Interest in IPOs to see slight uptick

|

Chinese companies may moderately renew their enthusiasm for IPOs in the second quarter. Provided to China Daily |

Faster growth in share prices likely to boost interest in new offerings

Chinese companies may moderately renew their enthusiasm for IPOs in the second quarter amid expectations that the economy is likely to rebound from April, analysts said.

According to data from Minsheng Securities Co Ltd, 25 Chinese companies launched IPOs in the A-share market in March, up from 17 in February, indicating a rebound in business financing requirements.

Analysts expect faster growth in share prices in the coming months and an improved outlook for corporate profits, which may boost boardroom confidence on raising more money in the mainland by selling new shares.

During the first three months, 49 companies listed on the A-share market, the same number as in the last quarter of 2011, which was the lowest since June 2009. The figure dropped from 64 in the July-to-September period, according to data from Wind Information Co Ltd, a Chinese financial information provider.

Newly listed companies in the first quarter raised a total of 34.5 billion yuan ($5.5 billion) from issuing 3.3 billion shares, compared with 42.2 billion yuan in the fourth quarter of last year and 68.7 billion yuan in the third quarter.

The gloomy situation in the IPO market reflects a deterioration in profits since the last three months of 2011, said Gao Ting, the chief China strategist with the UBS Securities Co Ltd.

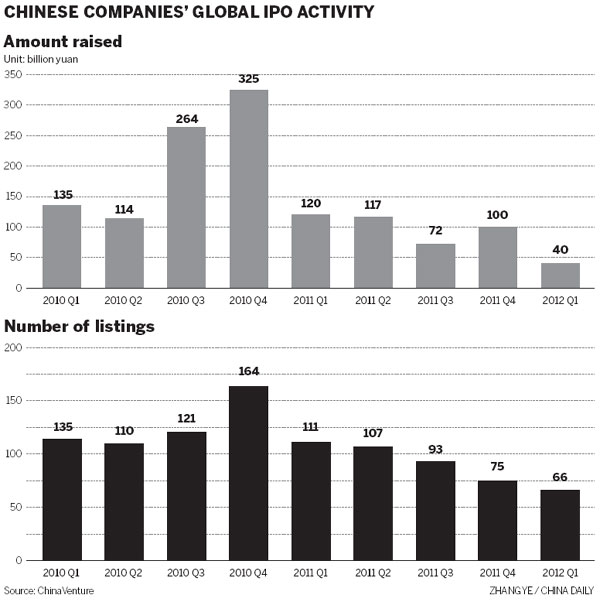

In global IPO markets, Chinese companies also cut back on listings. By the end of March this year, a total of 66 companies had listed on the global stock market (including the Chinese market), nine less than in the last quarter of 2011, compared with 93 in the third quarter, according to ChinaVenture.com, a business information service website.

"The upswing in the US economy and the easing European debt crisis may boost optimism at Chinese companies, which is also positive for the domestic stock market," Gao said.

Expectations that the central bank may moderately loosen monetary policy will also boost capital market liquidity, he added.

Economists forecast that economic growth in the second quarter may slightly accelerate from the expected 8.4 percent in the first three months - the lowest in about three years. The National Bureau of Statistics plans to release the latest quarterly GDP figures on Friday.

However, this year's IPO market in the Chinese mainland may not be as attractive for companies as that in 2010, because of the relatively lower level of price-earning ratios, said Tang Yi, general manager of Edmond de Rothschild Asset Management (Hong Kong) Ltd Co.

The China Securities Regulatory Commission, the top watchdog, announced on April 1 that it had started to seek opinions on proposed new rules on IPOs.

It vowed to "make the pricing of new shares reflect the real value of companies and protect investors' rights and interests".

"To some extent this move can help keep price-earning ratios within a rational scale for new stocks," but it will push the stock market reform in a more market-oriented direction, said an anonymous analyst from Minsheng Securities.

chenjia1@chinadaily.com.cn

(China Daily 04/13/2012 page14)