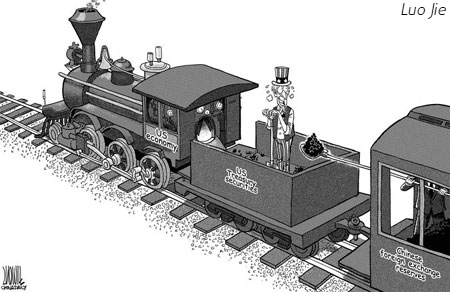

More than $650 billion of China's $2 trillion foreign exchange reserves are held as United States Treasury obligations, making China the largest holder of these securities. These holdings have grown for many years and form an important part of the relationship between the two nations.

China's holdings of US Treasury securities were a mixed blessing even before the current global financial crisis. China earned substantial goodwill from the US by financing America's deficits. China helped to reduce the impact of its US exports on the United States' overall balance of payments by investing the dollars earned from China's exports into the United States. But US Treasury securities are low-yielding and these holdings produced negative real returns for China when the RMB appreciated and the US dollar depreciated at rates more than the interest rates paid on the treasuries.

China then embarked on an ambitious program to achieve higher returns in the US markets. A substantial part of the foreign direct investments made by China's sovereign wealth fund, CIC, was invested in the financial sector of the US economy. The strategy was sensible but the timing proved unfortunate. Then the financial sector collapsed worldwide, initially triggered by failures in the subprime mortgage market. The crisis is now affecting real economies worldwide. Recessions have developed both within and beyond the US. One of the casualties of the collapse of the financial markets has been a growing mistrust of Wall Street, as investors come to believe that a financial institution holds those assets it wishes to own and sells those assets it no longer wants. It is easy, in these circumstances, to understand CIC's announcement that it will not, for the near term, invest in the financial sector in the US.

China has grown wary of investing new capital in the US just when asset values, such as the prices of securities, commodities and real estate, have fallen dramatically. Logically the time for investment is when values are low. China can achieve enhanced returns in the US, seizing the opportunity that is emerging from distressed asset prices, without committing additional capital to a market that has produced such negative results in the past year by redeploying its holdings of US Treasury securities.

The reasons which justified China's original investment in US Treasury securities are still valid. Selling the securities would have negative, if hard to quantify, consequences in terms of international relations and would also tend to depress the value of the very securities being sold. But the US Treasury Department has been publicly discussing purchasing outstanding US Treasury securities as a means of injecting liquidity into the US market. And a multinational flight to quality has resulted in an enormous global demand for US Treasury securities. China owns what investors worldwide want. China can take advantage of this phenomenon without triggering the negative effects of a sale of these holdings by using them as collateral.

The country could borrow virtually any amount, up to hundreds of billions of dollars, based on the value of these holdings and China's own ability to pay. The proceeds from these borrowings could then be invested, not into the financial sector but into the real economy of the United States; into companies that produce goods and services, generate profits and cash flow, employ millions of American workers and support local economies throughout North America. Many companies have suffered a decline in the market prices of their outstanding equity and debt securities due to the general financial malaise and not due to any inherent weakness as functioning businesses.

Such a choice should be politically popular in the US, which is struggling with the question of how to deploy the hundreds of billions of dollars of financial stimulus already committed by Congress and which is now engaged in the political exercise of authorizing additional stimulus. If China made this choice and invested wisely, the debt could easily be repaid from investment profits and China could also enjoy substantially enhanced investment returns on its dollar-denominated portfolio. If China were to invest poorly and prove unable to repay the borrowings out of investment earnings, the collateral would be forfeited to repay the debt. No new cash would need to be committed to US investment activity and no sale of Treasury securities would be needed.

The flood of liquidity into the financial markets from governments worldwide will certainly cause inflation in the future. Dollars that China borrows today will be repaid with dollars that, in real economic terms (and within the context of the US economy) will be cheaper tomorrow. It is therefore a very opportune time for China to engage in this borrowing. The cash flow needed to pay the interest on its loans could be generated in a variety of ways that would not adversely affect the domestic economy of China. Some of the interest would be earned from the yield on the Treasury securities themselves, some could be generated from China's export earnings. The opportunity for financial gain, once the recovery begins, is enormous.

The author is a senior partner in the Corporate Practice of Morris, Manning & Martin. He also co-chairs the firm's China Practice

(China Daily 02/23/2009 page2)