US bill proposes visas for realty

|

A sold sign at the Pulte Homes Inc Potomac Yards development in Alexandria, Virginia, in the United States. October new-home sales rose 1.3 percent to 307,000, lower than the 315,000 median forecast. Andrew Harrer / Bloomberg |

If passed it would be no guarantee of full citizenship but the Chinese are interested

BEIJING - Is it a good deal for wealthy Chinese to spend at least $500,000 buying a home in the United States in exchange for visas that could allow them to live in the country?

In October, Charles Schumer, a Democrat Senator in New York State, and a Republican colleague in Utah State, Mike Lee, introduced a bill that would grant foreigners visas if they spend at least $500,000 on residential housing in the US.

The answer, according to industry experts, might not as alluring as it seems to be.

The proposed Visa Improvements to Stimulate International Tourism to the United States of America Act (also known as VISIT-USA-Act), submitted to the Congress earlier last month, obviously aims to stimulate the bleak property market and further speed up the staggering economic recovery in the country, said Ding Ying, a Beijing-based expert on emigration to the US.

"It is so far only a proposal and needs approval from the president to be an act. Even if it is approved, the applicant would only get a visa to stay in the US for a limited period, not a visa for immigration as some people think," said Ding.

According to the proposal, a new type of residential visa that could be renewed every three years would be created for overseas homebuyers, but it would not put them on the way to citizenship. The buyer could either buy one residence of at least $500,000 or two for $250,000 apiece or more.

However, there are several restrictions in the proposed bill.

The property would have to be bought in cash with no mortgage or bank loans involved. The buyers would have to pay US taxes if they lived at the property for at least 180 days. Because only a residential visa would be on offer, the buyers would have to apply for an additional work visa in order to find employment. Furthermore, some social benefits such as Medicaid would not be available to foreign property buyers.

But the proposal is still attractive for some Chinese people because children of visa bearers would be entitled to enroll in public schools in the US. Children of foreign citizens are generally forbidden from enrolling in public primary and middle schools.

One of the major reasons given for Chinese people emigrating is because it means the next generation can get a better education.

Recent years have witnessed an increasing number of Chinese buying apartments and houses overseas, including in the US. This trend is further strengthened by the home-purchase restriction policies in China that are aimed at curbing a property market many believe to be overheated.

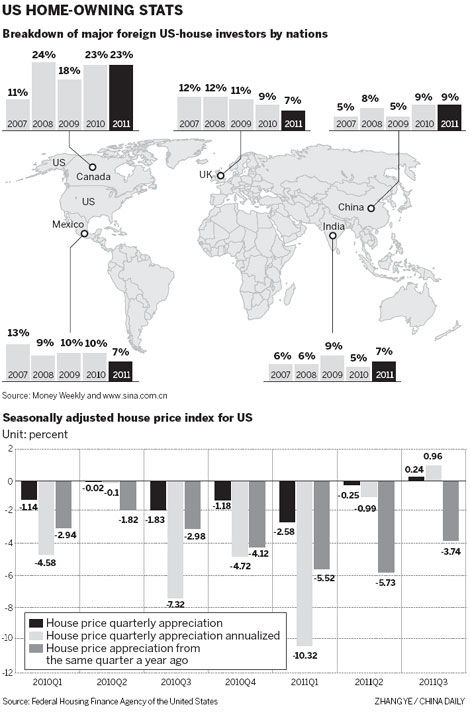

Data from the National Association of Realtors, a US trade organization for real estate agents, showed that as of March this year, foreign homebuyers invested about $82 billion in the US' property market last year, of which 9 percent came from China in terms of transaction volume, compared with 5 percent in 2007. Canada at 23 percent held the top position.

Stanley Lo, an agent with Green Banker, based in Burlingame, California, estimated overseas investment in the property market has quadrupled over the past two years. He said most of his customers were Chinese looking at real estate projects valued between $1 million and $1.5 million.

Most wealthy Chinese prospective buyers choose to make purchases in cities that are densely populated by their compatriots, such as Los Angeles, San Francisco and New York, which helped keep property prices high there. Florida and Las Vegas saw large falls in home prices.

According to an industry insider who declined to be identified, at least 17 billion yuan ($2.66 billion) has flown out of China in the past three years.

"Many people want to come and live in the United States. They will be here spending money and paying taxes, and the most important thing is they'll sop up the extra supply of homes we have right now compared with demand, and that's what's dragging our economy down," Schumer said.

The latest data released by the US Citizenship and Immigration Services showed that this year Chinese people accounted for 75 percent of the applicants for EB-5 visas for immigrant investors.

According to the newly unveiled Private Banking White Paper 2011 jointly released by Hurun Research Institute and the Bank of China, about half the number of Chinese with at least 10 million yuan are considering leaving China, while 14 percent have emigrated or are in the process of applying to.

"When purchasing homes overseas, most Chinese buyers aim to transfer part of their assets, spread risks or consider the education of their children," said a senior manager with realtor CBRE who declined to be named. "The yield, in fact, is not their primary concern. As the property markets in developed countries are generally stable and renminbi is expected to appreciate further, the return on such investments will not be attractive."

Chen Keyu contributed to this story

China Daily

(China Daily 12/13/2011 page14)