Year sees alliances in steel sector rise

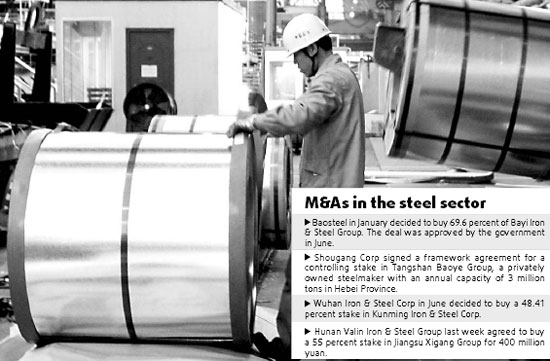

Mergers and acquisitions (M&As) in China's huge but fragmented steel sector are increasing this year, with big producers taking over the smaller ones.

The latest to hop on to the consolidation bandwagon is Hunan Valin Iron & Steel Group, the country's tenth-biggest steel mill by 2006 production, which last week decided to buy a 55 percent stake in Jiangsu Xigang Group, the No 69, for 400 million yuan.

Before that, Wuhan Iron & Steel Corp, the country's fifth-biggest steel mill by 2006 production, this month decided to take over Kunming Iron & Steel Co Ltd, ranked 23.

Zhang Xiaogang, president of the No 3 steelmaker Anshan Iron & Steel Corp, said recently it will ink an asset deal with the No 12, Benxi Iron & Steel Corp, later this year to form China's new steel champion, beating Baoshan Iron & Steel Corp (Baosteel).

Both Anshan and Benxi are located in Liaoning Province in the Northeast.

Cheng Weiqing, an analyst with CITIC Securities Co in Beijing, said the new pace of restructuring will help increase the steel sector's concentration ratio.

Cheng predicted China's top 10 steel mills will control 36 percent of total crude steel production in the country this year, up from 33 percent in 2006.

However, Zheng Dong, from Guosen Securities Co in Beijing, said the current pace of M&As or consolidations, mainly pushed by the government, is not fast enough for China's steel sector, where there are around 800-odd steel mills with the majority being too small to contest globally.

"Massive market-driven M&As are expected two to three years later as steelmakers will have to consolidate to survive mounting competition and gain more power in talks with raw material providers," Zheng said. "Many small steelmakers are unwilling to be bought out by big ones as they enjoy bumper profits thanks to strong market demand and prices."

Xu Zhongbo, CEO of Beijing Metal Consulting Co, agrees: "Who wants to be at the mercy of others if it's doing fine by itself? This is the biggest obstacle to M&As in this sector."

Production of small steelmakers is growing much faster than that of the entire sector due to robust demand and bullish prices at home and abroad.

First-half combined production of steel mills with an annual production capacity of less than 1 million tons jumped 36.8 percent year-on-year, according to data from China Iron & Steel Association.

At the same time, total crude steel production in China, the world's top steel producer since 1996, rose by 18.9 percent to 237.6 million tons.

In the first five months of this year, the sector posted 94.2 billion yuan in profits, rocketing 116.7 percent year-on-year.

Luo Bingsheng, vice-chairman of the steel association in Beijing, said the central government should take measures to "balance the interests of different local authorities" to facilitate trans-regional M&As in the steel sector.

"Central and local authorities should also help steel companies settle redundant workers and unload non-core businesses with M&As," Luo said.

China badly needs "world-class steel giants" as the world's two top steelmakers have consolidated into a new giant group, Arcelor Mittal, churning out 120 million tons a year. In contrast, Baosteel, China's No 1, produced 22.53 million tons last year.

Foreign giants are also eyeing M&As in China to expand in the world's biggest steel market, making M&As between domestic steel mills much more imperative.

Arcelor Mittal, which already owns 29.5 percent of Valin's Shenzhen-listed unit, Hunan Valin Steel Tube & Wire Co, is awaiting the Chinese regulator's nod to buy a stake of Laiwu Steel Corp in East China's Shandong Province.

According to a government policy for the sector announced in 2005, China plans to form two over-30-million-ton steel groups by 2010 through M&As.

The government also expects the top 10 steelmakers to control more than half of the nation's steel production by 2010 and over 70 percent by 2020.

(China Daily 08/15/2007 page15)