Prince loses grip on Citigroup crown

Charles Prince resigned on Sunday as chairman and chief executive of Citigroup Inc, as the bank said it may write off $11 billion of subprime mortgage losses, on top of a $6.5 billion write-down last quarter.

Robert Rubin, the former US Treasury Secretary who had chaired Citigroup's executive committee, was named chairman, while Sir Win Bischoff, who runs Citigroup's European operations, was named acting chief executive.

|

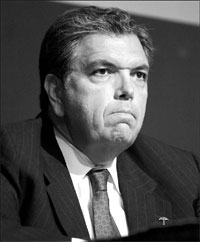

Former Citigroup CEO Charles Prince. Zack Seckler/Bloomberg News |

Citigroup said it expects to write down $5 billion to $7 billion after taxes - roughly three or four months of profit - for its $55 billion of exposure to US subprime mortgages.

The write-down equals $8 billion to $11 billion before taxes, and may rise if markets worsen, the largest US bank said. Citigroup's previous $6.5 billion write-down related to subprime mortgages, loan losses and other debt.

"I am responsible for the conduct of our businesses," Prince said in a memo to employees. "The size of these charges makes stepping down the only honorable course for me to take as chief executive officer. This is what I advised the board."

Citigroup, whose capital levels have been called into question, expects by June 2008 to return to normal capital levels, after previously expecting an early 2008 return. It has no plans to cut its 54 cents per share quarterly dividend.

"It's shocking," said Ralph Cole, a portfolio manager at Ferguson Wellman Capital Management in Portland, Oregon. "The size of the write-down is most surprising, and the quickness with which subprime is deteriorating. Who's to say it isn't the last write-off (in the financial industry). I wonder what it means for everyone else."

'Good plan'

Prince's departure came after he told investors on October 15, four days after an investment banking management shake-up, that the board thought Citigroup had a "good, sustainable strategic plan", and that further management changes weren't needed.

His exit ends a tumultuous four-year tenure marked by heavy turnover among senior executives, questions over strategy, and the mounting loan and credit losses. Problems have also spurred calls for the bank, which has $2.35 trillion of assets, to be broken up because it is too unwieldy.

Prince stepped down five days after Merrill Lynch & Co ousted Chief Executive Stanley O'Neal following a $8.4 billion write-down that was more than 50 percent higher than the bank had forecast, in what was also a speedy exit.

Citigroup shares have fallen 32 percent this year, and 17 percent since Prince became chief executive in October 2003. The shares rose early yesterday in their Tokyo market debut.

The dancing ends

Prince has struggled to improve results at Citigroup, especially in US consumer banking, its biggest business.

While Citigroup's Prince appeared to have some success early this year, the write-downs have thwarted that goal.

Prince didn't help his cause in July when he said Citigroup was "still dancing" to a private equity buyout boom that was about to flame out, suggesting to investors that he didn't appreciate the risks in leveraged lending.

Citigroup has exposure to mortgages through tens of billions of dollars of off-balance-sheet structured investment vehicles, and is in talks with rivals to set up a conduit to buy assets from troubled SIVs.

The US Securities and Exchange Commission is examining whether Citigroup accounted properly for its own SIVs, the Wall Street Journal said. Citigroup declined to confirm the existence of a probe.

Agencies

(China Daily 11/06/2007 page16)