Road King drives record yield for 'dim sum' bond

SINGAPORE - Road King Infrastructure Ltd, the toll-road operator with 15 projects spanning seven provinces in China, paid the highest yield on record to sell yuan bonds in Hong Kong and still saved on what it would have paid borrowing in China or in US dollars.

Road King sold 1.3 billion yuan ($198 million) of three- year notes yielding 6 percent, according to a person familiar with the offering. While that is 0.75 percentage points more than the record 5.25 percent paid this month by PCD Stores Group Ltd, it is less than the 8.6 percent that Road King's $200 million of May 2014 notes yielded on Feb 18, according to prices from ING Groep NV. Three- to five-year money in China costs 6.45 percent, data from the People's Bank of China show.

"China's infrastructure spending needs are huge and, in the context of funding costs, the interest on this bond issue is lower," said Prakash Gopalakrishnan, a credit strategist at Royal Bank of Scotland Group Plc. "Road King has an acceptable credit profile within the high-yield universe, and while there are better options for US dollar investors, this is aimed at those who are going long on Chinese yuan in Hong Kong."

Road King is reaping the benefits of raising debt in Hong Kong. It's also paying a lower yield than it would in the US market for sub-investment grade debt, as the world's fastest-growing major economy expands its 65,000 kilometers of expressways to accommodate the more than 18 million cars added last year.

Speculative-grade corporate debt yields in the United States have averaged 7.52 percent this year, according to the US High Yield Master II Index of Bank of America Merrill Lynch, which tracks the performance of more than 2,000 dollar-denominated securities. Speculative grade, or junk, bonds are rated BB+ or below by Standard & Poor's and Ba1, and lower by Moody's Investors Service.

Road King's latest sale of bonds will help repay loans, fund working capital and finance the acquisition of expressways, including a potential project in Shanxi province, according to a company statement filed with Hong Kong's stock exchange on Feb 17.

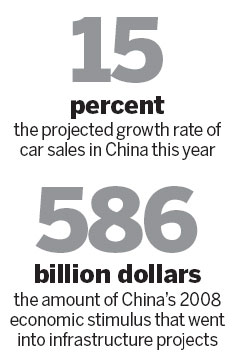

Almost 40 percent of China's $586 billion economic stimulus package in 2008 went into infrastructure spending as the nation strives to build 3 million km of expressways and highways by 2020, according to the Chicago-based research company Thomas White International Ltd.

The nation's 65,000-km expressway network is the second-longest in the world after the US, the company wrote in an August 2010 report.

Sales of new cars in China totaled 18 million last year and may grow by as much as 15 percent this year, figures from the China Association of Automobile Manufacturers show.

"With a low coupon rate relative to dollar offshore bonds, Road King's yuan bonds will lower the company's funding costs and improve its debt maturity profile," said Peter Choy, a senior vice-president at Moody's. "The full impact of the lower interest rate and debt repayments will be reflected in 2012."

The Hong Kong-listed company has total borrowings of HK$8.86 billion ($1.1 billion) and cash of HK$5.69 billion, according to its Feb 17 statement. The stock has gained 23 percent in the past 12 months, compared with a 15 percent increase in Hong Kong's benchmark Hang Seng Index.

With a dividend of 30 Hong Kong cents a share forecast by Bloomberg data, its gross dividend yield will be 7.14 percent compared with 4.29 percent for Hong Kong-listed Jiangsu Expressway Co and 2.81 percent for Shenzhen Expressway Co.

Bloomberg News

(China Daily 02/22/2011 page16)