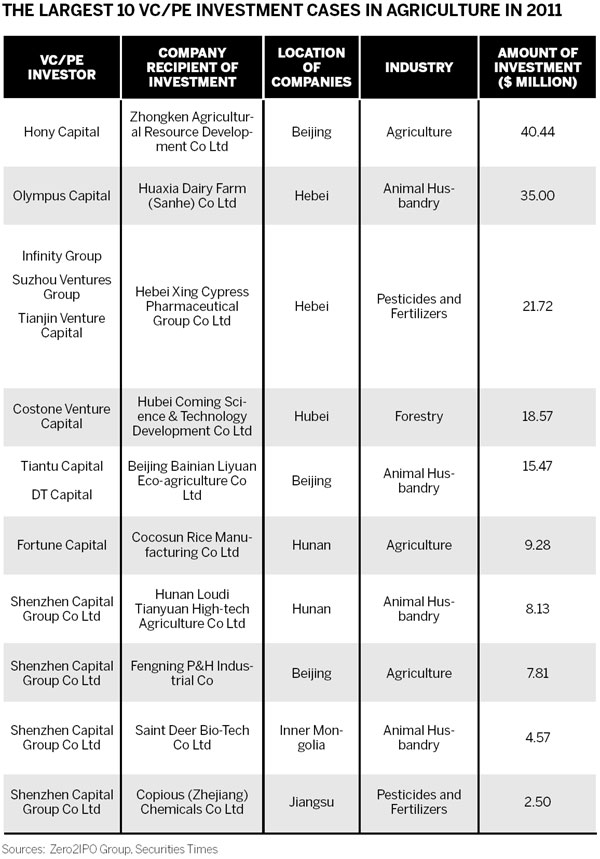

Of the two companies that Wang has invested in, one is Beijing Bainian Liyuan Eco-agriculture Co Ltd, a producer of organic chickens and eggs. In 2010 and 2011, the company received 45 million yuan in investment from Tiantu.

The other company is Zhouheiya Food Co Ltd, a supplier of cooked and marinated duck and goose meat products, based in Hubei province. Tiantu invested 60 million yuan in Zhouheiya in 2010 to help it build its supply chain and information management system.

The key to investment in agriculture-related companies, Wang said, is to understand the value chain. Not all segments of the chain are equally accessible to investors.

And more favorable opportunities currently exist in either the upstream or downstream segments of the industry.

Companies in the upstream, such as developers and suppliers of plant seeds, and those in the downstream, because of their proximity to the consumer market, "can both be very profitable", he said, and this offers ideal opportunities to venture capital investors.

But Wang still has to add an upstream company to his portfolio. He said he has already spent a lot of time screening seed companies.

Some successful seed companies have already got themselves listed on the mainland stock market, such as Shandong-based Denghai Seeds Co Ltd and Anhui-based Win-all High-tech Seed Co Ltd.

But in the Chinese seed market, industry concentration is low - with a lot of small companies vying for market share. So opportunities still abound for venture capital investors.

In the agricultural industry, companies usually rely on their connections with small farmers for their business growth. They distribute seeds and young livestock to farmers on the premise that they will get their harvests and act as their value-added processors.

There is no doubt that the "companies plus farming households" model, as the practice is called in China, can also hatch some fast-growth companies. Yet for outside investors with an interest in eventually transforming them into publicly listed companies, they have an inherent defect in that most of their dealings with the local farmers are in cash, and are hard to monitor or to be brought under rigorous financial management, Wang said.

The most important factors for investors to decide where to put their money, Wang pointed out, are the capabilities of the company's founder and its executive team. He said he was most impressed by Liu Chengjun, founder of Bainian Liyuan.

"We asked him to bring us some documents about the company the next day when we first met. 'No need,' he said, as he could tell us everything offhand. So he did, giving us all the details that we wanted," Wang recalled.

In the early stage of a project, nothing can give investors more confidence than the clarity of the entrepreneur's knowledge about his business, Wang said.

Liu was born into a farmer's family in Miyun, a mountainous county in Beijing's northeastern suburbs. Emboldened by the good natural environment in his hometown, Liu decided to launch a business to produce high-end organic chickens and eggs, and planned to make it the first Miyun company to be listed on the stock market.

Liu set up a corn farm covering some 1,133 hectares and a processing mill with an annual production capacity of 70,000 tons to ensure the chickens had enough high-quality feed.

In the case of Zhouheiya, Wang said he and his colleagues were most impressed by the determination of its boss Zhou Fuyu to make the duck meat business his lifelong career.

"We also attach high value to entrepreneurs who can bring in and work with professional managers," Wang said.

"The risks facing a company would be high whatever it does and however aggressively it competes in the market, if it is managed basically by a husband-and-wife team, and is unwilling to take on professional managers."

Product safety is another factor that is particularly important for food production.

"We picked Bainian Liyuan because of its guarantee of food safety and its popularity among customers, as reflected by a continuous rise in market demand.

Bainian Liyuan's safety guarantee is to a great extent determined by its location, Wang explained, because farmers are prohibited from using chemical fertilizers and pesticides around the nearby reservoir, which is one of the sources of the Chinese capital's water supply.

"Producing organic food is a logical step forward in Miyun's conditions," he said.

China's middle-class customers are becoming ever more conscious of health and sensitive to food safety, after a slew of food poisoning incidents.

Another key factor to be reckoned with, Wang pointed out, is marketing and distribution, including branding and strategic positioning in the market.

The traditional distribution channels, such as supermarkets, tend to charge companies for displaying their products and delay payments to them. To make matters worse, small and medium-sized agricultural companies are often denied loans by State-owned banks.

An innovation in distribution, therefore, can be a major attraction to investors. In Zhouheiya's case, the company adopted a chain store model consisting of more than 300 specialized outlets in 2011 in Wuhan, capital of Hubei province, and a number of other major cities such as Shanghai and Shenzhen.

At the same time, the company has also set up Internet ordering services on e-commerce portals like Taobao and Paipai.

Wang said investing in agricultural companies requires patience, and it can take up to seven years for a project to mature. So besides IPOs, a buyout can be a more convenient exit for venture capital as long as the evaluation of the company proves acceptable for both the acquiring and acquired parties.

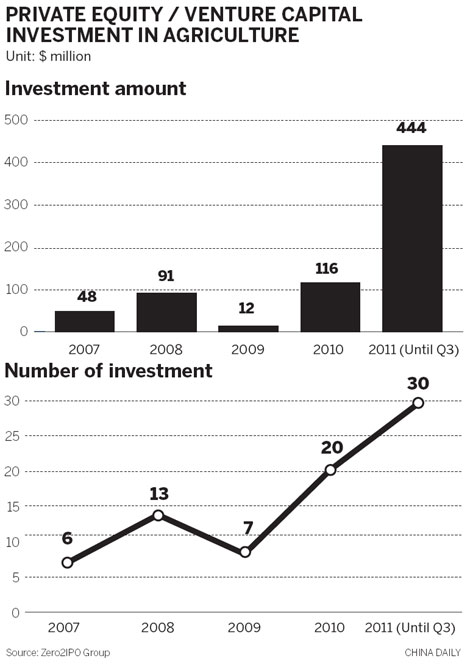

With the continuous rise in China's demand for higher quality foods, there has been increasing investment in all farm-related businesses.

Since 2006, global firms such as KKR & Co LP, Carlyle Group, and Blackstone Group have all made inroads. And, apart from Tiantu, the domestic players include CDH Fund and Hony Capital.

caixiao@chinadaily.com.cn

(China Daily 04/20/2012 page14)