China cuts holdings of US debt

Analysts say reduction indicates country is adjusting its portfolio

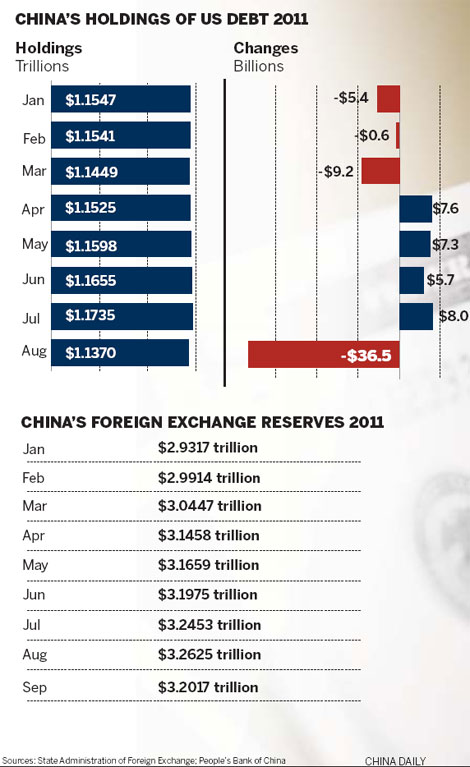

BEIJING - China divested $36.5 billion of its net holdings of US Treasury debt in August.

The move was the biggest sell-off of dollar assets by Beijing this year, despite a surge in foreign demand for US financial assets as investors sought a safe haven amid the European debt crisis.

Analysts said that the reduction of its holdings of US debt indicated that China has adjusted its foreign-exchange investment portfolio after the US credit rating was downgraded by Standard & Poor's in August.

"It is a normal market-based operation by the Chinese government. It has to do with the volatile market conditions after the downgrade of the US credit rating," said Guo Tianyong, director of the China Banking Research Center at the Central University of Finance and Economics.

China currently holds $1.137 trillion of US Treasury debt, meaning that the country is still the largest foreign owner of US debt, according to data released by the US Treasury Department on Tuesday. The August reduction was the first time that China had trimmed its US debt holdings in five months after a net purchase of more than $8 billion in July.

Some analysts said that the sell-off does not necessarily mean that China has lost faith in the US dollar. Instead, they said Beijing may want to allocate more assets to US corporate bonds, which offer more stable returns.

Analysts were also unsure as to whether US Treasury data, known as TIC data (Treasury International Capital System), will reveal an accurate picture of China's holdings of US debt.

They argued that China buys some of its US Treasuries in London. Initial TIC estimates often attribute the purchases based on the location where they are made instead of the origin of the buyers.

Despite China's reduction of US debt holdings, other major foreign investors significantly boosted their holdings in the same month as they sought a safe haven amid the growing European debt crisis.

The United Kingdom boosted its US Treasury holdings to $397.2 billion in August, a rise of 2.4 percent compared with July. Japan's holdings rose to $936.6 billion, up from $914.8 billion in July, according to data from the US Treasury Department.

Analysts said that dollar-denominated assets remain a safe and liquid investment option given the volume of China's purchases and the lack of alternative investment options in the market.

However, Yuan Gangming, a researcher at the Center for China in the World Economy at Tsinghua University in Beijing, said that the diversification of its huge foreign-exchange reserves remains a challenge as China seeks to protect the safety of its dollar-denominated assets.

In September, Beijing held talks with Rome over a possible purchase of Italian debt amid the European crisis. Meanwhile, last week China bought more Japanese debt holdings than it sold for the first time since October 2010.

"China should also diversify its rapidly accumulating foreign reserves by allowing enterprises to use them to acquire resources and expand overseas investment," Yuan said.

"It's the rights of China to manage its reserves suitable," Robert Hormats, a visiting US under secretary of state for economic, energy and agricultural affairs said in Beijing on Wednesday.

He said his level of confidence in the US financial system is high and the quality of the US Treasury remains sound.

Lan Lan contributed to this story.

China Daily

(China Daily 10/20/2011 page13)